New Business Entity Form

What is the New Business Entity

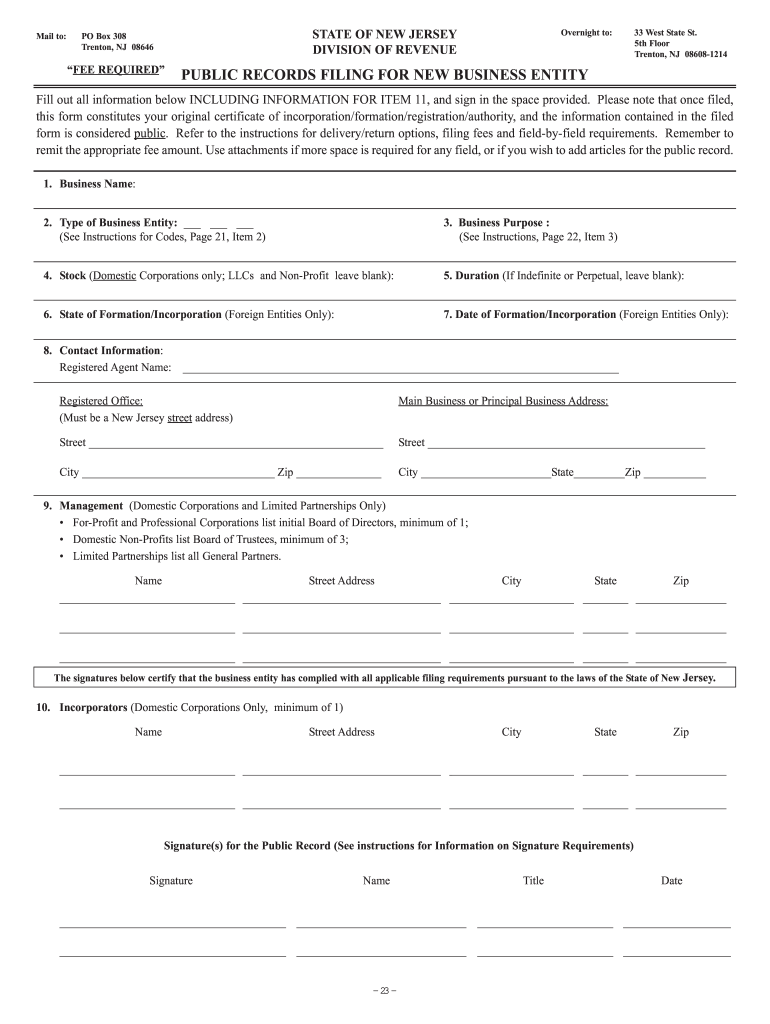

The New Jersey records filing business refers to the process of officially registering a new business entity with the state. This includes various types of entities such as Limited Liability Companies (LLCs), Corporations, and Partnerships. Each type of business entity has its own legal implications, tax obligations, and operational requirements. Understanding the distinctions between these entities is crucial for compliance and effective business management.

Steps to Complete the New Business Entity

Completing the New Jersey records filing business involves several key steps:

- Choose a business name that complies with state regulations.

- Select the appropriate business structure (LLC, Corporation, etc.).

- Prepare the necessary documents, such as Articles of Incorporation or Organization.

- File the documents with the New Jersey Division of Revenue and Enterprise Services.

- Pay the required filing fees.

- Obtain any necessary permits or licenses related to your business type.

Required Documents

When filing for a new business entity in New Jersey, specific documents are required. These typically include:

- Articles of Incorporation or Organization, depending on the entity type.

- Operating Agreement for LLCs, outlining the management structure.

- Bylaws for Corporations, detailing the governance of the entity.

- Employer Identification Number (EIN) application, if applicable.

Legal Use of the New Business Entity

Establishing a new business entity legally protects personal assets and provides a framework for operations. It is essential to adhere to state laws and regulations governing business operations, including tax obligations and reporting requirements. This legal structure also enhances credibility with customers and suppliers, as well as access to funding opportunities.

Form Submission Methods

In New Jersey, the new business entity filing can be completed through various methods:

- Online submission via the New Jersey Division of Revenue’s website.

- Mailing the completed forms to the appropriate state office.

- In-person submission at designated state offices.

Penalties for Non-Compliance

Failure to properly file for a new business entity can result in significant penalties, including:

- Fines for late submissions or incomplete filings.

- Loss of good standing with the state, affecting business operations.

- Potential legal action against the business for non-compliance with state regulations.

Quick guide on how to complete new business entity form

Your assistance manual on how to prepare your New Business Entity

If you’re curious about how to finalize and send your New Business Entity, here are some brief instructions on how to simplify tax processing.

First, you only need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revert to modify information as necessary. Enhance your tax oversight with sophisticated PDF editing, eSigning, and easy sharing.

Follow the directions below to finalize your New Business Entity in just a few minutes:

- Create your account and start handling PDFs in moments.

- Access our library to find any IRS tax form; explore different versions and schedules.

- Click Obtain form to open your New Business Entity in our editor.

- Complete the necessary fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to affix your legally-recognized eSignature (if necessary).

- Review your document and amend any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Use this guide to submit your taxes online with airSlate SignNow. Be aware that submitting on paper can lead to increased return errors and delayed refunds. Certainly, before e-filing your taxes, check the IRS website for filing guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct new business entity form

FAQs

-

What startups are looking for funding in March 2011? For the next three days, I'll be sitting with the VC team at USVP, one of Silicon Valley's biggest VC firms. I'm watching TED with them for the next three days at their offices on Sand Hill Road.

Payoff.com is a social finance platform enabling communities to fulfill their individual and collective dreams. We launched public beta in January 2011 and have collected 1,000+ dreams, of which over 90% are related to money. Payoff helps people fund their dreams and signNow their goals, like saving for a house or vacation, adopting a child, paying off credit cards, and starting a business, in addition to connecting them with other people working towards the same things. The current product enables users to share their dreams, set up goals, link and track financial accounts, earn badges, and receive cash Sur-Prizes for progress. We provide tools from top-quality partners, as well as educational content to help move users to action and success. Ultimately, we provide a more intuitive way for users to understand how they are spending their life -- it’s not about the dollars, but it’s about the positive use of money, time, talent, and charity. We aim to own dreams and achievement on the web. Payoff will create meaningful social connections and dialogue through dreams, goals, implicit communities based on personal transactions (the “real-life check-in”), and our partners. In addition, our relevance and recommendation engine is guided by a Science Advisory Board, with leaders from Cal-Tech, USC, and Northwestern. We recognize that achievement and financial behavior, like most decisions, is driven by emotions, not budgets and lists, and we are signNowing people in this emotional space. One user told us, “I feel more encouragement from these badges than I think you will ever know. I'm not the most emotional person but I have been so poor for most of my adult life trying to get through school that the day [the] "STASH" badge was awarded to me I cried!” Payoff is founded by Scott Saunders (Walz Group, Inc 500) and Eden Warner (pre-revenue to profitability CFO at Fandango), along with folks from Yahoo! and SpotRunner. You can view a video about us at and contact us at scott@payoff.com. Also, check out what folks are saying: AOL WalletPop: http://www.walletpop.com/2011/01...Business Insider: http://www.businessinsider.com/p...U.S. News Money: http://money.usnews.com/money/bl...

-

What will the impact of AI be on the marketing industry?

Excellent question!There are already signs of changes in the marketing practice caused by the growing adoption of smart technology. For instance, many software service providers have already equipped their products with AI applications that can be useful to marketing.And if you’re looking for a marketing breakthrough, you just have to go online and observe how Google seems to customize the ads you see based on your activity. That’s targeted advertising in digital marketing, and it’s a major development in syncing marketing goals and personalized customer experience.Aside from targeted marketing, AI is also improving the way marketers do their research.AI can collect and measure data from voice-based communications, gleaning information like customer preferences from calls or other voice-based interactions. Tenfold offers this voice-based marketing automation tool in our CTI solution, and we can do this for a wide range of telephony lines and data systems.AI also enhances the workflow through automation. Market segmentation and campaign management can be left to AI, while marketers use their time to develop creative marketing strategies.Another advantage of automating marketing processes is that it makes marketing more precise. You don’t have to worry about forgetting to update the campaign or leaving out important variables in segmentation—machines don’t forget, and they can track and activate multiple processes with higher efficiency.Data analytics, when coupled with a hardworking and highly creative team, can produce phenomenal results. At Tenfold, our marketing team staunchly supports AI and has used it wisely to grow our business.We’ve had better quality leads since our AI integration, thanks to automation and analytics. The insight generated through AI has also guided us in producing audience-specific content and distributing them accordingly.We’ve written several articles on AI and marketing at the Tenfold blog that expound on this topic. Do check them out if you want deeper insights on AI.

-

What is startup culture?

Many startup founders struggle to define the culture of their startup in the beginning. When they painfully realize later that culture actually has a big impact on their business, it's already too late.When studying at the University of Cambridge, my professor Philip Stiles defined Corporate Culture as the "shared values, artefacts and underlying assumptions of a firm". Let me explain:Shared Values:The exposed values are what the firm says about itself. In a startup, these values are usually manifested in a great vision (e.g. "We want to change how sport sponsorship works") and a mission statement (e.g. "We want to become the largest global sport sponsorship marketplace by 2017."). Artefacts:Artefacts are the visible manifestations of the culture. These include things like symbols (your CI, your logo), your office (co-working space, garage, fancy uptown office), the dress code (casual / business), your communication tools and style (email, Slack, meetings), etc.For example, my startup Sponsoo is a marketplace for sport sponsorship, so we all dressed up in sports clothes for a veeeeery very early team picture. Stuff like this shapes your startup culture.A group of nerds who are passionate about sports.Underlying assumptionsWhereas artefacts and values are publicly visible, the underlying assumptions are what your team members really thing about the company. Obviously, these assumptions are most difficult to grasp and to change. The "official" values need to be aligned with the team's underlying assumptions in order to be effective. As an entrepreneur, it's crucial to be receptive to what team members (might) think about the startup, and to be open to feedback of any kind. Team members should always feel comfortable to point out if they don't understand the corporate values or if they disagree with them. Don't lose touch with your team!But how do you actively design startup culture? In Business School, we identified three key mechanisms. The fourth one comes from personal experience, and also from best practices by McKinsey.Recruitment and SelectionRecruit people who believe in the company's vision and who are a good fit with the culture. This also means that you should get rid of team members who don't fit with the startup culture, even if they perform well in their daily business.Leadership by ExampleThe founders should lead by example. You're the evangelist of your product - if you don't believe in the mission and don't live and breath your values, your team members won't either.SocialisationYou can craft rituals - such as promotion, rewards, meetings, structures, stories ("founding myth") - to match the culture you want to have.Celebrate SuccessesYou should celebrate successes; even small ones. Your large vision is usually so far in the future that your team needs to be reminded from time to time that they are on track. In order to keep everyone motivated, it's important to celebrate every small success as a step into the right direction. Small successes matter! Moreover, celebrations stick in your team member's mind and ensure that the successes become part of the shared stories - the "artefacts" - of your startup. We celebrate that we won a startup pitch competition. The prize (the little golden thing that I'm biting) is now hanging in our office to remind us of our success.Good luck shaping your startup culture! Happy to hear your experiences in the comments.

-

Can I use Stripe with a Payoneer virtual account?

Stripe RequirementsFollowing are the Stripe requirements to accept payments from the United States:US Bank AccountSSN / EINUS Mailing AddressUS Phone NumberThe straightforward way is to register an LLC (Limited Liability Company) or C-Corporation company in the United States and open the bank account. However, even if you’re able to process the LLC registration (which is simple and can be done remotely), there is no bank in the United States that is willing to open an account without the potential owner first visiting the branch.Also, Stripe requires you to enter SSN or EIN to verify your identity, which is an other hurdle. For US address & phone number, you can get them easily remotely or even use fake details (not recommended).But the good new is you can still get all the necessary details without visiting the US and starts using Stripe in minutes. Let’s discuss how you can successfully sign up for Stripe from the United States.1. US Bank AccountYou can get a valid US bank account thanks to Payoneer — a global payment service that can be used as an alternative to PayPal to send and receive payments worldwide. It provides the users a prepaid MasterCard (you must have funds in prepaid card before you can use it online) and a US bank account to accept ACH payments from US companies. ACH is what Stripe uses to payout the customers. You’re done!Sign Up for PayoneerPayoneer is a very reliable and secure payment service available worldwide. I’ve been using it since early 2013 to accept payments from US clients, marketplace earnings, affiliate payouts etc. Since it is MasterCard supported that is widely accepted over the Internet, so it is my primary payment method whenever I want to pay online whether it is to buy an airline ticket, pay web hosting bills or to pay Amazon AWS monthly fees etc.Registration for Payoneer is straightforward and can be done in couple of minutes. If you will use this link to signup to Payoneer , you will get $25 sign up bonus.You just need to fill out few a four steps form and then validate your identity by sending them a passport or driving license soft copy.Once you sign up successfully, there is a waiting period, up to a week and then they send you a prepaid MasterCard on your address. Once you receive the card and activate it, Payoneer creates a virtual US bank account for you to accept ACH payments from US companies. That’s all you need. Now you’ve an official US bank account and can start accepting payments from Strip right away.2. SSN / EINSince SSN (Social Security Number) is only issued to U.S. citizens, permanent residents, and temporary (working) residents by the United States Social Security Administration, it is impossible for foreigners to get it.The alternative to SSN is EIN (Employer Identification Number), also known as Federal Tax Identification Number, used to identify a business entity in the United States. To get EIN remotely, you’ll need to make a call to IRS (Internal Revenue Service) and do the following:Download the form and fill it in beforehand.Call the IRS — phone number (800) 829-4933 — and tell them you need an EIN. They will insist you to send the form by fax, but there is a workaround for this. Just say that you do not have a fax machine and would like to do it by phone.The operator will ask you to have the form on hand and read out the fields.In next 15 minutes, you will have an official EIN which will also be sent to you by mail at your home country address.3. US Mailing AddressIt is pretty easy to get US mailing address, you can sign up for any PO Box service to get it. There are number of online services that offers this. I recommend MailBox Forwarding. They provide you with a mailing address which is accessible online. You can receive and view all your mail online: letters, documents, and packages, whether delivered by the USPS, FedEx, or UPS.You can even use any fake address but it is not recommended. You may have to receive important documents by mail in future like from IRS or even Stripe etc.4. US Phone NumberYou can get a US phone number from Sonetel and forward it to your local phone number. It costs less than $2 per month and you can receive all calls directly at your current phone number.Stripe Sign UpOnce you have everything you need to sign up for Stripe payment service, the remaining is simple and straightforward. Go to Stripe.com and create an account by filling all the details (email, password etc.) and confirm your email address. Then log in to Stripe and switch the LIVE/TEST switcher to LIVE, then click Activate Account. You will need to fill out all the necessary details but be extra cautious with following:Country: United StatesBusiness type: Individual / Sole ProprietorshipEIN: The number you got from IRSAddress: Your mail-forwarding address in the USPhone: Sonetel US phone numberSSN: 000–000–000Bank Account: Log in to your Payoneer account, click Receive -> Global Payment Service and copy all the bank information from there.That’s all. You now have fully functioning Stripe account and ready to accept payments!ConclusionHonestly speaking, it is not a 1-hour task but certainly a workable solution that can open the access to the best online payment platform — Stripe. If you’re left with no other option to accept payments, it is worth trying. To wrap up the discussion, let’s go over the steps once again:Sign Up for Payoneer Prepaid Mastercard (to get US bank account)Get EIN from IRS (download the form)Get US Mailing Address (from MailBox Forwarding)Get US Phone Number (from Sonetel)Sign Up at StripeUpdate Your Stripe AccountDone!

-

How can SEBI bring more investment through the capital market?

How low are capital market investments penetration? It's a known fact that only 2% of Indians invest in our capital markets directly (via their demat accounts) [1] compared to 30% in developed countries and 9% invest in mutual funds [2]. I don't have data on ULIPs but let's be overtly optimistic and say that it's 3%, taking the total to 14%. That means that just 14 out of every 100 people have direct or indirect exposure to the capital markets, compared to 55% for developed countries.Why is the penetration low? The problem is that finance is complicated and with the introduction of new products, it's getting even more convoluted. There are interest rate futures, VIX futures, currency and commodity derivatives and whatnot. These are fantastic products and absolutely essential to build deep, mature financial markets that attract foreign institutional capital. But the average Indian who has a day job and a family to look after just cannot be expected to understand them and have the software/hardware infrastructure to invest or hedge using these products.If I'm made the SEBI chairman today, this is what I'll do:Make it easy for a new crop of fund managers to start their investment companies: This must be highly regulated, though. There should be an rigorous exam like we have for the Indian Administrative Service. If people need to write a tough exam and sit through an even tougher interview to able to run the country, we should have the same for those who want to manager our citizen’s wealth. Only those who pass, should be allowed to build innovative business models in the finch space.Ease of marketing: Look at this advertisement of UTI's mutual fund. What the hell is all that at the bottom half of the page? I understand the importance of a risk disclosures, but this is killing marketing innovation in financial products. If you can't market, you can't signNow out to people nor can you educate them.Audits: Regular audits of fund houses to avoid another Sahara fiasco. I’m thinking semi annual audits.Micro investments: This is interesting, and something I have worked on. I was conducting a World bank funded research to check the viability of a new business model wherein people in Indian villages and urban slums could be organised in to co-operative societies (as a legal entity) and invest collectively. This will bring in investments from rural India into our capital markets.Get rid of the paperwork and bring in the technology: To open a simple demat and trading account you have to fill up a form that will put R.D. Sharma’s books to shame, put in more signatures than Priyanka Chopra writes autographs in a day. Imagine you could just sign up with a fund manager using your email, PAN, Aadhar number, a password and an OTP and start investing.Sources:[1] http://www.sebi.gov.in/investor/...[2] http://www.sebi.gov.in/cms/sebi_data/DRG_Study/Opportunities.pdf

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

I'm going to publish my novel via CreateSpace's services, but will publish under a publishing company that I create. What do I need to know?

Thanks for the A2A, Tom. Do not, under any circumstances, use an ISBN provided by CreateSpace. Yes, it's cheaper, but this makes CS the publisher of your book. So why does this matter? Because the publisher owns the files. Even if you pay CS to create your book files (and I really hope you don't because their work is awful) you will not own them. If you ever want to print your book elsewhere, for example, at IngramSpark.com, they will hold "your" files hostage until you pay them again. We rescue authors every week who discovered this "gotcha" too late.My advice is to be a self-publisher in the way it was originally intended before the industry was hijacked: control every aspect of your publishing business. Buy your own ISBNs; don't get sucked in to some assembly line that offers the same solution to thousands of authors a month and who farms your book production out to overseas sweatshops; hire your own editorial and design experts who will care about your book as much as you do. Most of all, remember to give your buyers the quality book they deserve. They'll retaliate with bad reviews if you don't. I invite you to download (or re-read) my free book, "Publish Like the Pros: A Brief Guide to Quality Self-Publishing" at Home and take advantage of a free consultation. Hope that helps.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the new business entity form

How to generate an eSignature for your New Business Entity Form in the online mode

How to make an eSignature for the New Business Entity Form in Google Chrome

How to generate an eSignature for putting it on the New Business Entity Form in Gmail

How to make an eSignature for the New Business Entity Form straight from your smart phone

How to make an eSignature for the New Business Entity Form on iOS

How to generate an electronic signature for the New Business Entity Form on Android devices

People also ask

-

What is a New Business Entity and how can airSlate SignNow help?

A New Business Entity is a formal organization created under the laws of a state, which can include LLCs, corporations, or partnerships. airSlate SignNow provides a seamless platform for these entities to manage and eSign essential documents securely, ensuring compliance and efficiency in your business operations.

-

How much does it cost to use airSlate SignNow for a New Business Entity?

airSlate SignNow offers flexible pricing plans that cater to the needs of a New Business Entity. Whether you are a startup or an established business, you can choose from various subscription options that fit your budget while providing powerful eSigning features.

-

What features does airSlate SignNow offer for a New Business Entity?

For a New Business Entity, airSlate SignNow provides robust features such as customizable templates, bulk sending, and advanced security measures. These features streamline the document signing process, making it easier for businesses to operate efficiently and securely.

-

Can airSlate SignNow integrate with other software for my New Business Entity?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Dropbox, making it an ideal choice for your New Business Entity. These integrations allow for smoother workflows, enabling you to manage documents and data in one place.

-

What are the benefits of using airSlate SignNow for a New Business Entity?

Using airSlate SignNow for your New Business Entity provides numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. By digitizing your document processes, you can save time and resources while ensuring compliance with legal requirements.

-

Is airSlate SignNow secure for a New Business Entity's sensitive documents?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and secure cloud storage, to protect sensitive documents for your New Business Entity. You can trust that your data is safe while you eSign and manage important agreements.

-

How can airSlate SignNow help streamline operations for a New Business Entity?

airSlate SignNow helps streamline operations for a New Business Entity by automating the document signing process and providing real-time tracking of document status. This efficiency reduces delays and enhances communication, allowing your team to focus on growth rather than paperwork.

Get more for New Business Entity

- How to prepare a civil motion delaware courts form

- Us 864lt bpdf form

- Assignment and assumption agreement secgov form

- Irrevocable trust agreement for benefit of trustors children form

- Loan agreement template free sample docsketch form

- Riverside county small claims courtcasmallclaims com form

- Detective badge blueprint purpose form

- City of quincy ma mooring permits ecode360 form

Find out other New Business Entity

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure