Fillable Kansas Real Estate Validation Form

What is the Fillable Kansas Real Estate Validation

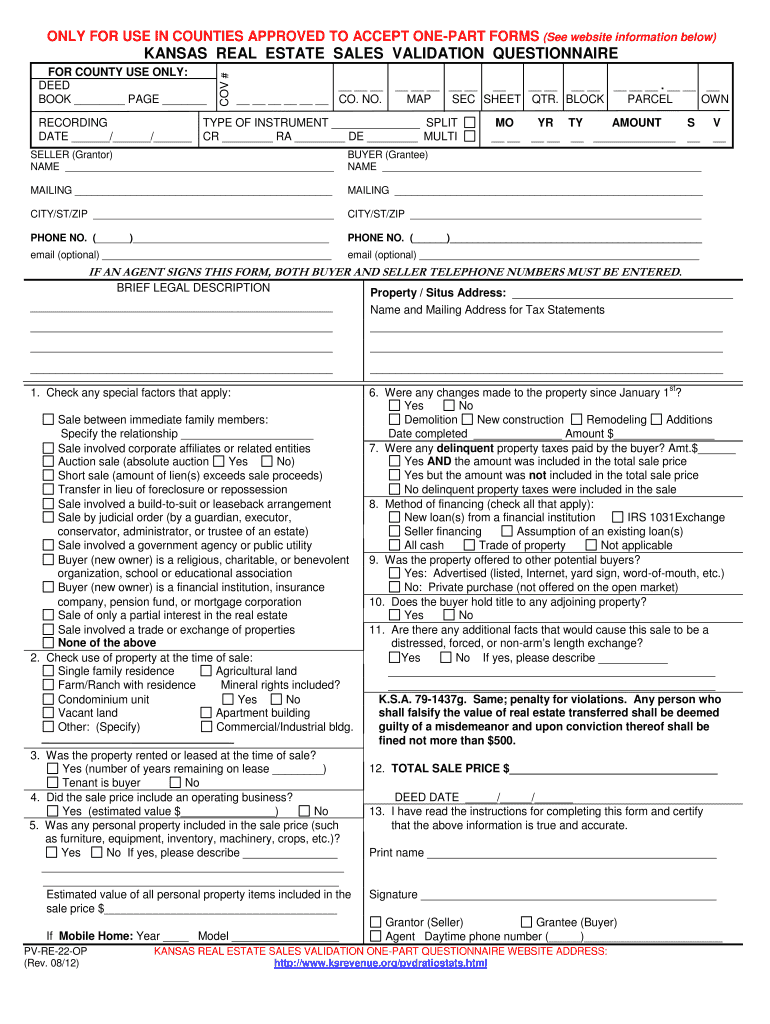

The fillable Kansas real estate sales validation is a document used to confirm the details of real estate transactions within the state of Kansas. This form serves as a formal declaration that the sale of a property has occurred and includes essential information such as the property address, sale price, and the names of the buyer and seller. It is crucial for ensuring that all parties involved in the transaction are in agreement and that the sale complies with local laws and regulations.

How to Use the Fillable Kansas Real Estate Validation

Using the fillable Kansas real estate sales validation involves several straightforward steps. First, access the form through a reliable source that provides it in a fillable format. Next, carefully enter all required information, ensuring accuracy to avoid delays in processing. Once completed, the form should be reviewed for any errors before being submitted. It is advisable to keep a copy for personal records after submission, as this may be needed for future reference or legal purposes.

Steps to Complete the Fillable Kansas Real Estate Validation

Completing the fillable Kansas real estate sales validation requires attention to detail. Follow these steps:

- Download the fillable form from a trusted source.

- Fill in the property details, including the address and sale price.

- Provide the names and contact information of both the buyer and seller.

- Ensure all fields are completed accurately.

- Review the form for any mistakes or missing information.

- Save the completed form and print it if necessary.

Legal Use of the Fillable Kansas Real Estate Validation

The fillable Kansas real estate sales validation is legally binding when completed correctly. It must adhere to state laws governing real estate transactions, which include accurate representation of the sale and proper signatures from all parties involved. Compliance with local regulations ensures that the document holds up in legal situations, such as disputes or audits. It is essential to understand the legal implications of the information provided on this form.

Key Elements of the Fillable Kansas Real Estate Validation

Several key elements must be included in the fillable Kansas real estate sales validation to ensure its validity. These elements include:

- Property address and legal description.

- Sale price of the property.

- Names and contact information of the buyer and seller.

- Date of the transaction.

- Signatures of all parties involved.

State-Specific Rules for the Fillable Kansas Real Estate Validation

In Kansas, specific rules govern the use of the real estate sales validation form. These rules include requirements for notarization, deadlines for submission after the sale, and stipulations regarding the accuracy of the information provided. Familiarizing oneself with these regulations is essential for compliance and to avoid potential legal issues. It is advisable to consult local real estate laws or seek legal advice if there are uncertainties regarding the form's use.

Quick guide on how to complete sales questionner in real estate form

Prepare Fillable Kansas Real Estate Validation effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Fillable Kansas Real Estate Validation on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Fillable Kansas Real Estate Validation with ease

- Find Fillable Kansas Real Estate Validation and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Fillable Kansas Real Estate Validation and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I find out how many sales my real estate agent has made in the last xx years?

The easiest way is obviously just to ask your agent. In real estate sales, experience is not measured in years despite what many agents say in their advertising. Experience is more accurately measured by the number of transactions an agent has completed. Further, USEFUL experience is measured by the number of those transactions that are similar to yours.When interviewing an agent, ask to see closed MLS listings from their past transactions. Look at the quality of the photos in the listing and the written description of the property. Do these look professional and of the quality you'd want? Also look at the asking price and final sale price, plus the number of days it took to sell the property. Ask about the selling strategy (a property sold below its asking price does not necessarily reflect an unsuccessful sale).If your agent can't or won't show you their past listings, you may be able to get the information yourself from the local MLS. Most MLS's have a "public facing web site" that let's you browse current property listings. Most also have profiles of agents who are members of the local REALTOR association, including the ability to see an agent's current and past listings.Membership in a REALTOR association and participation in the local MLS is not mandatory for agents, however. Due to the growth of real estate sites such as Trulia and Zillow, some agents advertise their listings just on those sites and don't use the MLS or join an association.

-

How do I find out which towns in CT or any state with non judicial real estate tax lien sales?

Check out the county’s tax commissioners website. Normally there's a section called Delinquent Tax on there. Click it and it will take you to the tax sales list. For example, Dekalb County, Georgia’s list can be found under delinquent taxes here: Tax Commissioner

-

What is the best way to invest in real estate?

From a distance, investing in real estate does seem very exciting. But it can prove to be a tough endeavor for those who’re starting a new.At the beginning, most investors feel that getting a real estate licence is enough and they can take everything on the go. But that approach is only confusing. It’s sort of like wanting to try out everything in a short span of time with no planning or strategy behind it.With that approach, mistakes are bound to happen. It’s okay, everybody makes mistakes but making one too many can leave you with little or no money, and you don’t want that do you?Are you a new investor? Here are 7 Mistakes Every Real Estate Investor Should Avoid.So if you want to start investing in real estate, where do you begin?The answer is very simple, stick to the basics. There are only two real estate fundamentals involved with starting in real estate. I’m not saying this is your formula for success because you’ll have to try out different strategies.Keeping it simple. Firstly, you have to identify your niche and secondly you have to plan a driving strategy to be successful in your niche.Identifying your nicheMaking a plan of actionThis blog will take you through all of the niches that you can look into when you’re beginning to invest in real estate and the different strategies that you can use.But, first let me paint a scenario for you!As children, all of us loved those every flavor candies, I sure did. When I got a hold of one of those boxes, I wanted to try all those different flavors and get a taste of everything. There were so many choices to pick from.Similarly, there are many choices while investing in real estate. You can choose a niche of your own liking and choose to apply a strategy to it. But unlike candies, you don’t have to try them all out to find out if you like them or not.You have to pick one and stick to it until you gain experience and get better at it. And that is what real estate investing is all about.Remember, choosing one niche helps you narrow down your focus and come up with a better action plan that will help to you make more money.Picking A Niche:When you’re investing in real estate, there are many niches that you can choose from. I have covered some of the basic and common types of property that you are likely to deal with in your line of business. Each of these categories can even be divided further but remember the point that I made earlier, these are just the basics, you can dig down further once you get a strong grip of the basics.Large Apartments:Small Apartments:Multi Family homesSingle Family homesCommercialRaw LandLarge Apartments:You might have seen big apartment complexes in your area as well. Yes, that is what I’m referring to when I say large apartments. This class of property usually is very high end and most people invest in this type through syndicates: a group of investors pooling in their resources. They are costly but they provide a steady inflow of cash after the investment with minimum personal involvement.Small ApartmentsThe difference between a large apartment building and a small apartment building is not very well defined. But usually buildings with 50 or lesser units is considered as small. Investment in such type of property can prove to be tricky because it’s a small investment for big expert investment funds while it’s too expensive for starting newbie. But once the finances are arranged, it can prove to be a worthy investment with great cash inflows.Multi Family Homes:Multi Family homes are usually 2-3 units and are a decent investment to make. Firstly, because you see lesser competition in this category and secondly, you’re able to enjoy the purchasing benefits of a single family home when you’re investing in this type of property. They prove to be a steady source of income and can even be used as a residence.Single Family HomesOne of the most common type of investment property that you’d see many investors dealing in is single family homes.Why is that so?Well, this type of property is usually easy to “buy n sell” and easy to rent out.And it’s relatively easier to arrange the finances for it. However, the cash inflow from this type of investment is not very big. The profits are small and marginal.Commercial:Investments in commercial real estate can vary between sizes and the intentions from the property. Some investors rent out their properties to small businesses for office use while some rent their property out to mega stores and supermarkets. Investment in this type of property is not recommended for those who’re not at a very strong financial position. Why? Because, although the cash flow is consistent when these properties are rented out but they might even remain empty for many months in a stretch.Raw Land:Well, it’s just a piece of land that can be used in many ways to generate profit . It can be worked on and sold for more value, it can be leased or rented out, and it can also be subdivided into smaller plots and then sold.Usually, a common strategy that is applied to raw land by many investors is “buy and hold” which means that they purchase the land and then hold for until it gets them substantial value. This value can increase over time due to a development nearby or a main freeway passing by.I have just outlined some of the very basic niches to start your real estate investment career. In the beginning, all you have to do is pick one niche and start working in the niche. This should be your stronghold; you should form connections, network, and know the in’s and out’s of that niche by heart. Sure, you can expand and test yourself in other niches as well when you’re experienced but when you’re starting in the investment business, sticking to your knitting is the best policy to adopt.Choosing a Driving StrategyNow that you have identified what niche you want to start with, it’s time to work on a driving strategyto get you going. I’ll try my best to keep this as simple as possible and take you through some of the basic strategies that you can adopt. It’s not set in stone to work with a single strategy and instead you can try out various strategies for your investment business.The Buy and Hold Strategy (long term investment)One of the most common forms of strategies involved with investing in real estate is the “Buy and Hold” strategy. The basic idea for this strategy is to buy a property and hold it for a substantial amount of time. During this time, the property can either be rented out or just held vacant until the time it’s value increases signNowly.Pros of the Buy and Hold StrategyDecreasing principle balanceIncreasing equityHowever, with this strategy, success is greatly depends upon an investor’s ability to identify good deals. It’s this basic understanding that makes all the difference. So as a starting investor, you should focus on learning how to identify deals, what bad decision you should avoid, and how to estimate expenses on a deal.If you’re able to do that, then my friend, you’ll surely be on your way to master the “buy and hold” strategy and will hopefully be on the road of making more money with your business.The Flipping Real Estate Strategy (short term investment)The second most popular strategy that is often used when investing in real estate is the house flippingstrategy. The basic idea is to purchase a house or a property at a lower price, making a small investment to make the property better and then selling it for a higher price. These type of investments are short term and are linked with your business objective.Rule of Thumb for flipping Houses: Buy the property for 70% of its original value (including investment)But for this strategy to succeed, speed is very important because it’s a short term investment. For you to be a successful house flipper, you can’t wait around and do it passively. You have to buy, make improvements, and sell the property as quickly as possible.The quick shotgun strategy helps you to avoid any monthly charges that might apply to your property, they may include, financing charges, property taxes or any other financial bills that might be due.Pro Tip: If your niche is to deal in single family houses, then this particular strategy is highly recommended for you.The WholeSaling StrategyUsually regarded as the easiest strategy for investing in real estate because an investor dealing wholesales does not actually have to own anything. A wholesaler’s job is to identify a good deal, get a contract for that deal, and then sell it to another investor or retail buyer.The fee of the contract may vary depending upon the size of the deal. However, being successful at wholesaling is not as easy as it sound. It may look easy but the key to being successful with this type of strategy is to continuously seek out newer and better deals and find new buyers for those contracts.Pro Tip: Staying persistent is the key to being successful in wholesaling.Starting in wholesaling is not a hard thing and someone with little financial resources (gotta have some money) can start to deal in wholesales. However, you have to manage your time and resources at the same time to be successful with it. A good amount of time needs to be spent prospecting for newer options while the same amount of time has to be spent in building a marketing funnel.If all of this information is going over your head and is too much to consume at the moment. There’s nothing to worry about. It’s only the beginning and investing in real estate is a learning curve from the beginning till the end. There are no shortcuts to being successful, so be patient. Take your time, step into the unknown waters, and learn to swim with the tide.I believe I have given you everything that you need in order to figure out what investment will work best for you. You can also plan to invest in rental properties. For which you might want to get yourself familiarized on How To Start Investing In Rental Properties.Hope my answer helped you a great deal :) Happy investing :)

-

How come real estate sales went from their older forms to the organized profession it is now?

It's different from every country, but the main denominator is money.To make more money, the old forms for selling had to be organized.Real estate involves huge sums of money for all parties included in a particular transaction. From the main players (buyers, seller, brokers, agents) to the support players (mortgage firms, construction companies, pest control, maintenance, etc) down to the government agencies (taxes bureaus, local permits, etc).The old ways of selling had to be organized to realize more profit, keep the transaction secure and make the tax man happy.Listings and documentations had to be digitalised, real estate brokers and agents had to be professionalized and all financial transactions tracked and monitored.Anything that makes money in this world would always be organized (whether it be through laissez faire or its opposite, these things will organize themselves in one form or another). That's how things work.

-

How do I get the capital or loans to invest in real estate and rent real estate out?

It depends whether you’re investing in commercial or residential real estate.The process to receive funding for a real estate investment differs on the type of property you’re looking to invest in, with the first and most important decision being between Residential real estate (homes and 2–4 unit Multifamily buildings), and Commercial real estate (buildings occupied by companies, or 5+ unit Multifamily properties).If you are looking to get started with Residential real estate investing and not sure where to start, there is a lot of great content on BiggerPockets: The Real Estate Investing Social Network - both guides and forums with other investors. The short answer is that funding will largely be based on your own credit score and finances.If you are looking to get involved in Commercial real estate, the process for receiving funding is a little bit different. Broadly, you can raise Equity (co-owners of your property), and generally you’ll supplement the total equity with Debt (an interest-bearing loan against the property).If you’re going commercial and have enough equity lined up, between yourself or an LLC with multiple investors including yourself, then next step is to find the property to invest in and create a great plan. Lenders in commercial real estate will evaluate the property itself and the plan, to determine metrics like the ratio of the property’s income to interest owed (Debt Service Coverage Ratio), the percent of the building value represented by the loan (Loan to Value), and some other measures of return and risk. These factors, plus your experience and financial strength, will determine the type of loan you qualify for. Banks, private lenders, and several other types of entities play in the commercial loan space.We’ve made it easy to find the best property-backed commercial lenders in the US by creating a platform that guides you through the loan application process, and instantly matches you with top lenders that are pre-selected for your deal scenario. Check out StackSource to learn more, or feel free to ask me other questions related to commercial real estate lending!

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I form a real estate investor group to invest into commercial properties?

Commercial real estate of you create new apartments in the sun belt.. It's basically, location, location, location and also cost, quality, and timing to the customer. I moved into a new. Apt complex. The owner cut allot of corners and built the development with allot of cheap labor. He built a website so the tenants could pay automatically. He has. A clubhouse with pool and fitness center. He just sold it after losing it up, for 55 million dollars. He had a good property manager, and loaded the buildings while he was finishing the others. I hear they're dividing up the Waldorf Asteria into condos. Astoria was named after John David Astor ergo had a fur trading company and built the New York Library. Blank Stone it's the largest property owner in the country. Simon Properties tried to by Taubman but Michigan would not let them. Read Rich Dad / Poor Dad. They have their own commercial real estate group. The author can give you advice. Commercial real estate id's chancey if you don't know what you are doing. I would invest with that rich dad poor dad group..Kawasaki sounds honest. He's also a former Vietnam Pilot.

Create this form in 5 minutes!

How to create an eSignature for the sales questionner in real estate form

How to make an electronic signature for the Sales Questionner In Real Estate Form in the online mode

How to generate an eSignature for your Sales Questionner In Real Estate Form in Google Chrome

How to generate an electronic signature for putting it on the Sales Questionner In Real Estate Form in Gmail

How to make an eSignature for the Sales Questionner In Real Estate Form straight from your mobile device

How to generate an eSignature for the Sales Questionner In Real Estate Form on iOS

How to make an eSignature for the Sales Questionner In Real Estate Form on Android devices

People also ask

-

What is Fillable Kansas Real Estate Validation?

Fillable Kansas Real Estate Validation is a feature that allows users to create and manage real estate forms that comply with Kansas state regulations. This ensures that all necessary fields are completed correctly, streamlining the process for both buyers and sellers.

-

How can Fillable Kansas Real Estate Validation benefit my real estate business?

By utilizing Fillable Kansas Real Estate Validation, your real estate business can save time and reduce errors in document processing. This feature enhances efficiency and ensures compliance with local regulations, allowing your team to focus on closing deals.

-

Is Fillable Kansas Real Estate Validation easy to use?

Yes, Fillable Kansas Real Estate Validation is designed to be user-friendly, making it simple for anyone to create and manage real estate documents. With intuitive templates and drag-and-drop functionality, you can easily customize forms to meet your specific needs.

-

What types of documents can I create with Fillable Kansas Real Estate Validation?

With Fillable Kansas Real Estate Validation, you can create various real estate documents, including purchase agreements, lease agreements, and disclosure forms. The flexibility of the platform allows you to tailor each document to your specific transaction requirements.

-

Does Fillable Kansas Real Estate Validation integrate with other software?

Yes, Fillable Kansas Real Estate Validation integrates seamlessly with various software applications, including CRM systems and property management tools. This integration enhances your workflow and ensures that all your documents are easily accessible and organized.

-

What is the pricing structure for Fillable Kansas Real Estate Validation?

airSlate SignNow offers competitive pricing for Fillable Kansas Real Estate Validation, with different plans tailored to suit businesses of all sizes. You can choose a plan that best fits your needs and budget, ensuring you get the most value from the solution.

-

Can I try Fillable Kansas Real Estate Validation before purchasing?

Absolutely! airSlate SignNow provides a free trial for Fillable Kansas Real Estate Validation, allowing you to explore its features and functionalities before making a commitment. This trial period is a great way to assess how it can benefit your real estate operations.

Get more for Fillable Kansas Real Estate Validation

- Nh crossbow form

- Labor housing inspection checklist form

- Responsibility statements for supervisors of an associate professional clinical counselor form

- Bus f001 form

- Form 499r 2 w 2pr

- Publication 1915 rev 1 2020 understanding your irs individual taxpayer identification number itin form

- Direct deposit enrollmentchange form astronaut scholarship

- Amsa250 multimodal dangerous goods form eb transport

Find out other Fillable Kansas Real Estate Validation

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself