Indemnity Card Form

What is the indemnity card?

The indemnity card is a legal document that provides a guarantee against potential losses or damages that may arise in specific transactions. It is often used in financial contexts, such as credit card transactions, where the cardholder may need to assure a third party that they will cover any liabilities. This card serves as a protective measure, ensuring that obligations are met and providing peace of mind to all parties involved.

How to use the indemnity card

Using the indemnity card involves a few straightforward steps. First, ensure that you understand the terms and conditions associated with the card. When making a transaction, present the indemnity card to the relevant party, such as a merchant or service provider. This card indicates that you are willing to assume responsibility for any potential issues that may arise from the transaction. Always keep a copy of the card and any related documents for your records.

Steps to complete the indemnity card

Completing the indemnity card requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including your personal details and the specifics of the transaction.

- Fill in all required fields on the card, ensuring that the information is accurate and up to date.

- Review the completed card for any errors or omissions.

- Sign and date the card to validate it.

- Submit the card to the relevant party or keep it for your records, depending on the situation.

Legal use of the indemnity card

The legal use of the indemnity card is crucial to ensure that it is recognized in various jurisdictions. The card must comply with local laws and regulations, which may vary by state. It is advisable to consult legal counsel if you are unsure about the specific requirements in your area. Proper use of the indemnity card can protect you from potential legal disputes and financial liabilities.

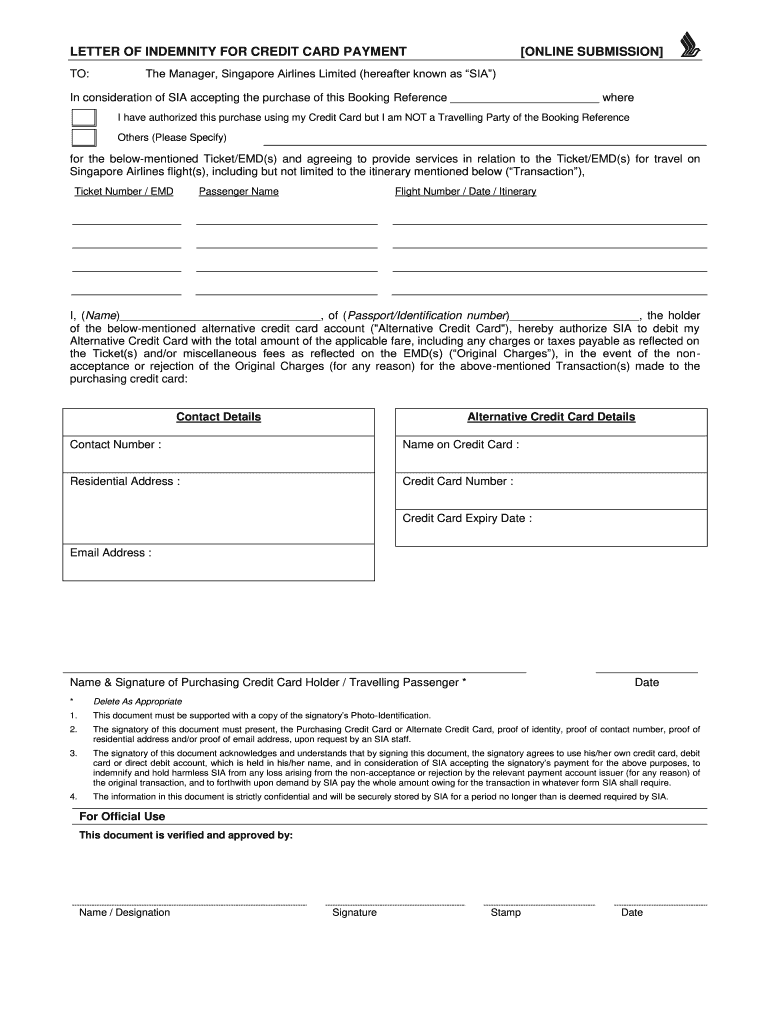

Key elements of the indemnity card

Several key elements must be included in the indemnity card to ensure its validity:

- Cardholder Information: Full name and contact details of the individual or business.

- Transaction Details: A description of the transaction or agreement covered by the indemnity.

- Signature: The cardholder’s signature to authenticate the document.

- Date: The date on which the indemnity card is issued.

Who issues the form?

The indemnity card is typically issued by financial institutions, credit card companies, or other authorized entities that facilitate transactions. It is important to ensure that the issuing organization is reputable and complies with relevant regulations. This helps guarantee that the indemnity card will be accepted by merchants and service providers when required.

Quick guide on how to complete letter of indemnity for credit card payment online bb

A concise manual on how to create your Indemnity Card

Finding the correct template can be difficult when you need to submit official international documents. Even if you possess the necessary form, it may be tedious to quickly fill it out in accordance with all specifications if you utilize physical copies rather than handling everything digitally. airSlate SignNow is the web-based eSignature platform that aids you in overcoming these hurdles. It allows you to obtain your Indemnity Card and promptly complete and sign it on the spot without the need to reprint documents every time you make a mistake.

Follow these steps to create your Indemnity Card with airSlate SignNow:

- Hit the Get Form button to upload your document to our editor instantly.

- Begin with the first blank field, enter details, and proceed with the Next tool.

- Complete the empty fields using the Cross and Check tools from the menu above.

- Select the Highlight or Line options to mark the most crucial information.

- Tap on Image and upload one if your Indemnity Card necessitates it.

- Make use of the right-side pane to add additional fields for you or others to complete if needed.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Done button and selecting your file-sharing options.

After your Indemnity Card is ready, you can share it however you prefer - deliver it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you may securely store all your finalized documents in your account, organized in folders according to your preferences. Don’t waste effort on manual document filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How many students use credit/debit cards or any other form of online payments in India?

I don't think data is available in details around age group of people who are buying online. However this number might be increasing. Students who study away from home town now a days almost always have a bank account with debit card. That makes it easy for parents to send them money.

-

When you apply for a credit card on the phone, does the operator simply fill out a web form the way you would if you applied online? Or do you get to explain situations if you are denied at first?

Don't waste your time calling in, just fill it out online yourself. Your financial details and credit score are put through an automated system. Your credit history does all of the explaining for you unfortunately. Also, ditto to what Bryan said about higher end cards, they will actually take the time to verify your income and personal assets in some cases to offset tarnished credit.

Create this form in 5 minutes!

How to create an eSignature for the letter of indemnity for credit card payment online bb

How to make an electronic signature for the Letter Of Indemnity For Credit Card Payment Online Bb online

How to create an electronic signature for the Letter Of Indemnity For Credit Card Payment Online Bb in Chrome

How to make an eSignature for putting it on the Letter Of Indemnity For Credit Card Payment Online Bb in Gmail

How to make an electronic signature for the Letter Of Indemnity For Credit Card Payment Online Bb right from your smart phone

How to generate an electronic signature for the Letter Of Indemnity For Credit Card Payment Online Bb on iOS devices

How to generate an eSignature for the Letter Of Indemnity For Credit Card Payment Online Bb on Android devices

People also ask

-

What is a letter indemnity?

A letter indemnity is a document that serves as a guarantee against any losses related to the transaction or agreement it accompanies. In the context of airSlate SignNow, using a letter indemnity can help protect businesses from potential financial risks while streamlining their document signing process.

-

How does airSlate SignNow handle letter indemnity documents?

AirSlate SignNow simplifies the process of managing letter indemnity documents by offering a user-friendly platform for creating, sending, and eSigning. With customizable templates and secure storage, businesses can efficiently manage their letter indemnity transactions with ease.

-

Is airSlate SignNow's letter indemnity solution cost-effective?

Yes, airSlate SignNow provides a cost-effective solution for handling letter indemnity documents. Our pricing plans are designed to accommodate businesses of all sizes, allowing for efficient management of essential documents without breaking the bank.

-

What are the benefits of using airSlate SignNow for letter indemnity?

Using airSlate SignNow for letter indemnity brings numerous benefits, including time savings, enhanced security, and smoother collaboration. This digital platform streamlines document processes, ensuring that letter indemnity agreements are managed efficiently and securely.

-

Can I integrate letter indemnity documents with other applications using airSlate SignNow?

Absolutely! airSlate SignNow offers multiple integrations with popular applications, making it easy to incorporate letter indemnity into your existing workflows. This seamless integration helps ensure that your document management processes are fluid and interconnected.

-

How do I create a letter indemnity template in airSlate SignNow?

Creating a letter indemnity template in airSlate SignNow is simple. You can start by selecting our customizable template feature, where you can input the necessary details and clauses to tailor the document according to your needs, ensuring that each letter indemnity meets your requirements.

-

Is airSlate SignNow legally compliant for letter indemnity documents?

Yes, airSlate SignNow is designed to comply with all relevant eSignature laws, ensuring that your letter indemnity documents are legally binding. Our platform adheres to regulations such as the ESIGN Act and UETA, providing peace of mind for businesses.

Get more for Indemnity Card

- Permit to employ and work work experience ca dept of education the permit to employ and work form must be completed and signed

- Self employment income worksheet form

- Starry night and the astronauts form

- Mch 213 g form

- Sample recall plan form

- Sharepoint aag form

- Document for internal use only form

- Registrationwaiver form individualparticipant last pit

Find out other Indemnity Card

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free