Capital Loss Carryover Worksheet to Form

What is the Capital Loss Carryover Worksheet

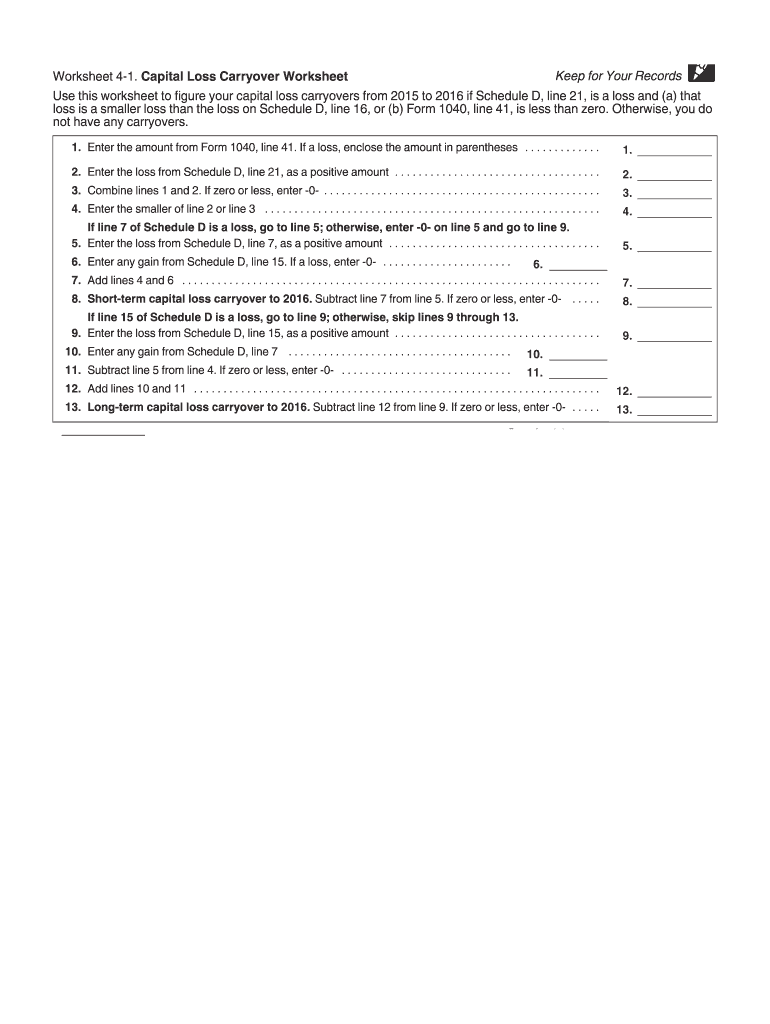

The capital loss carryover worksheet is a tax form used by individuals and businesses to calculate and report capital losses that can be carried over to future tax years. This worksheet is particularly useful for taxpayers who have incurred losses from the sale of investments or assets, allowing them to offset future capital gains. By accurately completing this worksheet, taxpayers can ensure they maximize their tax benefits while remaining compliant with IRS regulations.

How to use the Capital Loss Carryover Worksheet

To effectively use the capital loss carryover worksheet, begin by gathering all relevant financial documents, including previous tax returns and records of capital gains and losses. Next, input your total capital losses for the current year, as well as any capital gains. The worksheet will guide you through the calculation process, helping you determine the amount of loss that can be carried over to future tax years. It is essential to follow IRS guidelines closely to ensure accuracy and compliance.

Steps to complete the Capital Loss Carryover Worksheet

Completing the capital loss carryover worksheet involves several key steps:

- Gather your financial documents, including past tax returns.

- List all capital gains and losses for the current tax year.

- Calculate your total capital losses and gains.

- Use the provided sections of the worksheet to determine the carryover amount.

- Review your entries for accuracy before submission.

Following these steps will help ensure that you accurately report your capital losses and maximize your potential tax benefits.

IRS Guidelines

The IRS provides specific guidelines for using the capital loss carryover worksheet. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. For instance, the IRS allows individuals to offset capital gains with capital losses, but there are limits on how much loss can be deducted in a given year. Understanding these regulations is crucial for proper tax reporting and planning.

Legal use of the Capital Loss Carryover Worksheet

The legal use of the capital loss carryover worksheet is grounded in IRS regulations. When completed accurately, the worksheet serves as a valid document for reporting capital losses on tax returns. It is important to ensure that all information is truthful and complete, as discrepancies can lead to audits or penalties. Utilizing a reliable electronic signature solution can further enhance the legal standing of your completed worksheet.

Examples of using the Capital Loss Carryover Worksheet

Examples of using the capital loss carryover worksheet include scenarios where an investor sells stocks at a loss and wishes to carry that loss forward to offset future gains. For instance, if a taxpayer sells shares for a $5,000 loss in one year but realizes a $3,000 gain the following year, they can use the worksheet to apply the loss against the gain, reducing their taxable income. Such examples illustrate the practical benefits of accurately completing the worksheet.

Quick guide on how to complete capital loss carryover worksheet 2019 to 2020

Prepare Capital Loss Carryover Worksheet To effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle Capital Loss Carryover Worksheet To on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Capital Loss Carryover Worksheet To with ease

- Locate Capital Loss Carryover Worksheet To and click Get Form to initiate the process.

- Employ the tools we offer to complete your document.

- Mark important sections of your documents or obscure confidential information using tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Capital Loss Carryover Worksheet To and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the capital loss carryover worksheet 2019 to 2020

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a carryover worksheet in airSlate SignNow?

A carryover worksheet in airSlate SignNow allows users to track and manage document workflows effectively. This tool helps businesses ensure that important tasks and signatures are not overlooked, providing a clear overview of all pending actions. With user-friendly features, it simplifies the process of maintaining organization in document management.

-

How can I create a carryover worksheet using airSlate SignNow?

Creating a carryover worksheet in airSlate SignNow is a straightforward process. Simply log into your account, select the document you want to manage, and utilize the worksheet feature to delineate specific tasks and due dates. This organized approach enhances productivity and streamlines your workflow.

-

Is there a cost associated with the carryover worksheet feature?

The carryover worksheet feature is included in the airSlate SignNow subscription plans, which offer various pricing options to fit different business needs. Given its ability to increase efficiency and management of document flows, many find it a cost-effective solution. For detailed pricing, you can visit our plans page.

-

What are the benefits of using a carryover worksheet?

Using a carryover worksheet in airSlate SignNow helps mitigate missed deadlines and improves overall document efficiency. It provides a clear visual representation of your document tasks, ensuring that every important action is accounted for. This proactive management tool ultimately aids in better decision-making.

-

Can I integrate the carryover worksheet with other tools?

Yes, airSlate SignNow allows integration with various productivity tools to enhance the functionality of your carryover worksheet. You can easily sync it with popular applications like Google Drive, Salesforce, and more. This seamless integration helps centralize your workflow for maximum efficiency.

-

Is it easy for teams to collaborate using the carryover worksheet?

Absolutely! Teams can collaborate efficiently using the carryover worksheet within airSlate SignNow. Multiple users can access and update tasks in real-time, enhancing communication and ensuring everyone is aligned on document status and deadlines. This collaborative approach boosts overall team productivity.

-

What types of documents can be managed with the carryover worksheet?

The carryover worksheet in airSlate SignNow can manage various document types, including contracts, agreements, and internal memos. It supports any document requiring signatures or approvals, making it versatile for different business needs. This flexibility helps streamline processes across departments.

Get more for Capital Loss Carryover Worksheet To

- Individual payroll record form

- Bv ramana higher engineering mathematics download form

- Tempus unlimited new hire paperwork form

- The jamaican drivers guide pdf download form

- Oxford english book for class 5 answers form

- Dha exam model question paper for physiotherapist pdf form

- Fillable cashiers check template form

- Application for extension of time to file brief juvenile case form

Find out other Capital Loss Carryover Worksheet To

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form