Loss of Income Verification Form

What is the Loss Of Income Verification Form

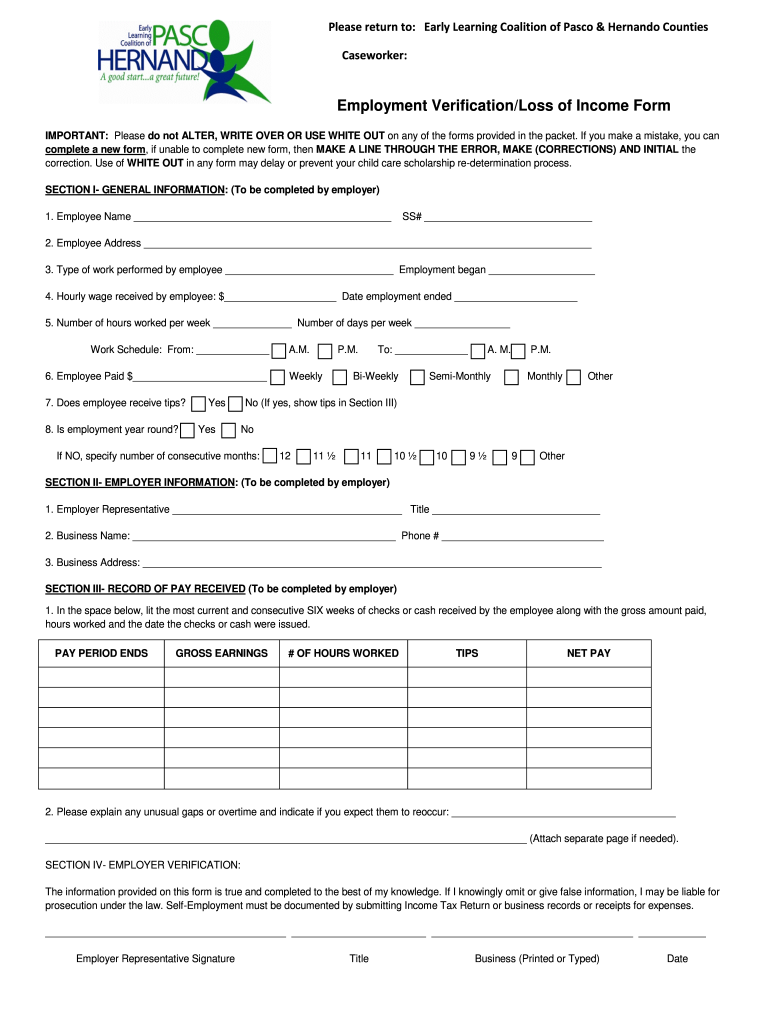

The Loss Of Income Verification Form is a document used to confirm a person's reduction or loss of income due to various circumstances, such as job loss, illness, or other unforeseen events. This form is often required by financial institutions, government agencies, or insurance companies to assess eligibility for benefits, loans, or assistance programs. It serves as an official record that outlines the individual's financial situation and supports claims for financial relief or adjustments.

How to use the Loss Of Income Verification Form

Using the Loss Of Income Verification Form involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary documentation that supports your claim of income loss, such as pay stubs, termination letters, or tax returns. Next, fill out the form with your personal details, including your name, address, and the reason for income loss. Be sure to include any relevant dates and financial figures. Once completed, submit the form to the requesting agency or institution, either electronically or by mail, depending on their requirements.

Steps to complete the Loss Of Income Verification Form

Completing the Loss Of Income Verification Form requires careful attention to detail. Follow these steps:

- Gather documentation: Collect all relevant financial documents that demonstrate your income loss.

- Fill out personal information: Provide your full name, address, and contact information.

- Detail income loss: Clearly state the reason for your income loss, including dates and amounts.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the form: Send the completed form to the appropriate agency or institution as instructed.

Key elements of the Loss Of Income Verification Form

Several key elements must be included in the Loss Of Income Verification Form to ensure its validity. These elements typically include:

- Personal Information: Full name, address, and contact details of the individual submitting the form.

- Reason for Income Loss: A clear explanation of the circumstances leading to the loss of income.

- Financial Details: Specific figures related to the income loss, including previous earnings and current financial status.

- Supporting Documents: A list of attached documents that validate the claims made in the form.

- Signature: A signature or electronic signature to authenticate the form.

Legal use of the Loss Of Income Verification Form

The Loss Of Income Verification Form holds legal significance, especially when submitted to government agencies or financial institutions. It is essential that the information provided is truthful and accurate, as submitting false information can lead to legal consequences. The form must comply with relevant laws and regulations, such as the Fair Credit Reporting Act and other applicable state and federal guidelines. Proper execution of the form ensures that it is recognized as a legitimate document in legal contexts.

Eligibility Criteria

Eligibility for using the Loss Of Income Verification Form typically depends on the individual's circumstances surrounding their income loss. Common criteria include:

- Proof of income prior to the loss, such as pay stubs or tax returns.

- Documentation of the event causing the income loss, such as a layoff notice or medical records.

- Residency requirements, as some programs may be state-specific.

Quick guide on how to complete loss of income verification form

Complete Loss Of Income Verification Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Handle Loss Of Income Verification Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The optimal method to alter and eSign Loss Of Income Verification Form with ease

- Locate Loss Of Income Verification Form and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management within a few clicks from any device of your choice. Edit and eSign Loss Of Income Verification Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct loss of income verification form

Create this form in 5 minutes!

How to create an eSignature for the loss of income verification form

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is a Loss Of Income Verification Form?

A Loss Of Income Verification Form is a document used to confirm an individual's loss of income, often required for loan applications or financial assistance. This form provides the necessary details to help organizations understand a person's financial situation. Using airSlate SignNow, you can easily create and eSign this form, streamlining the verification process.

-

How can I create a Loss Of Income Verification Form using airSlate SignNow?

Creating a Loss Of Income Verification Form with airSlate SignNow is simple and efficient. You can choose from customizable templates or design your own form from scratch. Once created, you can send it out for electronic signatures, ensuring a quick and hassle-free process.

-

Is there a cost associated with using the Loss Of Income Verification Form feature?

airSlate SignNow offers cost-effective plans that include the use of the Loss Of Income Verification Form feature. Pricing varies based on the number of users and additional features needed. You can review our pricing plans on our website to find the best option that suits your business needs.

-

What are the benefits of using airSlate SignNow for the Loss Of Income Verification Form?

Using airSlate SignNow for the Loss Of Income Verification Form enhances efficiency by simplifying document management and signature collection. It provides a user-friendly experience and ensures that all forms are securely stored and easily accessible. Additionally, the platform speeds up the approval process, helping you serve your clients better.

-

Can I integrate the Loss Of Income Verification Form with other software?

Yes! airSlate SignNow allows integrations with various applications to enhance your workflow, including CRM systems and document management tools. You can seamlessly integrate the Loss Of Income Verification Form into your existing processes, making it easy to manage and track submissions across platforms.

-

How secure is the Loss Of Income Verification Form when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Loss Of Income Verification Form. We employ bank-level encryption to protect your data, ensuring that your information remains confidential and secure. User access controls and audit trails further enhance the safety and compliance of your documents.

-

What types of businesses benefit from using a Loss Of Income Verification Form?

Various industries, including finance, real estate, and insurance, can benefit from using a Loss Of Income Verification Form. This form is essential for loan providers assessing financial stability or organizations offering assistance based on income status. By streamlining this process, businesses can improve their service delivery and speed up decision-making.

Get more for Loss Of Income Verification Form

Find out other Loss Of Income Verification Form

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT