Wotc Questionnaire 2012-2026

What is the WOTC Questionnaire

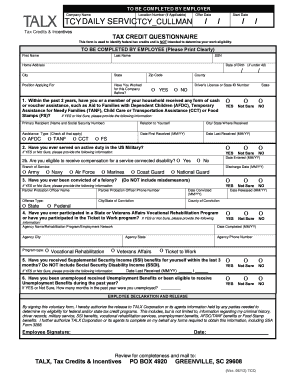

The Work Opportunity Tax Credit (WOTC) Questionnaire is a vital document used by employers to determine eligibility for the tax credit. This form collects information about the employee's background, including their veteran status, disability status, and other qualifying factors. By completing this questionnaire, employers can identify potential tax savings when hiring individuals from targeted groups, such as veterans or individuals receiving government assistance.

How to use the WOTC Questionnaire

Using the WOTC Questionnaire involves several straightforward steps. First, ensure that the form is accessible to the new employee during the onboarding process. The employee should fill out the questionnaire accurately, providing all necessary information about their eligibility. Once completed, the employer must review the responses to confirm that they meet the criteria for the tax credit. Finally, the employer submits the questionnaire to the appropriate state workforce agency to initiate the tax credit process.

Steps to complete the WOTC Questionnaire

Completing the WOTC Questionnaire requires careful attention to detail. Here are the essential steps:

- Obtain the latest version of the WOTC Questionnaire, ensuring it is the correct form for your state.

- Provide accurate personal information, including name, address, and Social Security number.

- Answer all questions regarding eligibility categories, such as veteran status or participation in certain government programs.

- Sign and date the form to certify that the information provided is true and complete.

- Submit the completed questionnaire to the employer for review and further processing.

Legal use of the WOTC Questionnaire

The WOTC Questionnaire is legally binding when filled out correctly and submitted according to state regulations. Employers must ensure compliance with the applicable laws governing the use of this form. This includes maintaining confidentiality of the employee's personal information and adhering to deadlines for submission. Failure to comply with these legal requirements may result in penalties or disqualification from receiving the tax credit.

Eligibility Criteria

To qualify for the Work Opportunity Tax Credit through the WOTC Questionnaire, certain eligibility criteria must be met. These criteria typically include:

- Employment of individuals from specific target groups, such as veterans, ex-felons, or long-term unemployed individuals.

- Verification of the employee's status through the questionnaire.

- Meeting state-specific guidelines for submission and processing of the questionnaire.

Form Submission Methods

The WOTC Questionnaire can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state workforce agency's portal.

- Mailing the completed form to the appropriate agency office.

- In-person submission at designated workforce centers.

Quick guide on how to complete wotc questionnaire

Complete Wotc Questionnaire effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Manage Wotc Questionnaire on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Wotc Questionnaire with ease

- Locate Wotc Questionnaire and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhaustive form searches, or mistakes that necessitate producing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Wotc Questionnaire and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wotc questionnaire

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the work opportunity tax credit questionnaire?

The work opportunity tax credit questionnaire is a tool designed to help businesses determine eligibility for the work opportunity tax credit (WOTC). By filling out this questionnaire, employers can assess whether they can take advantage of potential tax credits for hiring individuals from certain target groups. Utilizing this questionnaire streamlines the process of qualifying for the WOTC, making it an essential resource for businesses.

-

How can airSlate SignNow help with the work opportunity tax credit questionnaire?

airSlate SignNow allows businesses to send, eSign, and manage the work opportunity tax credit questionnaire seamlessly. By providing a straightforward digital platform, it simplifies the collection of necessary information from employees and ensures that the forms are completed accurately and efficiently. This enhances the process of securing tax credits and saves valuable time.

-

What are the pricing plans for using airSlate SignNow to manage the work opportunity tax credit questionnaire?

airSlate SignNow offers several pricing plans tailored for different business needs, including a cost-effective solution for managing the work opportunity tax credit questionnaire. Each plan provides a variety of features designed to enhance document management and eSigning processes. You can find detailed pricing information on the airSlate SignNow website or contact sales for a personalized quote.

-

What features does airSlate SignNow offer for the work opportunity tax credit questionnaire?

airSlate SignNow includes features like customizable templates, secure eSigning, document tracking, and cloud storage, all of which streamline the handling of the work opportunity tax credit questionnaire. These features ensure that businesses can easily access and manage their documents while maintaining compliance and security. Moreover, it simplifies the collaboration process among team members.

-

What are the benefits of using airSlate SignNow for the work opportunity tax credit questionnaire process?

Using airSlate SignNow for the work opportunity tax credit questionnaire process offers numerous benefits such as improved efficiency, reduced paper waste, and enhanced data security. The platform allows businesses to collect and store information in a streamlined manner, enabling quicker access to tax credits. Additionally, the easy-to-use interface maximizes user adoption and decreases the time spent on paperwork.

-

Does airSlate SignNow integrate with other software for managing the work opportunity tax credit questionnaire?

Yes, airSlate SignNow offers robust integrations with various software platforms, allowing businesses to manage the work opportunity tax credit questionnaire more effectively. Integrations with HR systems and payroll software ensure that the necessary data is seamlessly imported and exported. This makes managing the entire process even more efficient and reduces the risk of errors.

-

Is there customer support available for the work opportunity tax credit questionnaire through airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions or issues regarding the work opportunity tax credit questionnaire. Whether you need help with the platform’s functionalities or troubleshooting access issues, the support team is readily available to provide assistance through various channels, including live chat and email support.

Get more for Wotc Questionnaire

- Ins5035 application for accreditation as an iro for entities with national accreditation form

- Training certificate md do dpm state medical board of ohio form

- Designation of individuals authorized access to cms computer form

- Dmv insurance services bureau form

- Free wisconsin residential lease agreement with option to form

- Var form 300 rental application final

- Please fill in all information completely docplayernet

- Free virginia lease agreementsresidential ampampamp commercial form

Find out other Wotc Questionnaire

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document