Form W 8ben

What is the Form W-8BEN

The Form W-8BEN, or Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is a tax form used by non-U.S. persons to certify their foreign status. This form is essential for individuals who receive income from U.S. sources, as it helps establish eligibility for reduced withholding tax rates under applicable tax treaties. By submitting the W-8BEN, individuals can avoid being taxed at the higher default rate on certain types of income, such as dividends and interest.

Steps to Complete the Form W-8BEN

Completing the Form W-8BEN involves several clear steps:

- Provide personal information: Fill in your name, country of citizenship, and permanent address.

- Claim tax treaty benefits: If applicable, indicate your eligibility for benefits under a tax treaty between your country and the United States.

- Sign and date the form: Ensure you sign and date the form to validate it. Your signature certifies that the information provided is accurate and complete.

It is important to ensure that all information is accurate to avoid any issues with the IRS.

Legal Use of the Form W-8BEN

The Form W-8BEN is legally binding and must be used in accordance with IRS regulations. It is crucial for non-U.S. individuals to submit this form to withholding agents or financial institutions to prevent excessive tax withholding on U.S. source income. Failure to provide a valid W-8BEN can result in the application of a 30% withholding tax on certain payments. Therefore, understanding the legal implications of this form is essential for compliance with U.S. tax laws.

Key Elements of the Form W-8BEN

Several key elements must be included when filling out the Form W-8BEN:

- Name of the beneficial owner: This should match the name on your official documents.

- Country of citizenship: Indicate the country where you hold citizenship.

- Permanent address: Provide a complete and accurate address outside the United States.

- Taxpayer Identification Number (TIN): If applicable, include your foreign TIN.

- Signature and date: Your signature must be provided to confirm the information.

Form Submission Methods

The Form W-8BEN can be submitted through various methods depending on the requirements of the withholding agent or financial institution:

- Online submission: Some institutions allow electronic submission of the form through their platforms.

- Mail: You can print and mail the completed form directly to the withholding agent or financial institution.

- In-person delivery: In certain cases, you may be required to deliver the form in person at the institution.

Always check with the specific institution for their preferred submission method to ensure compliance.

Filing Deadlines / Important Dates

While the Form W-8BEN does not have a specific filing deadline, it is essential to submit it before receiving any payments subject to withholding. If you do not provide the form in a timely manner, the withholding agent may apply the default withholding rate. It is advisable to keep track of any changes in your tax status or residency, as this may require submitting a new form. Regularly reviewing the form's validity is crucial to ensure compliance with IRS regulations.

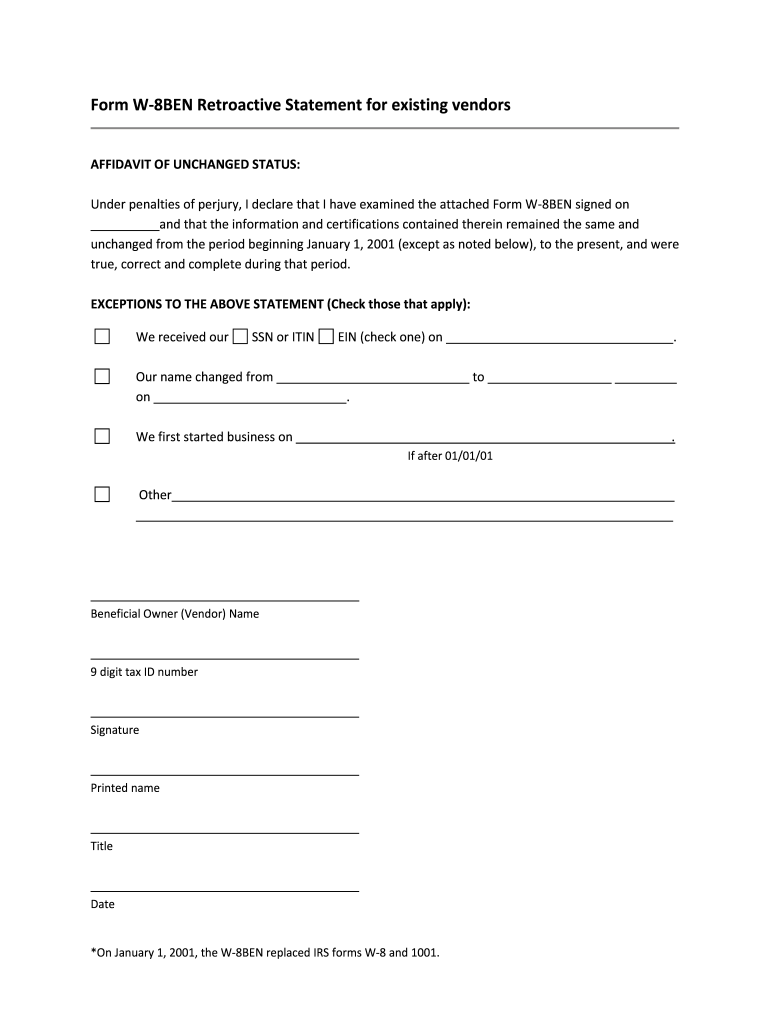

Quick guide on how to complete w 8ben retroactive form

Discover how to effortlessly navigate the Form W 8ben completion with this simple guide

Electronic filing and form completion is growing in popularity and has become the preferred option for a diverse range of clients. It presents numerous benefits compared to conventional printed materials, including convenience, time savings, enhanced precision, and security.

Using tools like airSlate SignNow, you can search for, modify, verify, and enhance and send your Form W 8ben without the hassle of endless printing and scanning. Follow this concise manual to begin and finalize your document.

Follow these steps to obtain and complete Form W 8ben

- Begin by clicking the Get Form button to access your document in our editor.

- Observe the green label on the left that highlights required fields to ensure you don’t miss them.

- Utilize our sophisticated features to annotate, modify, sign, safeguard, and enhance your document.

- Protect your file or convert it into an interactive form using the options available in the right panel.

- Review the document and check for errors or inconsistencies.

- Hit DONE to conclude your editing.

- Change the name of your document or keep it as is.

- Select the storage option where you wish to save your document, send it via USPS, or click the Download Now button to download your form.

If Form W 8ben isn’t what you were seeking, you can explore our extensive library of pre-imported templates that can be filled out with ease. Check out our solution today!

Create this form in 5 minutes or less

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the w 8ben retroactive form

How to make an electronic signature for your W 8ben Retroactive Form in the online mode

How to create an electronic signature for your W 8ben Retroactive Form in Chrome

How to make an eSignature for signing the W 8ben Retroactive Form in Gmail

How to create an eSignature for the W 8ben Retroactive Form from your smart phone

How to create an electronic signature for the W 8ben Retroactive Form on iOS

How to generate an electronic signature for the W 8ben Retroactive Form on Android devices

People also ask

-

What is Form W 8ben and who needs it?

Form W 8ben is a tax form used by foreign individuals and entities to signNow their foreign status and claim reduced withholding tax rates on certain types of income. If you are a non-U.S. person receiving income from U.S. sources, you will need to fill out Form W 8ben to avoid excessive tax withholding.

-

How can airSlate SignNow help me manage Form W 8ben?

airSlate SignNow offers an easy-to-use platform for sending and eSigning Form W 8ben. With our electronic signature solution, you can streamline the process, ensuring that your forms are completed and sent securely, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Form W 8ben?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. You can choose a plan that suits your requirements for managing documents like Form W 8ben, with features like unlimited templates, eSignature capabilities, and integration options.

-

What features does airSlate SignNow offer for handling Form W 8ben?

airSlate SignNow provides a range of features for handling Form W 8ben, including customizable templates, secure eSigning, and document tracking. These features ensure that your Form W 8ben is completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for Form W 8ben management?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more. This allows you to manage your Form W 8ben alongside other business processes, enhancing your workflow efficiency.

-

What are the benefits of using airSlate SignNow for Form W 8ben?

Using airSlate SignNow for Form W 8ben simplifies the document signing process, reduces manual errors, and ensures compliance with tax regulations. Additionally, our platform is user-friendly and provides a secure environment for managing sensitive information.

-

How secure is my data when using airSlate SignNow for Form W 8ben?

airSlate SignNow prioritizes the security of your data by implementing industry-standard encryption and compliance protocols. When you handle Form W 8ben through our platform, you can trust that your information is protected against unauthorized access.

Get more for Form W 8ben

- Patient registration washington township medical foundation form

- Form al 864lt

- Nc do 11apdf form

- Personally came and appeared before me the undersigned authority in and for the said form

- Ga sample final contractors affidavits virtual underwriter form

- Affidavit by an attorney in fact in the capacity of an administrator of an estate form

- Maryland notaries public maryland secretary of state form

- Corporation was held on 20 immediately following form

Find out other Form W 8ben

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer