T3010 Form 2009-2026

What is the T3010 Form

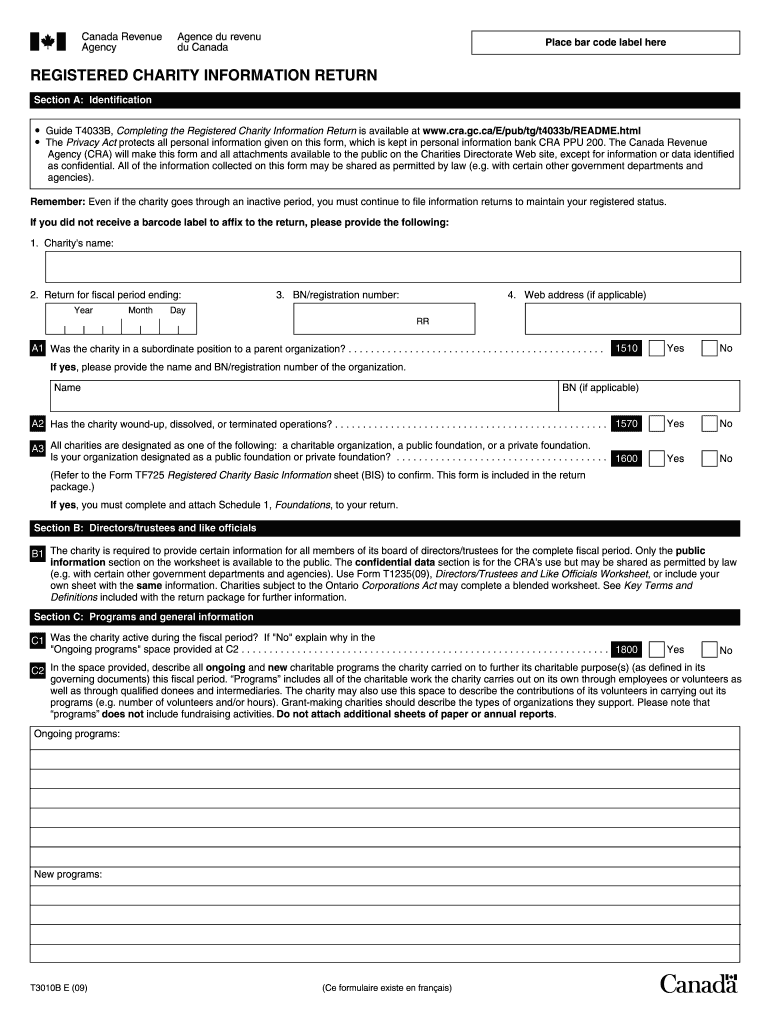

The T3010 form, officially known as the registered charity information return, is a crucial document required by the Canada Revenue Agency (CRA) for registered charities in Canada. This form provides essential information about a charity's activities, financial status, and governance. It helps ensure transparency and accountability within the charitable sector. Charities must file the T3010 annually to maintain their registered status and comply with federal regulations.

Steps to Complete the T3010 Form

Completing the T3010 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, balance sheets, and details about charitable activities. Next, fill out the form carefully, providing information about the charity's mission, programs, and financial transactions. It is important to review the form for any errors or omissions before submission. Finally, submit the completed T3010 form to the CRA by the specified deadline to avoid penalties.

Legal Use of the T3010 Form

The T3010 form serves as a legal document that verifies a charity's compliance with the Income Tax Act. It must be filled out accurately to reflect the charity's operations and financial activities. The information provided in the T3010 is subject to review by the CRA, which may conduct audits to ensure that charities are adhering to legal requirements. Failure to complete and submit the T3010 form can result in penalties, including the loss of registered charity status.

How to Obtain the T3010 Form

The T3010 form can be obtained directly from the Canada Revenue Agency's website. Charities can download the form in PDF format, which can be filled out electronically or printed for manual completion. Additionally, the CRA provides guidance documents and resources to assist charities in understanding the requirements and process for completing the T3010. It is advisable to ensure that you have the most current version of the form to comply with any updates in regulations.

Filing Deadlines / Important Dates

Charities must be aware of the filing deadlines for the T3010 form to maintain compliance with CRA regulations. Typically, the T3010 must be filed within six months of the end of the charity's fiscal year. It is essential for organizations to mark these dates on their calendars and prepare their documentation in advance to ensure timely submission. Late filings may incur penalties, so staying informed about these deadlines is crucial for all registered charities.

Form Submission Methods

Charities have multiple options for submitting the T3010 form to the CRA. The form can be filed online using the CRA's online services, which allows for quicker processing and confirmation of receipt. Alternatively, charities may choose to submit the form by mail, ensuring that it is sent to the correct CRA address. In-person submissions are generally not available, making online and mail options the most practical for most organizations.

Quick guide on how to complete t3010 form

Complete T3010 Form seamlessly on any device

Digital document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage T3010 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-based procedure today.

The easiest method to alter and eSign T3010 Form effortlessly

- Obtain T3010 Form and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and eSign T3010 Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t3010 form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the cra form t3010 and who needs it?

The cra form t3010 is a registered charity information return required by the Canada Revenue Agency. Any charity that has been registered for more than one fiscal year must file this form annually to maintain its status. Using airSlate SignNow can streamline the submission process, ensuring that your charity complies efficiently.

-

How can airSlate SignNow help me with the cra form t3010?

AirSlate SignNow offers an easy-to-use platform for electronically signing and sending documents, including the cra form t3010. With our eSignature solution, you can complete your filings quickly and securely, reducing the time spent on paperwork and ensuring accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the cra form t3010?

Yes, airSlate SignNow offers a variety of pricing plans to meet your needs, starting with a free trial. This cost-effective solution provides you with the tools required to efficiently prepare and submit the cra form t3010, making it a valuable investment for your charity.

-

What features does airSlate SignNow provide for filing the cra form t3010?

AirSlate SignNow includes essential features such as templates for the cra form t3010, eSigning, document tracking, and automated reminders. These functionalities streamline the process, allowing you to complete your forms easily and efficiently, thus reducing potential filing delays.

-

Can I integrate airSlate SignNow with other software for managing the cra form t3010?

Absolutely! AirSlate SignNow integrates seamlessly with various applications commonly used by charities, enhancing your workflow. By integrating with platforms like CRM systems or accounting software, you can sync data easily and ensure that all necessary information for your cra form t3010 is accurate and up-to-date.

-

What benefits does using airSlate SignNow provide for completing the cra form t3010?

Using airSlate SignNow to complete your cra form t3010 enables quicker turnaround times and enhances accuracy. Our platform minimizes the chance of errors associated with manual entries and facilitates secure storage of your documents. This ensures that you can easily access your filings whenever needed.

-

How does airSlate SignNow ensure the security of my cra form t3010?

AirSlate SignNow employs industry-leading security measures to protect your documents, including encryption and secure cloud storage. When filing your cra form t3010 with us, you can trust that your sensitive information is safeguarded during transmission and archiving.

Get more for T3010 Form

- 51319 title vi non discrimination complaint form njgov

- This form is only to be used to request the reprint of licenses due to the loss of the original documents previously issued by

- New jersey general bill of sale form

- Stop vawa progress report form updated 91117

- Tort claim form nevada attorney general state of nevada

- Apartments for rent near procter r hug high school reno nv form

- Submit this form by email to mldinfomld

- File a complaintthe department of business oversight form

Find out other T3010 Form

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template