Application for a Canada Revenue Agency Individual 2019-2026

What is the Application For A Canada Revenue Agency Individual

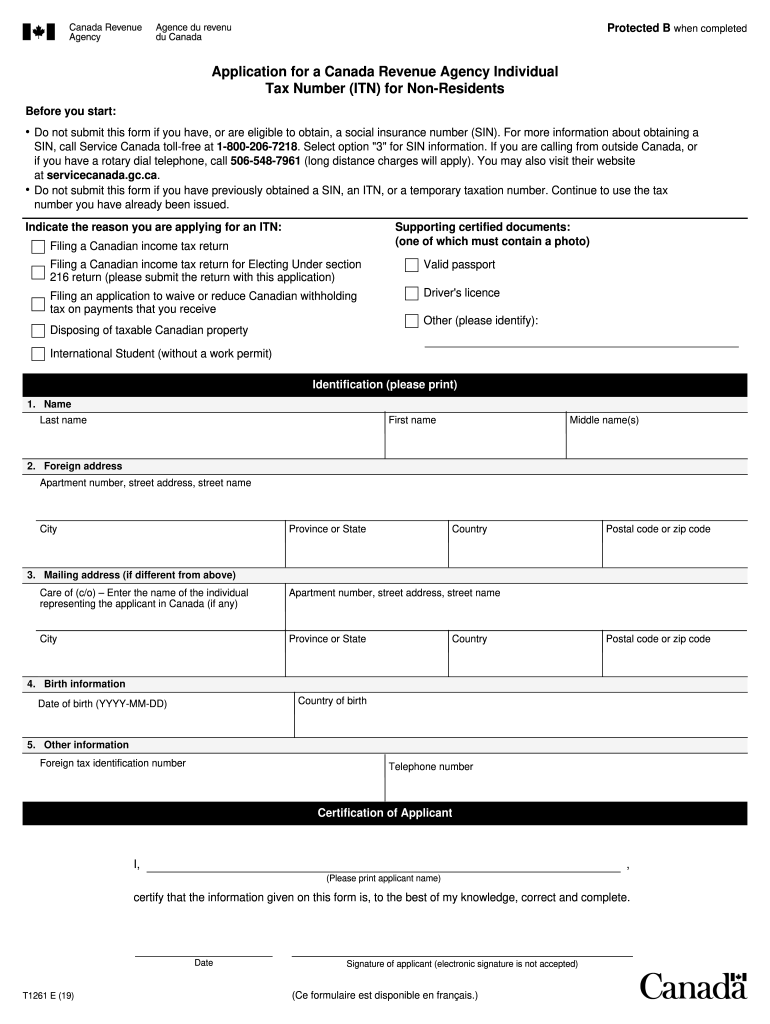

The CRA application is a crucial document used by individuals in Canada to apply for a variety of tax-related purposes. This application is essential for obtaining a Social Insurance Number (SIN) or an Individual Tax Number (ITN), which are necessary for tax identification and reporting. The CRA application allows individuals to ensure they are compliant with Canadian tax laws, facilitating the filing of tax returns and accessing government benefits.

Steps to complete the Application For A Canada Revenue Agency Individual

Completing the CRA application involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name, date of birth, and current address. Next, determine if you require a SIN or ITN based on your residency status and tax obligations. Fill out the application form clearly, providing all requested information. Once completed, review the form for any errors or omissions. Finally, submit the application through the appropriate channels, either online or by mail, to ensure timely processing.

Legal use of the Application For A Canada Revenue Agency Individual

The legal validity of the CRA application hinges on compliance with Canadian tax laws and regulations. It is essential to provide accurate information, as any discrepancies can lead to penalties or delays in processing. The CRA recognizes electronic submissions as legally binding, provided that the application meets specific criteria. Utilizing secure and compliant eSignature solutions helps ensure that your application is processed efficiently and in accordance with legal standards.

Required Documents

When applying for a CRA application, certain documents are required to verify your identity and residency status. Commonly needed documents include:

- A government-issued photo ID, such as a passport or driver's license

- Proof of residency, which may include utility bills or bank statements

- Your Social Insurance Number (if applicable)

- Any previous tax documents, if available

Having these documents ready can streamline the application process and minimize potential delays.

Form Submission Methods (Online / Mail / In-Person)

The CRA application can be submitted through multiple methods to accommodate different preferences. Individuals can choose to complete the application online through the CRA's secure portal, which offers a quick and efficient way to submit. Alternatively, the application can be printed and mailed to the appropriate CRA office. For those who prefer a face-to-face interaction, in-person submissions may be possible at designated CRA locations. Each method has its own processing times, so it's advisable to choose the one that best fits your timeline.

Eligibility Criteria

Eligibility for the CRA application varies based on the purpose of the application. Generally, individuals must be residents of Canada or have specific tax obligations related to Canadian income. For a Social Insurance Number, applicants must be Canadian citizens, permanent residents, or temporary residents with valid work permits. For an Individual Tax Number, the criteria may extend to non-residents earning income in Canada. Understanding these eligibility requirements is crucial to ensure a successful application process.

Quick guide on how to complete application for a canada revenue agency individual

Accomplish Application For A Canada Revenue Agency Individual effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Application For A Canada Revenue Agency Individual on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Application For A Canada Revenue Agency Individual with ease

- Obtain Application For A Canada Revenue Agency Individual and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searching, or mistakes requiring new document copies to be printed. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Alter and eSign Application For A Canada Revenue Agency Individual and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for a canada revenue agency individual

Create this form in 5 minutes!

How to create an eSignature for the application for a canada revenue agency individual

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a CRA application and how does airSlate SignNow fit in?

A CRA application refers to the process of preparing documentation for the Canada Revenue Agency. airSlate SignNow simplifies this process by allowing businesses to easily send and eSign all necessary documents online, ensuring compliance with CRA requirements while enhancing efficiency.

-

What are the key features of airSlate SignNow for CRA applications?

airSlate SignNow offers features like document templates, customizable workflows, and secure eSigning capabilities that streamline the CRA application process. By using these tools, businesses can reduce errors and speed up their submission times.

-

How does pricing work for airSlate SignNow regarding CRA applications?

Pricing for airSlate SignNow is designed to be cost-effective, catering to various business sizes. Depending on the chosen plan, users can enjoy features tailored for CRA applications, including bulk sending and advanced integrations, all at competitive rates.

-

Can I integrate airSlate SignNow with other applications for CRA applications?

Yes, airSlate SignNow seamlessly integrates with many popular applications, enhancing the CRA application process. Integrations with CRMs and file storage services enable users to manage their documents more efficiently and securely.

-

What benefits does airSlate SignNow provide for businesses handling CRA applications?

Using airSlate SignNow for CRA applications allows businesses to save time and reduce paperwork. The digital signature feature ensures documents are processed quickly, while tracking notifications keep users informed throughout the submission process.

-

Is airSlate SignNow secure for managing CRA applications?

Absolutely, airSlate SignNow prioritizes security with encryption and compliance with industry standards. This means that all documents related to CRA applications are kept safe, giving users peace of mind as they manage sensitive information.

-

How easy is it to use airSlate SignNow for CRA applications?

airSlate SignNow is designed to be user-friendly, making it easy for anyone to manage CRA applications. The intuitive interface allows users to create, send, and sign documents without technical hurdles, streamlining the overall process.

Get more for Application For A Canada Revenue Agency Individual

- Revised uniform anatomical gift act donation virginia

- Virginia process 497428435 form

- Virginia anatomical form

- Employment or job termination package virginia form

- Newly widowed individuals package virginia form

- Employment interview package virginia form

- Personnel file 497428440 form

- Assignment of mortgage package virginia form

Find out other Application For A Canada Revenue Agency Individual

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online