1120 Ic Disc P Form 2017-2026

What is the 1120 Ic Disc P Form

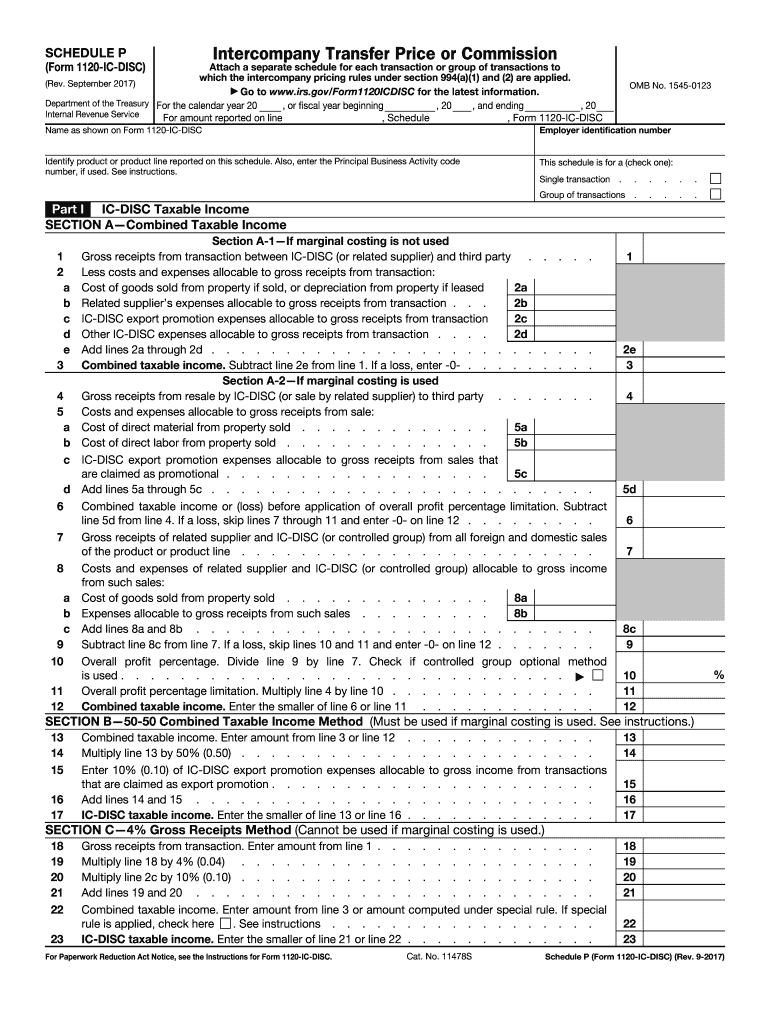

The 1120 Ic Disc P Form is a tax document used by U.S. corporations to report income from international sales. This form is specifically designed for companies that qualify as Interest Charge Domestic International Sales Corporations (IC-DISCs). It allows these entities to take advantage of certain tax benefits associated with their export activities. By utilizing the 1120 Ic Disc P Form, businesses can potentially reduce their overall tax liability while complying with IRS regulations.

How to use the 1120 Ic Disc P Form

Using the 1120 Ic Disc P Form involves several steps to ensure accurate reporting of income and deductions. First, businesses must determine their eligibility as an IC-DISC. Once eligibility is confirmed, the form must be filled out with accurate financial information, including gross receipts and expenses related to export sales. It's essential to follow the specific instructions provided by the IRS for the form to avoid errors that could lead to penalties. After completing the form, it should be submitted along with any required supporting documents.

Steps to complete the 1120 Ic Disc P Form

Completing the 1120 Ic Disc P Form requires attention to detail. Here are the key steps:

- Gather financial records related to international sales.

- Confirm eligibility as an IC-DISC based on IRS guidelines.

- Fill out the form, ensuring all income and deductions are accurately reported.

- Review the form for completeness and accuracy.

- Submit the form to the IRS by the specified deadline.

Legal use of the 1120 Ic Disc P Form

The legal use of the 1120 Ic Disc P Form is crucial for businesses seeking to benefit from tax incentives related to international sales. It is important to ensure that all information provided is truthful and complies with IRS regulations. Misrepresentation or errors can lead to audits, penalties, or disqualification from IC-DISC benefits. Businesses should maintain proper documentation to support the claims made on the form, as this can be essential in the event of an IRS inquiry.

Filing Deadlines / Important Dates

Filing deadlines for the 1120 Ic Disc P Form are typically aligned with the corporate tax return deadlines. Generally, the form must be filed by the 15th day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid penalties.

Required Documents

When completing the 1120 Ic Disc P Form, certain documents are required to support the information reported. These may include:

- Financial statements detailing income and expenses.

- Documentation of export sales and related transactions.

- Records of any prior year filings that may impact the current year's form.

Having these documents ready can streamline the process and ensure compliance with IRS requirements.

Quick guide on how to complete 1120 ic disc p form

Prepare 1120 Ic Disc P Form easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1120 Ic Disc P Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign 1120 Ic Disc P Form with ease

- Find 1120 Ic Disc P Form and select Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from your device of choice. Modify and electronically sign 1120 Ic Disc P Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1120 ic disc p form

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the IRS 1120DISC form and why is it important?

The IRS 1120DISC form is essential for U.S. exporters who use a domestic international sales corporation (DISC) to minimize taxes on export income. Filing this form correctly can help businesses maximize their financial benefits while complying with IRS regulations.

-

How can airSlate SignNow assist with the IRS 1120DISC form process?

airSlate SignNow streamlines the process of filing the IRS 1120DISC form by allowing users to easily send, sign, and manage documents online. Our platform ensures all necessary signatures and approvals are in place, simplifying compliance and reducing errors.

-

Is there a cost to use airSlate SignNow for the IRS 1120DISC form?

Absolutely! airSlate SignNow offers a cost-effective solution for managing the IRS 1120DISC form and other documents. Our pricing plans are designed to fit various business needs, making it affordable for all sizes of companies.

-

What features does airSlate SignNow provide for IRS document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage specifically for forms like the IRS 1120DISC form. These tools help ensure your documents are organized, accessible, and compliant.

-

Can I integrate airSlate SignNow with other software for IRS filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and ERP systems, facilitating the easy completion of the IRS 1120DISC form alongside your other financial documents. This integration streamlines workflows, eliminating the need for manual data entry.

-

What benefits does airSlate SignNow offer for businesses dealing with the IRS 1120DISC form?

By using airSlate SignNow to manage the IRS 1120DISC form, businesses can save time and reduce the risk of errors. Our solution enhances efficiency through easy document tracking and ensures timely submissions, helping companies avoid penalties.

-

Is airSlate SignNow secure for managing sensitive IRS forms?

Yes, airSlate SignNow prioritizes your security when managing sensitive documents, including the IRS 1120DISC form. We implement multiple layers of security measures, including encryption and secure access controls, to protect your information.

Get more for 1120 Ic Disc P Form

- Sickness fitness certificate rajasthan in hindi pdf download form

- Joining relieving report pdf form

- All car engine oil capacity chart pdf form

- Modelo as 78 form

- Zanaco account opening forms

- Bd2037b tax file number registration department of veterans bb form

- Animal care services form

- Gas utility load form city of port aransas gas cityofportaransas

Find out other 1120 Ic Disc P Form

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast