Chubb Renewal Application Financial Institution Bond Brokers Form 1991-2026

What is the Chubb Renewal Application Financial Institution Bond Brokers Form

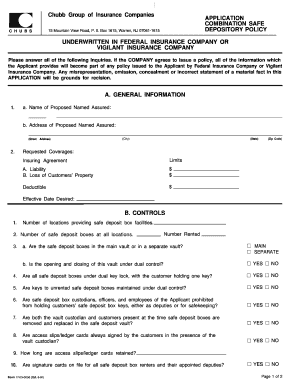

The Chubb Renewal Application Financial Institution Bond Brokers Form is a crucial document used by financial institutions and bond brokers to renew their insurance coverage with Chubb. This form ensures that the organization maintains compliance with regulatory requirements while providing necessary information about the business operations, financial standing, and risk management strategies. By completing this form, institutions can secure their coverage and protect themselves against potential liabilities.

Steps to Complete the Chubb Renewal Application Financial Institution Bond Brokers Form

Completing the Chubb Renewal Application involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather Required Information: Collect all necessary documents, including financial statements, previous policy details, and information about any claims made in the past year.

- Fill Out the Form: Carefully enter the required information in the application, ensuring all fields are completed accurately to avoid delays.

- Review for Accuracy: Double-check all entries for accuracy and completeness. Any discrepancies can lead to processing delays.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Legal Use of the Chubb Renewal Application Financial Institution Bond Brokers Form

The Chubb Renewal Application is legally binding once submitted. It is essential for applicants to understand that the information provided must be truthful and accurate, as any misrepresentation can lead to penalties or denial of coverage. The form complies with relevant regulations and is designed to protect both the insurer and the insured by ensuring that all parties are aware of the risks involved in the financial sector.

Eligibility Criteria for the Chubb Renewal Application Financial Institution Bond Brokers Form

To be eligible for the Chubb Renewal Application, applicants must meet specific criteria, including:

- Being a licensed financial institution or bond broker operating within the United States.

- Maintaining a good standing with regulatory authorities and having no outstanding compliance issues.

- Providing accurate financial information that demonstrates the ability to manage risks effectively.

Form Submission Methods for the Chubb Renewal Application Financial Institution Bond Brokers Form

Applicants have several options for submitting the Chubb Renewal Application. These methods include:

- Online Submission: Many applicants prefer to submit their forms electronically through Chubb's secure online portal, which allows for faster processing.

- Mail: Applicants can print the completed form and send it via postal mail to the designated Chubb office.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at a local Chubb office is also an option.

Key Elements of the Chubb Renewal Application Financial Institution Bond Brokers Form

The Chubb Renewal Application includes several key elements that applicants must complete. These elements typically include:

- Business Information: Details about the organization, including name, address, and contact information.

- Financial Data: Information regarding the institution's financial performance, including revenue, assets, and liabilities.

- Risk Management Practices: A description of the measures in place to mitigate risks associated with financial operations.

- Claims History: A record of any claims made in the past year, which helps assess the risk profile of the applicant.

Quick guide on how to complete chubb renewal application financial institution bond brokers form

Complete Chubb Renewal Application Financial Institution Bond Brokers Form effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without holdups. Handle Chubb Renewal Application Financial Institution Bond Brokers Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Chubb Renewal Application Financial Institution Bond Brokers Form without exertion

- Locate Chubb Renewal Application Financial Institution Bond Brokers Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from a device you prefer. Edit and eSign Chubb Renewal Application Financial Institution Bond Brokers Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chubb renewal application financial institution bond brokers form

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What are Chubb renewal applications?

Chubb renewal applications are the documents required for renewing insurance policies with Chubb. These applications ensure that your coverage remains active and include important information that helps in assessing your risk profile.

-

How can airSlate SignNow simplify Chubb renewal applications?

airSlate SignNow simplifies Chubb renewal applications by allowing businesses to easily send and eSign documents online. This streamlines the process, making it faster and reducing the likelihood of errors that may occur with manual paperwork.

-

What features does airSlate SignNow offer for handling Chubb renewal applications?

airSlate SignNow offers features such as document templates, real-time tracking, and secure eSigning capabilities specifically for Chubb renewal applications. These tools enhance efficiency and ensure that your documents are completed quickly and securely.

-

Is airSlate SignNow cost-effective for managing Chubb renewal applications?

Yes, airSlate SignNow is a cost-effective solution for managing Chubb renewal applications. With flexible pricing plans, businesses can choose the option that best fits their needs while still accessing premium features to streamline their document processes.

-

Can I integrate airSlate SignNow with other tools while handling Chubb renewal applications?

Absolutely! airSlate SignNow seamlessly integrates with various tools and platforms, allowing for efficient management of Chubb renewal applications. These integrations enhance workflow automation and improve overall productivity.

-

What benefits does airSlate SignNow provide for Chubb renewal applications?

The benefits of using airSlate SignNow for Chubb renewal applications include increased speed in document processing, enhanced security with encrypted signatures, and improved compliance management. This ensures that your renewal applications meet industry regulations effortlessly.

-

How secure is the data stored in airSlate SignNow for Chubb renewal applications?

Data security is a top priority at airSlate SignNow. All documents, including Chubb renewal applications, are stored using advanced encryption methods to protect sensitive information, ensuring peace of mind for your business and your clients.

Get more for Chubb Renewal Application Financial Institution Bond Brokers Form

- Commonly used imaging techniques for diagnosis and staging form

- For appointment under a pathways form

- Society of toxicologic pathology application for use of mailing lists form

- Accidental death ampamp dismemberment required documentation form

- North american provisional affilate membership application form

- Main idea worksheets with answers pdf form

- Astmh membership form

- Federal register volume 74 issue 165 thursday august 27 form

Find out other Chubb Renewal Application Financial Institution Bond Brokers Form

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document