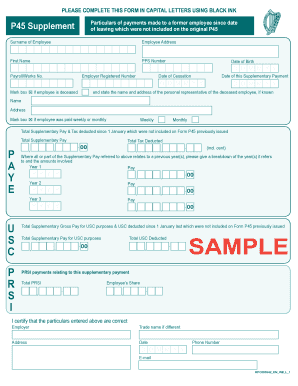

P45 Example Form

What is the P45 Example

The P45 form is a crucial document used in the United States for reporting an employee's tax information when they leave a job. It includes essential details such as the employee's name, address, Social Security number, and the total earnings and taxes withheld during the employment period. Understanding the P45 is vital for both employees and employers, as it ensures accurate tax reporting and compliance with IRS regulations.

Steps to complete the P45 Example

Completing the P45 form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and employment details. Next, accurately fill in your earnings and tax withheld amounts for the period worked. It is important to double-check all entries for accuracy. After completing the form, sign and date it to validate the information provided. Finally, submit the form to your employer or the relevant tax authority as required.

Legal use of the P45 Example

The P45 form holds legal significance as it serves as an official record of an employee's earnings and tax contributions. It is essential for tax purposes, particularly when filing annual tax returns. The IRS requires accurate reporting of income, and the P45 aids in ensuring that both employers and employees meet their tax obligations. Failure to correctly complete or submit this form can lead to penalties or complications with tax filings.

How to obtain the P45 Example

Obtaining a P45 form can typically be done through your employer or the relevant tax authority. Employers are required to provide this form to employees upon termination of employment. If you do not receive a P45, you can request one directly from your HR department. Additionally, some tax authorities may offer downloadable versions of the P45 form on their official websites, allowing for easy access and completion.

Form Submission Methods (Online / Mail / In-Person)

The P45 form can be submitted through various methods, depending on the requirements of your employer or tax authority. Many organizations now accept electronic submissions, allowing for a quicker and more efficient process. Alternatively, you may choose to mail the completed form or submit it in person at the designated office. It is important to confirm the preferred submission method to ensure compliance with any specific guidelines.

Required Documents

When completing the P45 form, certain documents may be required to support the information provided. These can include your Social Security card, previous pay stubs, and any relevant tax documents that outline your earnings and withholdings. Having these documents on hand will facilitate accurate completion of the form and help avoid any discrepancies during the submission process.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the P45 form is crucial for timely compliance. Typically, employers must provide the P45 to employees by the end of the pay period in which employment ends. Additionally, employees should be aware of the deadlines for submitting their tax returns, which may be influenced by the information reported on the P45. Keeping track of these important dates can help avoid penalties and ensure proper tax reporting.

Quick guide on how to complete p45 example

Complete P45 Example effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle P45 Example on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to edit and eSign P45 Example effortlessly

- Find P45 Example and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misfiled documents, tedious form quests, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign P45 Example and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p45 example

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Ireland Form P45 and why is it important?

The Ireland Form P45 is a tax document issued to employees when they leave a job. It outlines their earnings and tax deductions up to their departure date. Employers and employees must complete the form accurately, as it is essential for tax compliance and claim purposes.

-

How does airSlate SignNow simplify the process of managing the Ireland Form P45?

AirSlate SignNow streamlines the management of the Ireland Form P45 by providing an easy-to-use platform for digital document signing and sending. Users can create, edit, and securely sign P45 forms online, reducing the time and effort needed compared to traditional paper methods.

-

What are the key features of airSlate SignNow for handling Ireland Form P45?

Key features of airSlate SignNow for handling the Ireland Form P45 include secure electronic signatures, form templates, and document tracking. These tools help businesses ensure that their P45 forms are filled out correctly and signed promptly, enhancing efficiency and compliance.

-

Is airSlate SignNow cost-effective for small businesses handling Ireland Form P45?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the Ireland Form P45. With competitive pricing plans, it allows businesses to reduce costs associated with printing and mailing documents, while also saving time on processing forms.

-

Can airSlate SignNow integrate with my existing HR software for managing Ireland Form P45?

Absolutely! airSlate SignNow can integrate with various HR software and systems to facilitate the seamless management of the Ireland Form P45. This integration helps ensure that data flows smoothly between systems, simplifying the employee offboarding process.

-

What security measures does airSlate SignNow have for protecting Ireland Form P45 documents?

AirSlate SignNow employs advanced security measures to protect the integrity and confidentiality of Ireland Form P45 documents. These include encryption, secure cloud storage, and compliance with data protection regulations to safeguard sensitive employee information.

-

How can I get started with airSlate SignNow for the Ireland Form P45?

Getting started with airSlate SignNow for the Ireland Form P45 is easy! Simply sign up for an account on the airSlate SignNow website, explore the templates for P45 forms, and begin creating and sending documents for electronic signature in minutes.

Get more for P45 Example

- Tr8 technical report form

- Annual maintenance report form

- Blower door test form fill online printable fillable

- Cf 4 form

- Application for reissue of summons format

- Insurance update and vehicle reinstatement servicearizona form

- Contact usdivision of motor vehiclesnh department form

- Authorization certificate guardian form

Find out other P45 Example

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast