Hdfc Chargdispute Form

What is the HDFC Credit Card Dispute Form?

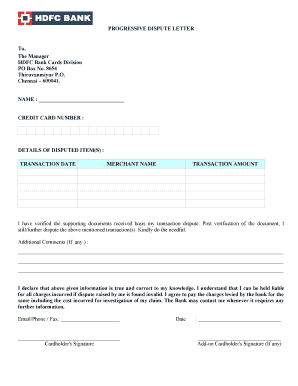

The HDFC credit card dispute form is a formal document used by cardholders to report unauthorized transactions or discrepancies related to their credit card account. This form allows customers to raise concerns regarding billing errors, fraudulent charges, or any other issues that may arise during their credit card usage. By submitting this form, cardholders initiate the dispute resolution process with HDFC Bank, ensuring that their concerns are documented and addressed appropriately.

Steps to Complete the HDFC Credit Card Dispute Form

Completing the HDFC credit card dispute form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information, including your credit card number, transaction details, and any relevant documentation that supports your claim.

- Access the HDFC credit card dispute form online or download the form from the HDFC Bank website.

- Fill out the form with accurate details, including your personal information, the nature of the dispute, and the specific transaction in question.

- Attach any supporting documents, such as receipts or statements, that validate your claim.

- Review the completed form for accuracy before submission.

- Submit the form via the designated method, whether online, by mail, or in person at an HDFC Bank branch.

Key Elements of the HDFC Credit Card Dispute Form

Understanding the key elements of the HDFC credit card dispute form is crucial for effective completion. The form typically includes:

- Cardholder Information: This section requires your name, contact details, and credit card number.

- Transaction Details: Specify the date, amount, and description of the disputed transaction.

- Nature of Dispute: Indicate whether the dispute is due to fraud, billing error, or other reasons.

- Supporting Documentation: A section to list any documents you are attaching to support your claim.

- Signature: Your signature is required to authorize the dispute and confirm the information provided is accurate.

Legal Use of the HDFC Credit Card Dispute Form

The HDFC credit card dispute form is legally recognized as a formal request for investigation into disputed transactions. When completed and submitted correctly, it serves as a binding document that initiates the bank's obligation to review and resolve the dispute. It is essential to ensure that all information provided is truthful and accurate, as any false claims could lead to legal repercussions. The form must also comply with relevant regulations governing electronic signatures and consumer protection laws.

Form Submission Methods

Cardholders have multiple options for submitting the HDFC credit card dispute form. These methods include:

- Online Submission: Many customers prefer submitting the form electronically through the HDFC Bank website or mobile app.

- Mail: You can print the completed form and send it to the designated HDFC Bank address via postal service.

- In-Person: Alternatively, you may visit a local HDFC Bank branch to submit the form directly to a customer service representative.

Examples of Using the HDFC Credit Card Dispute Form

There are various scenarios in which a cardholder may need to use the HDFC credit card dispute form. Common examples include:

- Reporting unauthorized transactions that appear on your statement.

- Disputing a charge for a service or product that was not received.

- Addressing billing errors, such as incorrect amounts charged.

- Notifying the bank of duplicate charges for the same transaction.

Quick guide on how to complete hdfc chargdispute

Prepare Hdfc Chargdispute effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Hdfc Chargdispute on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Hdfc Chargdispute with ease

- Obtain Hdfc Chargdispute and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Modify and eSign Hdfc Chargdispute and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hdfc chargdispute

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the HDFC credit card dispute form?

The HDFC credit card dispute form is a document that allows cardholders to formally raise a dispute regarding transactions on their credit card statement. This form helps in addressing issues such as unauthorized transactions, billing errors, or any discrepancies. By filling out this form, customers initiate the process for HDFC to investigate and resolve their concerns.

-

How can I access the HDFC credit card dispute form?

You can easily access the HDFC credit card dispute form through the official HDFC Bank website or their mobile app. Additionally, you may request a physical copy from your nearest HDFC branch. Ensuring the timely submission of this form is crucial for efficient resolution of your disputes.

-

What information is required to fill out the HDFC credit card dispute form?

To complete the HDFC credit card dispute form, you typically need to provide details such as your credit card number, the transaction date, the merchant name, and a description of the issue. Supporting documentation, like receipts, may also be required to bolster your claim. Accurate and comprehensive information increases the chances of a prompt resolution.

-

What are the features of the HDFC credit card dispute process?

The HDFC credit card dispute process includes a straightforward online form submission and a dedicated support team for handling disputes. Customers receive updates throughout the investigation, ensuring transparency and communication. Additionally, the process is designed to be efficient, aiming for resolutions within specified time frames.

-

How long does it take to resolve disputes using the HDFC credit card dispute form?

Typically, disputes raised using the HDFC credit card dispute form are resolved within 30 days, depending on the complexity of the case. HDFC Bank is committed to providing timely responses, and they may request additional information if needed. Staying in contact with customer support can help expedite the process.

-

Are there any fees associated with filing the HDFC credit card dispute form?

Generally, there are no fees associated with filing the HDFC credit card dispute form for legitimate disputes. HDFC Bank understands the importance of addressing customer concerns without imposing additional costs, ensuring a hassle-free experience. However, it's always wise to check for any specific terms related to unique situations.

-

What benefits does the HDFC credit card dispute form offer to cardholders?

The HDFC credit card dispute form empowers cardholders by providing a structured mechanism to address transaction discrepancies. By allowing customers to formally dispute charges, HDFC enhances consumer protection and ensures peace of mind. This proactive approach fosters trust and security in the credit card service.

Get more for Hdfc Chargdispute

- On premise prequalification packet with ownership informationtabc complete this packet for the sale of alcoholic beverages for

- Tx form

- Ala fl 050 attorney or party without attorney name state bar number and address for court use only fax no alameda courts ca form

- Dds 29 georgia department of driver services form

- Dr 1 rev form

- Ampquotaffidavit of non use of registered motor vehicleampquot idaho form

- Affidavit of non use form

- Power of attorney purchase price and odometer disclosure for electronic title tr 40 power of attorney purchase price and form

Find out other Hdfc Chargdispute

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy