Application for Group Exemption 2012-2026

What is the application for group exemption?

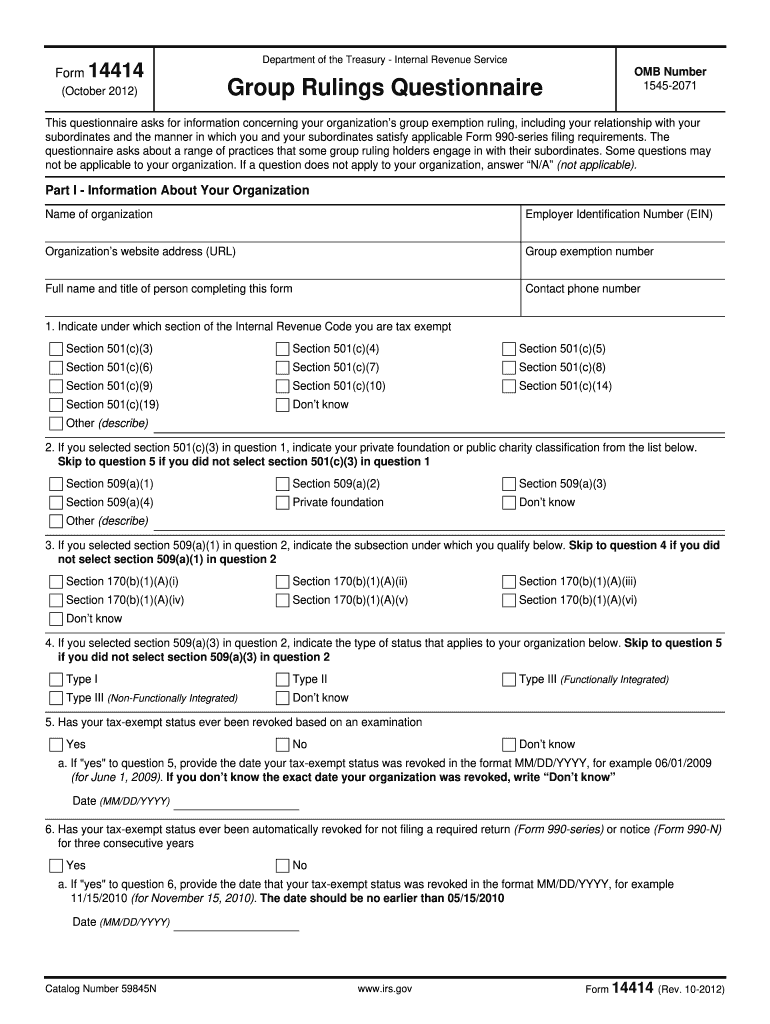

The application for group exemption allows certain organizations to apply for tax-exempt status under a single umbrella. This is particularly beneficial for groups of related entities, such as those sharing a common purpose or mission. Under Rev Proc 80-27, organizations can streamline their tax-exempt status by submitting a single application rather than individual applications for each entity. This process simplifies compliance and reduces administrative burdens for both the organizations and the IRS.

Eligibility criteria for the application for group exemption

To qualify for a group exemption under Rev Proc 80-27, organizations must meet specific criteria. Each member of the group must be a subordinate organization under the common control of a central organization. Additionally, the central organization must be recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code. The application must include documentation demonstrating the relationship between the central organization and its subordinates, along with a clear statement of the group's purpose.

Steps to complete the application for group exemption

Completing the application for group exemption involves several key steps:

- Gather necessary documentation, including the central organization’s tax-exempt determination letter and the governing documents of each subordinate organization.

- Complete IRS Form 1023 or Form 1024, as applicable, ensuring all required information is accurately provided.

- Prepare a comprehensive narrative that outlines the relationship between the central organization and its subordinates, including shared goals and activities.

- Submit the application along with the required fee to the IRS, ensuring compliance with all filing deadlines.

Required documents for the application for group exemption

When applying for group exemption, organizations must submit several key documents, including:

- The central organization’s tax-exempt determination letter from the IRS.

- Governing documents for each subordinate organization, such as articles of incorporation and bylaws.

- A detailed narrative explaining the relationship between the central organization and its subordinates.

- Any additional information required by the IRS to demonstrate compliance with tax-exempt status requirements.

IRS guidelines for the application for group exemption

The IRS provides specific guidelines for organizations seeking group exemption under Rev Proc 80-27. These guidelines outline the eligibility requirements, documentation needed, and the application process. Organizations must ensure they adhere to these guidelines to avoid delays or denials in their applications. Regular updates and clarifications from the IRS can impact the application process, so staying informed is essential for compliance.

Penalties for non-compliance with group exemption requirements

Failure to comply with the requirements of the group exemption can result in significant penalties. Organizations may face revocation of their tax-exempt status, which can lead to back taxes, fines, and legal repercussions. Additionally, non-compliance may affect the ability of subordinate organizations to maintain their tax-exempt status. It is crucial for organizations to understand and adhere to all regulations to avoid these potential consequences.

Quick guide on how to complete application for group exemption

Prepare Application For Group Exemption effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the needed form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Application For Group Exemption on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Application For Group Exemption with ease

- Locate Application For Group Exemption and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Application For Group Exemption to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for group exemption

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is rev proc 80 27 and how does it impact eSigning documents?

Rev proc 80 27 refers to a specific IRS procedure that outlines the acceptance of electronic signatures for certain tax documents. By leveraging airSlate SignNow, businesses can ensure their eSigned documents comply with rev proc 80 27, enhancing operational efficiency and reducing paper usage.

-

How does airSlate SignNow ensure compliance with rev proc 80 27?

airSlate SignNow adheres to the guidelines set forth in rev proc 80 27, offering a secure platform for electronic signatures. Our platform is designed to meet legal standards, thus ensuring that your eSigned documents are valid and enforceable by the IRS.

-

What are the pricing options for airSlate SignNow when dealing with documents related to rev proc 80 27?

airSlate SignNow provides flexible pricing plans that cater to various business sizes and needs, including those needing compliance with rev proc 80 27. Our transparent pricing structure ensures that you can choose a plan that fits your budget and the volume of documents you handle.

-

What features does airSlate SignNow offer for businesses focusing on rev proc 80 27?

airSlate SignNow boasts several features to assist with eSigning and managing documents under rev proc 80 27. These include user-friendly templates, customizable workflows, and comprehensive tracking to ensure all aspects of your eSigning process remain compliant and efficient.

-

Can I integrate airSlate SignNow with other software while ensuring compliance with rev proc 80 27?

Yes, airSlate SignNow offers seamless integration with popular software platforms to streamline your document management process. By integrating with your existing systems, you can maintain compliance with rev proc 80 27 while enhancing productivity and collaboration.

-

What benefits can my business expect from using airSlate SignNow for rev proc 80 27 compliance?

Using airSlate SignNow for rev proc 80 27 compliance can signNowly reduce processing times and paper waste. Additionally, you gain access to secure storage and easy retrieval of eSigned documents, ultimately improving your workflow and ensuring compliance.

-

Is airSlate SignNow suitable for small businesses concerned with rev proc 80 27?

Absolutely! airSlate SignNow is tailored to meet the needs of businesses of all sizes, including small businesses navigating the complexities of rev proc 80 27. Our user-friendly interface and affordable pricing make it an excellent choice for businesses looking to implement electronic signatures.

Get more for Application For Group Exemption

- Girl scout permission slip form

- Fm 4679 forms miami dade county public schools

- Miami dade county direct deposit form

- Verification statement form

- Douglas county eviction process form

- Illinois community college verification form

- Schedule an appointment form templatejotform

- Appointment scheduling request form

Find out other Application For Group Exemption

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast