Aamu Deposit Form

What is the Aamu Deposit

The Aamu deposit refers to a specific financial arrangement that allows individuals to receive funds directly into their bank accounts. This process is often used for payroll, government benefits, and other types of payments. By utilizing the Aamu direct deposit system, recipients can ensure that their funds are transferred securely and efficiently without the need for physical checks. This method not only streamlines the payment process but also enhances the overall experience for users by providing immediate access to their funds.

How to use the Aamu Deposit

Using the Aamu deposit is a straightforward process. First, individuals need to provide their banking information to the entity responsible for issuing the payments. This typically includes the bank name, account number, and routing number. Once this information is submitted, the payer can initiate direct deposits into the recipient's account. It is important to verify that all information is accurate to avoid any delays in receiving funds.

Steps to complete the Aamu Deposit

Completing the Aamu deposit involves several key steps:

- Gather necessary banking information, including your account number and routing number.

- Contact the organization or employer that will be making the deposit.

- Provide the required banking information to the payer.

- Confirm that the information is correct and complete.

- Monitor your bank account for the deposit to ensure it is received on the scheduled date.

Legal use of the Aamu Deposit

The Aamu deposit is legally recognized as a valid method of receiving payments in the United States. To ensure compliance with federal and state regulations, it is essential that both the payer and recipient adhere to the necessary guidelines. This includes maintaining accurate records of transactions and ensuring that all banking information is kept secure. By following these legal requirements, users can protect themselves and ensure that their deposits are processed without issues.

Eligibility Criteria

To be eligible for the Aamu deposit, individuals typically need to meet certain criteria. This may include being a recipient of regular payments such as wages, government benefits, or other financial disbursements. Additionally, users must have an active bank account that can accept direct deposits. It is advisable to check with the specific organization or agency issuing the payments to understand any additional eligibility requirements that may apply.

Required Documents

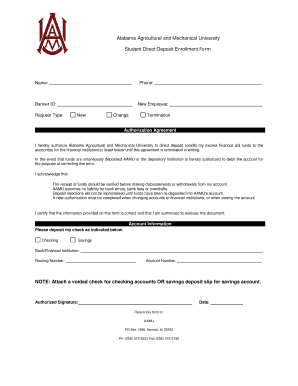

When setting up an Aamu deposit, individuals may need to provide specific documentation. Commonly required documents include:

- A completed direct deposit authorization form.

- Proof of identity, such as a driver's license or social security card.

- Banking information, including account and routing numbers.

Having these documents ready can help facilitate a smooth setup process for direct deposits.

Quick guide on how to complete aamu deposit

Effortlessly Prepare Aamu Deposit on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily access the appropriate template and securely store it digitally. airSlate SignNow equips you with all the resources necessary to swiftly create, modify, and eSign your documents without interruptions. Handle Aamu Deposit on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

The simplest way to modify and eSign Aamu Deposit with ease

- Locate Aamu Deposit and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Aamu Deposit and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aamu deposit

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is an aamu deposit?

An aamu deposit refers to a specific financial process that allows businesses to secure the necessary funds for their transactions. It is commonly used when engaging in contract negotiations or securing services. Understanding the aamu deposit can help streamline your payment processes and ensure timely service delivery.

-

How does airSlate SignNow support the aamu deposit process?

airSlate SignNow offers features that simplify the aamu deposit process by enabling businesses to send and sign documents electronically. This reduces the time spent on paperwork and enhances security. With intuitive templates, you can easily incorporate the aamu deposit details into your contracts.

-

What are the pricing options for airSlate SignNow when using the aamu deposit feature?

airSlate SignNow provides various pricing plans, making it accessible for businesses of all sizes. Each plan includes essential features that support the aamu deposit process, such as document tracking and eSignature capabilities. You can choose a plan that best fits your business needs while staying budget-friendly.

-

Are there any benefits to using airSlate SignNow for managing aamu deposits?

Using airSlate SignNow for managing aamu deposits offers numerous benefits, including improved efficiency and reduced operational costs. The platform enhances the overall user experience by making document handling seamless and secure. Additionally, you can track your aamu deposits in real-time for added peace of mind.

-

Can airSlate SignNow integrate with other tools to assist with aamu deposits?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing the management of aamu deposits. By connecting tools like CRM systems and accounting software, you can streamline your workflow and ensure that all documentation related to aamu deposits is easily accessible. This integration helps keep your team organized and informed.

-

What types of documents can I manage related to the aamu deposit using airSlate SignNow?

With airSlate SignNow, you can manage a wide range of documents related to the aamu deposit, including contracts, agreements, and payment authorizations. The easy-to-use platform allows you to upload, edit, and send various document types for eSignature. This versatility helps ensure all necessary documents are completed efficiently.

-

Is it secure to handle aamu deposits through airSlate SignNow?

Absolutely! airSlate SignNow utilizes advanced security measures to protect sensitive information during the aamu deposit process. With encryption, secure access controls, and compliance with industry regulations, you can confidently manage your aamu deposits knowing that your data is adequately protected.

Get more for Aamu Deposit

- As a childrens community health plan member you can use this personal health information phi authorization form wh en you want

- State of new york workers compensation board self insurer s statement of outstanding disability claims name of self insurer w form

- State of new york workers compensation board initial application by employee of licensee under section 50 3 b or 50 3 d to form

- State of new york workers compensation board renewal application by employee of licensee under section 50 3 b or 50 3 d to form

- State of new york workers compensation board claim for volunteer ambulance workers benefits in a death case this claim will be form

- R0211 pdf form

- Usmle rx express videos download form

- Form 4988

Find out other Aamu Deposit

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document