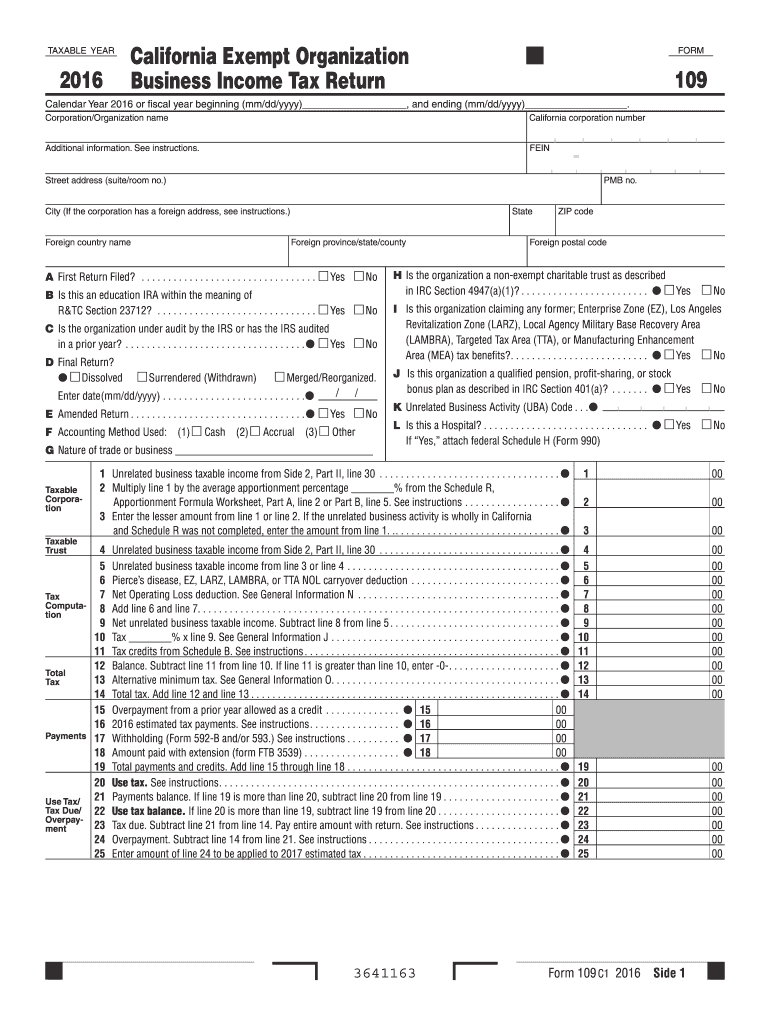

Form 109 2016

What is the Form 109

The Form 109 is a tax document utilized in the United States primarily for reporting income, expenses, and other financial information to the Internal Revenue Service (IRS). It serves as a means for individuals and businesses to report various types of income, including wages, dividends, and distributions from retirement accounts. Understanding the purpose of Form 109 is crucial for accurate tax filing and compliance with federal regulations.

How to use the Form 109

Using Form 109 involves filling out the necessary fields with accurate financial information. Taxpayers must report their income and any applicable deductions or credits. After completing the form, it is essential to review the information for accuracy before submission. The form can be filed electronically or mailed to the IRS, depending on the taxpayer's preference and the specific requirements of their situation.

Steps to complete the Form 109

Completing Form 109 requires several steps to ensure accuracy and compliance. First, gather all relevant financial documents, such as W-2s, 1099s, and any other income statements. Next, enter your personal information, including your name, address, and Social Security number. Then, report your income in the appropriate sections, ensuring that all figures are accurate. Finally, review the completed form for any errors, sign it, and submit it to the IRS.

Legal use of the Form 109

Form 109 is legally recognized by the IRS and must be used in accordance with federal tax laws. Taxpayers are required to file this form accurately to avoid penalties and ensure compliance with tax regulations. The IRS has established guidelines for the proper use of Form 109, including deadlines for submission and requirements for eSignatures, which have been expanded to facilitate digital filing.

Filing Deadlines / Important Dates

Filing deadlines for Form 109 are crucial for maintaining compliance with IRS regulations. Typically, the deadline for submitting Form 109 is April 15 of each year, although this date may vary depending on weekends or holidays. It is important for taxpayers to be aware of these deadlines to avoid late fees or penalties. Additionally, if filing electronically, the deadlines may differ slightly, so checking the IRS website for the most current information is advisable.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting Form 109. These guidelines outline the necessary information to include, the acceptable methods of submission, and the specific requirements for eSignatures. Taxpayers should familiarize themselves with these guidelines to ensure that their submissions meet all legal standards and avoid potential issues with the IRS.

Quick guide on how to complete form 109 2016

Your assistance manual on how to prepare your Form 109

If you're interested in learning how to generate and submit your Form 109, here are a few straightforward guidelines to simplify the tax filing process.

To begin, you merely need to set up your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to edit, create, and complete your tax documents effortlessly. Using its editor, you can alternate between text, check boxes, and eSignatures, and revert to modify answers as necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Form 109 in moments:

- Create your account and start working on PDFs in no time.

- Utilize our directory to acquire any IRS tax form; browse through versions and schedules.

- Click Get form to access your Form 109 in our editor.

- Fill in the required fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that paper filing can lead to return errors and delay refunds. Naturally, before e-filing your taxes, ensure you check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 109 2016

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Is it required to fill form 109 online for a CA articleship transfer?

No need.You can fill offline also.2 ways to fill 109 form1 online2 offlineFor offline , Download form from site then take 3 prints and fill it.1 to Icai ,next one to principal and another one for you.Thank you

Create this form in 5 minutes!

How to create an eSignature for the form 109 2016

How to make an eSignature for your Form 109 2016 online

How to make an eSignature for the Form 109 2016 in Chrome

How to create an electronic signature for signing the Form 109 2016 in Gmail

How to make an eSignature for the Form 109 2016 right from your mobile device

How to create an eSignature for the Form 109 2016 on iOS

How to generate an eSignature for the Form 109 2016 on Android

People also ask

-

What is Form 109 and how can airSlate SignNow help with it?

Form 109 is a tax form used in the United States for reporting various types of income. airSlate SignNow streamlines the process of filling out and eSigning Form 109, making it easier for businesses to manage their tax documentation efficiently. Our platform ensures compliance and security, giving you peace of mind during tax season.

-

How much does airSlate SignNow cost for managing Form 109?

airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes. Depending on your needs for managing documents like Form 109, you can choose a plan that fits your budget while providing all necessary features for eSigning and document management.

-

What features does airSlate SignNow offer for Form 109 handling?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage specifically for documents like Form 109. These features help simplify the eSigning process, ensuring that you and your clients can complete tax forms quickly and securely.

-

Can I integrate airSlate SignNow with my accounting software for Form 109?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms, making it easy to manage Form 109 alongside your financial documents. This integration enhances workflow efficiency and ensures that all your tax-related processes are streamlined and accessible.

-

How does airSlate SignNow ensure the security of Form 109 documents?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards. When handling sensitive documents like Form 109, you can trust that your information is protected, ensuring that both you and your clients feel secure during the eSigning process.

-

Is it easy to use airSlate SignNow for new users unfamiliar with Form 109?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for new users to navigate and manage documents like Form 109. With helpful tutorials and customer support, you'll quickly become proficient in eSigning and document management.

-

What are the benefits of using airSlate SignNow for eSigning Form 109?

Using airSlate SignNow for eSigning Form 109 offers numerous benefits, including faster turnaround times, enhanced accuracy, and reduced paperwork. Our platform allows for easy collaboration, so you can ensure that all parties involved can sign and submit the form without any hassle.

Get more for Form 109

- Title lien statement boone county kentucky clerk form

- Nccap application form

- Affidavit of abandonment form

- Nyati savings amp credit society ltd form

- Weekly transportation log daily transportation in facility owned vehicle form

- Ua form 3 postgraduate traning verifciation form

- Large bereavement arrangement made in absorbent floral foam also called a sympathy tribute or sympathy basket form

- Personal record request katy independent school district katyisd form

Find out other Form 109

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney