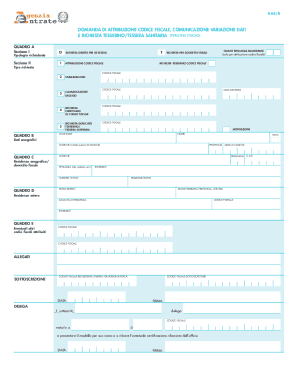

Domanda Di Attribuzione Codice Fiscale Form

What is the domanda di attribuzione codice fiscale?

The domanda di attribuzione codice fiscale is a formal request for the issuance of a tax identification number in Italy, known as the codice fiscale. This number is essential for various legal and financial transactions, including opening a bank account, signing contracts, and accessing public services. The codice fiscale serves as a unique identifier for individuals and entities, similar to a Social Security number in the United States. Understanding its significance is crucial for anyone engaging in activities that require official identification in Italy.

Steps to complete the domanda di attribuzione codice fiscale

Completing the domanda di attribuzione codice fiscale involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name, date of birth, and place of birth. Next, fill out the application form, which may require additional details such as your address and nationality. Once the form is completed, review it for any errors or omissions. Finally, submit the form to the appropriate authority, usually the Agenzia delle Entrate, either in person or via mail. Keeping a copy of the submitted form is advisable for your records.

Required documents for the domanda di attribuzione codice fiscale

When applying for the codice fiscale, specific documents must be provided to support your application. These typically include:

- A valid form of identification, such as a passport or driver’s license.

- Proof of residency, which may include utility bills or lease agreements.

- Any additional documentation requested by the Agenzia delle Entrate, depending on your individual circumstances.

Ensuring that all required documents are included will help facilitate a smooth application process.

Legal use of the domanda di attribuzione codice fiscale

The domanda di attribuzione codice fiscale is legally recognized and must be completed accurately to ensure compliance with Italian tax laws. The codice fiscale is used for various legal transactions, including tax filings, property purchases, and employment contracts. Failure to obtain or properly use this identification number can lead to legal complications, including fines or delays in processing official documents. Therefore, understanding the legal implications of the codice fiscale is essential for individuals and businesses operating in Italy.

Form submission methods for the domanda di attribuzione codice fiscale

The domanda di attribuzione codice fiscale can be submitted through several methods, providing flexibility for applicants. The primary submission methods include:

- In-person: Applicants can visit their local Agenzia delle Entrate office to submit the form directly.

- By mail: Completed forms can be mailed to the appropriate Agenzia delle Entrate office. Ensure that all documents are securely attached.

- Online: Some regions may offer an online submission option, allowing applicants to complete the process digitally through official government portals.

Choosing the right submission method can help streamline the application process and reduce wait times.

Eligibility criteria for the domanda di attribuzione codice fiscale

Eligibility for the domanda di attribuzione codice fiscale generally extends to all individuals, including both residents and non-residents of Italy. Specific criteria may include:

- Individuals who are planning to reside in Italy for an extended period.

- Foreign nationals conducting business or financial transactions in Italy.

- Italian citizens returning to Italy after living abroad.

Understanding these criteria can help ensure that applicants meet the necessary requirements for obtaining their codice fiscale.

Quick guide on how to complete domanda di attribuzione codice fiscale

Prepare Domanda Di Attribuzione Codice Fiscale effortlessly on any device

Online document organization has become popular among businesses and individuals. It offers a suitable eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Domanda Di Attribuzione Codice Fiscale on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Domanda Di Attribuzione Codice Fiscale without hassle

- Locate Domanda Di Attribuzione Codice Fiscale and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Domanda Di Attribuzione Codice Fiscale and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the domanda di attribuzione codice fiscale

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is a domanda codice fiscale and why do I need it?

La domanda codice fiscale is a request for the Italian tax code, essential for various administrative tasks. This code identifies individuals in the Italian tax system and is often required for opening bank accounts, signing contracts, or formalizing documents. Understanding how to properly submit a domanda codice fiscale can streamline your business processes.

-

How does airSlate SignNow help with the domanda codice fiscale process?

airSlate SignNow offers an efficient way to create, send, and eSign documents related to the domanda codice fiscale. With user-friendly features, you can easily manage forms and receive completed requests quickly. The platform simplifies compliance by allowing you to electronically sign all necessary documents securely.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit different business needs. Each plan includes features that help manage documents such as the domanda codice fiscale easily and efficiently. You can choose a plan that allows you to scale as your volume of eSigning increases without losing functionality.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow, especially when handling a domanda codice fiscale. You can connect with popular business tools like CRMs and project management software to streamline document management and improve efficiency. This integration ensures that your documents are always in sync across platforms.

-

Is airSlate SignNow secure for processing sensitive documents?

Absolutely, airSlate SignNow prioritizes security with robust encryption and compliance standards. When handling documents related to the domanda codice fiscale, you can trust that your sensitive information is protected. The platform also offers audit trails and secure cloud storage to keep your data safe.

-

What are the key features of airSlate SignNow for managing the domanda codice fiscale?

Key features of airSlate SignNow include customizable templates, real-time tracking, and a user-friendly interface, which are beneficial for managing the domanda codice fiscale. You can automate reminders and notifications to ensure that all parties stay informed throughout the signing process. This enhances efficiency and reduces the time spent on document management.

-

Can airSlate SignNow help with international requests for domanda codice fiscale?

Yes, airSlate SignNow is equipped to handle international requests related to the domanda codice fiscale. The platform supports multiple languages and currencies, making it suitable for businesses operating across borders. This flexibility simplifies the process for international clients needing to obtain their Italian tax codes.

Get more for Domanda Di Attribuzione Codice Fiscale

Find out other Domanda Di Attribuzione Codice Fiscale

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy