8569 2006-2026

What is the 8569

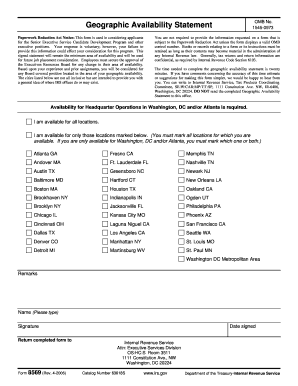

The 8569 form, also known as the Geographic Availability Statement, is a document used primarily in tax-related contexts. It provides information about the availability of certain tax benefits or credits in specific geographic areas. This form is essential for taxpayers who need to demonstrate eligibility for various tax provisions based on their location. Understanding the purpose and requirements of the 8569 is crucial for accurate tax reporting and compliance.

How to use the 8569

Using the 8569 involves several steps to ensure accurate completion. First, gather all necessary information regarding your geographic location and the specific tax benefits you are claiming. Next, fill out the form with precise details, ensuring that all entries align with IRS guidelines. After completing the form, review it for accuracy before submission. The 8569 can be submitted electronically or via traditional mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the 8569

Completing the 8569 requires careful attention to detail. Follow these steps for successful completion:

- Gather relevant documentation that supports your claims regarding geographic availability.

- Fill out the form with accurate personal and location information.

- Ensure that all entries are consistent with IRS requirements.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, as per your preference.

Legal use of the 8569

The 8569 form must be used in compliance with IRS regulations to ensure its legal validity. This includes adhering to all guidelines regarding the information provided and the manner of submission. Utilizing a reliable eSignature platform can enhance the legal standing of the completed form, as it provides a secure method for signing and ensuring compliance with eSignature laws. The legal use of the 8569 is critical for maintaining the integrity of your tax filings.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 8569. It is essential to familiarize yourself with these guidelines to ensure compliance. Key aspects include understanding the eligibility criteria for the geographic benefits being claimed, as well as the required documentation that must accompany the form. Adhering to these guidelines will help prevent delays or issues with your tax filings.

Filing Deadlines / Important Dates

Timely submission of the 8569 is crucial to avoid penalties. The IRS sets specific deadlines for filing tax forms, including the 8569. It is important to keep track of these dates to ensure that your form is submitted on time. Missing a deadline can lead to complications in your tax situation, including potential fines or loss of benefits. Always verify the current year's deadlines as they may vary.

Quick guide on how to complete 8569

Effortlessly Prepare 8569 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a seamless, eco-conscious substitute for conventional printed and signed paperwork, allowing users to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Manage 8569 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 8569 effortlessly

- Locate 8569 and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign 8569 and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8569

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the pricing structure for the airSlate SignNow 8569 solution?

The airSlate SignNow 8569 solution offers flexible pricing plans to meet various business needs. Our plans start at competitive rates, which ensure that even small businesses can afford electronic signature solutions. Additionally, each plan includes a free trial to let you explore the features before committing.

-

What features does airSlate SignNow 8569 offer?

airSlate SignNow 8569 provides a robust set of features that streamline document management. Key features include customizable templates, real-time notifications, and a secure signing process. This ensures that your documents are handled efficiently and securely.

-

How does airSlate SignNow 8569 benefit businesses?

Using airSlate SignNow 8569 allows businesses to save time and reduce paperwork costs. The easy-to-use platform enhances productivity by enabling quick eSigning and document sharing. By reducing the reliance on physical documents, businesses can also minimize their environmental impact.

-

Can airSlate SignNow 8569 integrate with other software?

Yes, airSlate SignNow 8569 easily integrates with a variety of popular applications, including CRM and project management tools. This integration capability ensures that your workflow remains uninterrupted, allowing seamless transfer of data across platforms. It helps users maintain organized records and improves overall efficiency.

-

Is airSlate SignNow 8569 suitable for all business sizes?

Absolutely! airSlate SignNow 8569 is designed to cater to businesses of all sizes, from startups to large enterprises. The solution's scalability ensures that it can grow alongside your business, meeting your needs no matter how complex or straightforward they may be.

-

What security features are included in airSlate SignNow 8569?

Security is a top priority in airSlate SignNow 8569, which includes features like SSL encryption and two-factor authentication. These measures help protect sensitive documents and maintain compliance with regulations. Businesses can trust that their data is safe while using our eSignature solution.

-

How can I get support for airSlate SignNow 8569?

Support for airSlate SignNow 8569 is readily available through multiple channels. Users can access our help center, engage in live chat, or contact our customer service team via email. We are committed to ensuring you have the resources needed for a smooth experience.

Get more for 8569

Find out other 8569

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free