Form 8926 2018-2026

What is the Form 8926

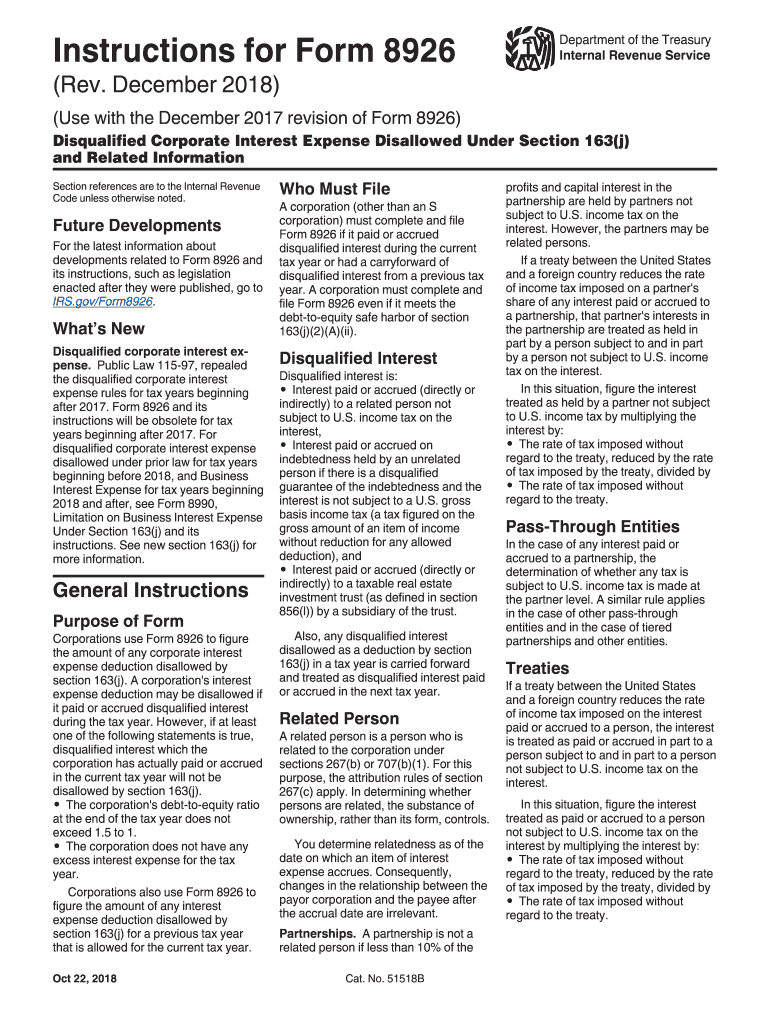

The IRS Form 8926 is specifically designed for corporations to report disallowed interest expenses under IRS Section 163(j). This form is essential for businesses that have incurred interest expenses that exceed the allowable limits set forth by the IRS. Understanding the purpose of Form 8926 is crucial for compliance with tax regulations, as it helps ensure that corporations accurately report their financial activities related to interest deductions.

How to use the Form 8926

Using Form 8926 involves several steps to ensure accurate reporting of disallowed interest expenses. Corporations must first gather relevant financial information, including total interest expense and adjusted taxable income. After completing the form, it is important to review the entries for accuracy. This form must be filed alongside the corporation's tax return, ensuring that the IRS is informed of any disallowed interest expenses. Proper usage of Form 8926 can help prevent potential penalties associated with incorrect reporting.

Steps to complete the Form 8926

Completing Form 8926 requires careful attention to detail. The following steps outline the process:

- Gather financial records, including interest expense documentation and taxable income calculations.

- Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

- Calculate the total interest expense and determine the allowable interest deduction based on adjusted taxable income.

- Report any disallowed interest expenses on the appropriate lines of the form.

- Review the completed form for accuracy before submission.

Legal use of the Form 8926

Form 8926 must be completed and submitted in accordance with IRS guidelines to ensure its legal validity. The form serves as a declaration of disallowed interest, and inaccuracies can lead to compliance issues. Corporations should be aware of the legal implications of submitting incorrect information, as this can result in penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of Form 8926.

Filing Deadlines / Important Dates

Filing deadlines for Form 8926 align with the corporate tax return deadlines. Typically, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For calendar year taxpayers, this means the deadline is April 15. However, if an extension is filed, the deadline for submitting Form 8926 may also be extended. It is important for corporations to be aware of these dates to avoid late filing penalties.

Penalties for Non-Compliance

Failure to properly file Form 8926 can result in significant penalties. The IRS may impose fines for late filing or inaccuracies on the form. Additionally, disallowed interest expenses that are not reported correctly can lead to adjustments in taxable income, resulting in further tax liabilities. Understanding the consequences of non-compliance emphasizes the importance of accurate reporting and timely submission of Form 8926.

Quick guide on how to complete form 8926

Prepare Form 8926 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and electronically sign your documents quickly and without delays. Manage Form 8926 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form 8926 with ease

- Obtain Form 8926 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 8926 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8926

Create this form in 5 minutes!

How to create an eSignature for the form 8926

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is IRS Section 163(j) and how does it affect my business?

IRS Section 163(j) limits the deductibility of interest expense for businesses. This tax provision can affect your company's cash flow and debt management strategies. Understanding IRS Section 163(j) is essential for effective tax planning and compliance.

-

How can airSlate SignNow help with managing documents related to IRS Section 163(j)?

airSlate SignNow streamlines the process of eSigning and managing important documents related to IRS Section 163(j). Our platform enables you to easily create, send, and track documents, ensuring that you stay compliant with tax regulations. This efficiency saves time and reduces the risk of errors.

-

Is airSlate SignNow compatible with accounting software handling IRS Section 163(j) calculations?

Yes, airSlate SignNow integrates seamlessly with various accounting software that may assist in calculations related to IRS Section 163(j). This integration helps you manage your financial documents while ensuring compliance with tax laws. By combining these tools, you can streamline your workflow.

-

What are the pricing options for airSlate SignNow, especially for businesses needing IRS Section 163(j) documentation?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including those focusing on IRS Section 163(j) documentation. You can choose a plan that aligns with your volume of eSignature needs and budget. Explore our pricing page for more detailed information.

-

What features does airSlate SignNow offer for managing IRS Section 163(j) compliance?

AirSlate SignNow provides features like document templates, bulk sending, and audit trails to help manage IRS Section 163(j) compliance effectively. These features ensure that your documentation process is secure and compliant with regulations. Enhanced tracking options allow you to review document history easily.

-

Can airSlate SignNow help ensure timely completion of IRS Section 163(j) related documents?

Absolutely! With airSlate SignNow's reminders and notifications, you can ensure timely completion of all IRS Section 163(j) related documents. This feature helps prevent missed deadlines and keeps your business compliant with tax laws. Streamlining the signing process enhances your operational efficiency.

-

How does airSlate SignNow help mitigate risks associated with IRS Section 163(j)?

By utilizing airSlate SignNow, businesses can mitigate risks associated with IRS Section 163(j) compliance through secure document handling and easy eSigning. Our platform offers reliable security features that protect sensitive information, helping to safeguard your business against potential tax penalties. Accurate record-keeping reduces risk signNowly.

Get more for Form 8926

- Lomita teen program parental fact sheet and waiver form

- Agreement for san antonio bexar county continuum of care form

- Idaho state museum field trip request form historyidahogov

- Nc child support direct deposit form

- Nation ok gaming commission form

- Annual certification of compliance with conflict of interest policy form

- Chromebook program grades 9 12 washington school district form

- 2 application for emergency financial assistance final form

Find out other Form 8926

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself