Rbc Overdraft Fee Form

Understanding the RBC Overdraft Fee

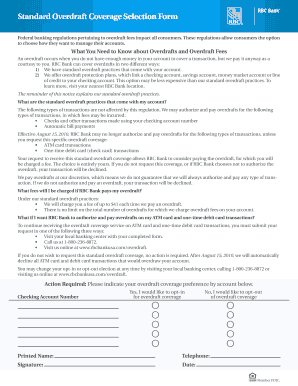

The RBC overdraft fee is a charge applied when a customer's account balance falls below zero due to transactions exceeding the available funds. This fee is designed to cover the bank's costs associated with processing these transactions. Understanding the specifics of this fee is crucial for managing your finances effectively. Typically, the overdraft fee can vary based on the account type and the bank's policies, so it is advisable to review your account agreement for precise details.

Steps to Complete the RBC Overdraft Fee Form

Completing the RBC overdraft fee form involves several straightforward steps. First, gather all necessary information, including your account number and personal identification details. Next, access the form through your online banking portal or request a physical copy from your local branch. Fill out the form accurately, ensuring that all required fields are completed. Once you have reviewed the information for accuracy, submit the form as directed, either online or by mailing it to the appropriate address provided by RBC.

Legal Use of the RBC Overdraft Fee

The legal use of the RBC overdraft fee is governed by banking regulations and the terms outlined in your account agreement. It is essential to understand that while overdraft services can provide a safety net, they come with associated costs. The bank must disclose the fees and terms clearly, ensuring that customers are aware of their rights and obligations. Compliance with these regulations protects both the bank and the customer, fostering transparency in banking practices.

Eligibility Criteria for RBC Overdraft Protection

Eligibility for RBC overdraft protection typically requires customers to maintain a good standing with the bank. This includes having an active account in good condition without any significant negative balances or history of non-payment. Additionally, customers may need to meet specific age and residency requirements, as well as provide personal identification. Checking with RBC directly can provide the most accurate and detailed eligibility criteria for their overdraft protection services.

Key Elements of the RBC Overdraft Fee

Several key elements define the RBC overdraft fee. These include the amount of the fee itself, which can vary, as well as the conditions under which the fee is applied. Customers should be aware of the daily limits on overdraft charges and any grace periods that may apply. Furthermore, it is important to understand how overdraft interest is calculated and when it is charged, as this can significantly impact the total cost of using overdraft services.

Examples of Using the RBC Overdraft Fee

Understanding practical examples of how the RBC overdraft fee works can help in managing finances. For instance, if a customer makes a purchase that exceeds their account balance, the bank may cover the transaction, resulting in an overdraft fee. Another example is when a scheduled payment is processed, but the account does not have sufficient funds. In both cases, the customer will incur an overdraft fee, highlighting the importance of monitoring account balances regularly.

Form Submission Methods for RBC Overdraft Fee

Submitting the RBC overdraft fee form can be done through various methods. Customers can complete the form online via the RBC banking portal, ensuring a quick and efficient process. Alternatively, for those who prefer traditional methods, the form can be printed and mailed to the designated address. In-person submissions are also an option at local RBC branches, where staff can assist with any questions or concerns regarding the form.

Quick guide on how to complete rbc overdraft fee

Complete Rbc Overdraft Fee effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Rbc Overdraft Fee on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Rbc Overdraft Fee with ease

- Obtain Rbc Overdraft Fee and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Modify and electronically sign Rbc Overdraft Fee and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rbc overdraft fee

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is RBC standard overdraft, and how does it work?

RBC standard overdraft is a banking feature that allows you to cover unexpected expenses by accessing extra funds when your account balance goes negative. This service can help prevent declined transactions and unexpected fees, ensuring smooth transactions. By opting for RBC standard overdraft, customers can maintain peace of mind, knowing they have financial flexibility when needed.

-

What are the fees associated with RBC standard overdraft?

The fees for RBC standard overdraft may vary based on your bank account type and the amount you overdraw. Typically, you might face a per-use fee each time you utilize the overdraft. Make sure to review the terms and conditions specific to your account to understand the full costs associated with RBC standard overdraft advantages.

-

How do I set up RBC standard overdraft for my account?

To set up RBC standard overdraft, you can visit your nearest RBC branch or use their online banking platform. During the setup process, you will need to agree to the terms and confirm the limits applicable to your account. Once activated, RBC standard overdraft will automatically apply when your account balance falls below zero.

-

What are the benefits of using RBC standard overdraft?

Using RBC standard overdraft can prevent declined transactions, ensuring that your payments go through, which can be crucial during emergencies. It also provides financial flexibility, allowing you to manage your expenses effectively. With RBC standard overdraft, you can avoid additional fees from merchants due to insufficient funds.

-

Can RBC standard overdraft be linked to multiple accounts?

Yes, RBC standard overdraft can be linked to multiple accounts, enabling you to manage overdraft protection across various accounts seamlessly. Doing so can streamline your transactions and ensure that if one account runs low, the funds can be accessed efficiently from another linked account. It's an excellent way to enhance your financial management strategies with RBC banking.

-

Is RBC standard overdraft automatically activated for all customers?

No, RBC standard overdraft is not automatically activated for all customers. You will need to opt-in for this service according to your banking needs. It’s advisable to discuss your specific requirements with an RBC representative to ensure you understand how the standard overdraft works and its conditions.

-

What happens if I exceed my RBC standard overdraft limit?

If you exceed your RBC standard overdraft limit, your transactions may be declined, and you could incur additional fees. Exceeding your limit also could impact your banking relationship, as it may suggest mismanagement of funds. It’s crucial to monitor your account regularly to avoid going beyond the approved overdraft amount.

Get more for Rbc Overdraft Fee

- One walmart w2 form

- Texas driver license application form 521265184

- Oil change receipt form

- Gina wilson geometry answer key form

- Lease agreement zimbabwe pdf form

- Boekenhoutkloof traffic college fees 2021 form

- Application for student office aide riviera isd rivieraisd esc2 form

- Chateau chantal donation request form

Find out other Rbc Overdraft Fee

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template