Form Estimated 2017

What is the Form Estimated

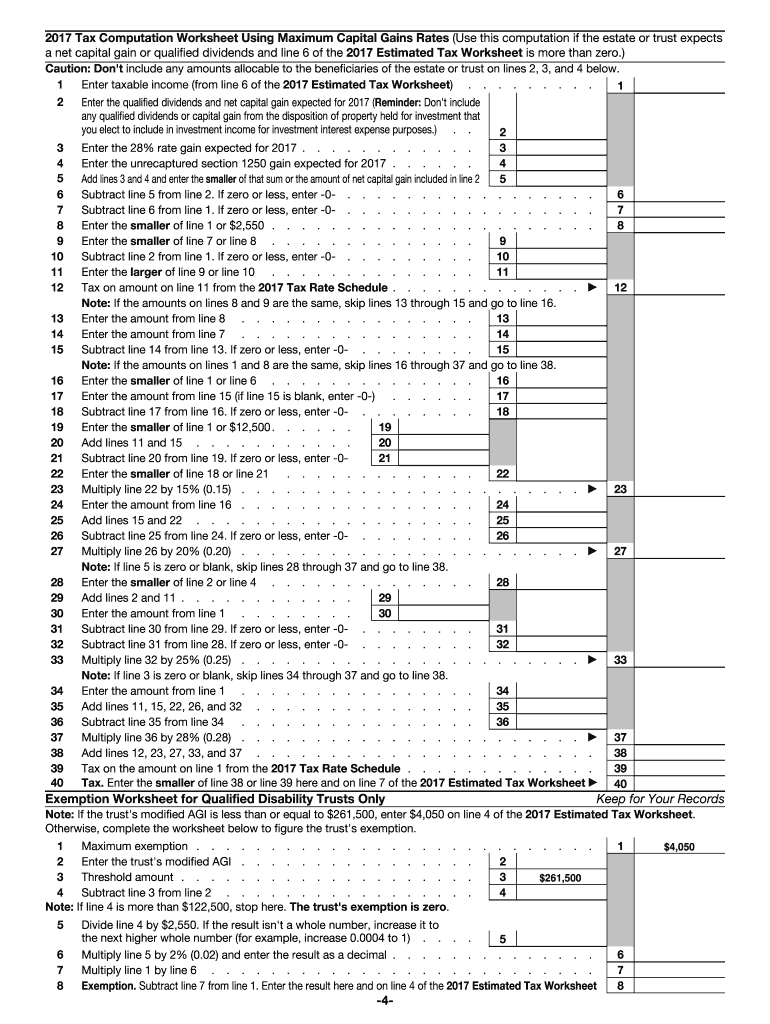

The Form Estimated is a tax document used by individuals and businesses to report and pay estimated taxes to the Internal Revenue Service (IRS). This form helps taxpayers calculate their expected tax liability for the year and make quarterly payments to avoid penalties for underpayment. It is particularly important for self-employed individuals, freelancers, and those with significant income not subject to withholding.

How to use the Form Estimated

To effectively use the Form Estimated, taxpayers need to gather relevant financial information, including income sources and deductions. The form requires calculations based on projected income for the year. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference. Regularly updating the form throughout the year can help ensure accurate payments and prevent any surprises at tax time.

Steps to complete the Form Estimated

Completing the Form Estimated involves several key steps:

- Gather financial documents, including previous tax returns and income statements.

- Estimate your total income for the year, considering all sources.

- Calculate expected deductions and credits to determine your taxable income.

- Use the IRS tax tables to estimate your tax liability based on your taxable income.

- Divide your total estimated tax by four to determine quarterly payment amounts.

- Fill out the Form Estimated with the calculated figures.

- Submit the form and make the necessary payments by the due dates.

Legal use of the Form Estimated

Using the Form Estimated is legally required for individuals and businesses that expect to owe tax of one thousand dollars or more when they file their return. Failure to file and pay estimated taxes can result in penalties and interest charges. It is essential to ensure that the form is filled out accurately and submitted on time to comply with IRS regulations.

Filing Deadlines / Important Dates

Taxpayers must be aware of the key deadlines for submitting the Form Estimated to avoid penalties. Generally, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these dates is crucial for maintaining compliance with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form Estimated can be submitted in several ways, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers choose to file electronically through the IRS website or authorized e-filing services.

- Mail: Taxpayers can print the completed form and send it to the appropriate IRS address based on their location.

- In-Person: While less common, some may opt to deliver the form directly to a local IRS office.

Quick guide on how to complete form estimated 2017

Explore the most efficient method to complete and endorse your Form Estimated

Are you still squandering time on preparing your official paperwork in hard copy instead of managing it online? airSlate SignNow presents a superior approach to finalize and endorse your Form Estimated and similar forms for public services. Our innovative electronic signature tool equips you with all the essentials to handle documents swiftly and in accordance with official standards – robust PDF editing, managing, securing, signing, and sharing features all readily accessible within a user-friendly interface.

Only a few steps are necessary to finalize and endorse your Form Estimated:

- Incorporate the fillable template into the editor with the Get Form button.

- Examine what details you need to include in your Form Estimated.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Checkbox, and X tools to fill the blanks with your details.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using your preferred method.

- Add the Date next to your signature and finish your task by clicking the Done button.

Store your completed Form Estimated in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our platform also offers versatile file sharing options. There’s no need to print your forms when you can submit them for the appropriate public office – do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form estimated 2017

FAQs

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the form estimated 2017

How to create an eSignature for your Form Estimated 2017 online

How to generate an eSignature for the Form Estimated 2017 in Chrome

How to create an electronic signature for signing the Form Estimated 2017 in Gmail

How to make an eSignature for the Form Estimated 2017 from your smartphone

How to generate an electronic signature for the Form Estimated 2017 on iOS

How to generate an electronic signature for the Form Estimated 2017 on Android

People also ask

-

What features does airSlate SignNow offer for creating and managing Form Estimated?

airSlate SignNow provides a variety of powerful features for creating and managing Form Estimated. You can customize templates, set automated reminders, and track signatures in real time. This ensures that your document management process is efficient and streamlined, saving you valuable time.

-

How can I integrate airSlate SignNow with other applications for Form Estimated?

Integrating airSlate SignNow with other applications is simple and efficient, especially for handling Form Estimated. The platform supports various integrations, including CRM systems and cloud storage solutions. This allows for seamless data transfer and enhances your document workflow.

-

What pricing plans are available for airSlate SignNow focused on Form Estimated?

airSlate SignNow offers flexible pricing plans tailored to your needs when dealing with Form Estimated. Whether you're a small business or an enterprise, you can choose a plan that suits your budget and usage. Each plan includes essential features that ensure effective document management.

-

Is airSlate SignNow secure for sending Form Estimated documents?

Yes, airSlate SignNow takes security seriously for sending Form Estimated documents. The platform employs industry-standard encryption and complies with major security certifications. This ensures that your sensitive documents are protected throughout the eSigning process.

-

Can I customize templates for Form Estimated in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize templates specifically for Form Estimated. You can add your branding, modify text fields, and adjust workflows according to your needs, giving you a tailored solution for all your document signing requirements.

-

How does airSlate SignNow help improve workflow efficiency for Form Estimated?

airSlate SignNow improves workflow efficiency for Form Estimated by automating key processes. With features like automated reminders and real-time tracking, you can minimize delays and ensure documents are signed promptly. This greatly enhances productivity and accelerates your business processes.

-

What is the turnaround time for sending and receiving signed Form Estimated?

The turnaround time for sending and receiving signed Form Estimated documents with airSlate SignNow is remarkably quick. Most documents are signed and returned within minutes, depending on recipient availability. This efficiency allows you to keep your projects moving forward without unnecessary delays.

Get more for Form Estimated

- Mcb account number form

- Received goods temperature log sheet form

- Translation reflection rotation dilation worksheet form

- Utility will serve letter template form

- Multiple worksite report bls 3020 5727187 form

- Drapery work order template 400439459 form

- Wedding rehearsal information worksheet love notes weddings

- Aoda questionnaire marinette county wisconsin form

Find out other Form Estimated

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later