Irs Form 10492 2005-2026

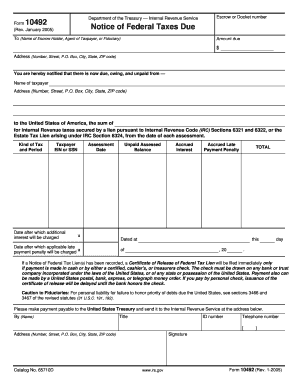

What is the IRS Form 10492

The IRS Form 10492 is a specific tax form used for reporting certain financial activities to the Internal Revenue Service. This form is primarily utilized by individuals and businesses to ensure compliance with federal tax regulations. Understanding the purpose of this form is essential for accurate tax reporting and to avoid potential penalties.

How to Use the IRS Form 10492

Using the IRS Form 10492 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and deductions. Next, fill out the form with the required details, ensuring that all figures are accurate. After completing the form, review it for any errors before submission. It's advisable to keep a copy for your records.

Steps to Complete the IRS Form 10492

Completing the IRS Form 10492 requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report income from various sources accurately.

- Include any applicable deductions or credits.

- Review all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the IRS Form 10492

The IRS Form 10492 is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is crucial to adhere to all regulations regarding the form's use to ensure compliance with federal tax laws. Failure to use the form properly may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 10492 are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates to ensure timely submission.

Form Submission Methods

The IRS Form 10492 can be submitted through various methods. Taxpayers have the option to file electronically using IRS-approved software, which often provides a more efficient and secure way to submit forms. Alternatively, the form can be mailed to the appropriate IRS address, or submitted in person at designated IRS offices. Each submission method has its own advantages, so choosing the right one for your situation is essential.

Quick guide on how to complete irs form 10492

Effortlessly Prepare Irs Form 10492 on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Irs Form 10492 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Irs Form 10492 with Ease

- Locate Irs Form 10492 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or redact sensitive details with features specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Form 10492 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 10492

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to 10492?

airSlate SignNow is a digital signature platform designed to help businesses manage their document signing needs efficiently. The term '10492' indicates a specific service or pricing tier within our offerings. With airSlate SignNow, businesses can streamline their workflow and utilize eSignatures for various documents, making it a cost-effective solution.

-

How much does airSlate SignNow cost for customers in the 10492 area?

The pricing for airSlate SignNow varies depending on the plan you choose and the features included. For customers in the 10492 area, we offer competitive rates that ensure you receive the best value for your investment. By selecting a plan that meets your specific needs, businesses can optimize their document management processes.

-

What features does airSlate SignNow offer that benefit users in the 10492 region?

AirSlate SignNow provides numerous features such as customizable templates, mobile access, real-time tracking, and secure cloud storage. For users in the 10492 area, these features facilitate a seamless signing experience, allowing businesses to work efficiently and save time. Integrated workflow solutions further enhance productivity.

-

Can airSlate SignNow help with compliance for businesses in 10492?

Yes, airSlate SignNow helps businesses in the 10492 area comply with various legal and regulatory standards through its secure eSignature technology. Our platform is designed to meet industry regulations, ensuring that your documents are legally binding and compliant. This peace of mind allows businesses to focus on growth without worrying about legal issues.

-

What integrations does airSlate SignNow support for users in 10492?

airSlate SignNow offers integrations with a variety of tools such as Google Drive, Salesforce, and Zapier, benefiting users in the 10492 region. This connectivity allows businesses to automate their workflows and create a more efficient document management system. By integrating with existing tools, airSlate SignNow enhances productivity across teams.

-

Is it easy to get started with airSlate SignNow for those in the 10492 area?

Getting started with airSlate SignNow is straightforward, especially for users in the 10492 area. Our platform includes an intuitive interface that simplifies document uploading, signing, and sending. Additionally, we provide comprehensive tutorials and customer support to ensure a smooth onboarding process for new users.

-

How secure is the airSlate SignNow platform for users located in 10492?

Security is a top priority for airSlate SignNow, ensuring that users in the 10492 area can sign and send documents with confidence. Our platform employs industry-standard encryption protocols and robust security measures to protect your data. This commitment to security provides businesses peace of mind while conducting sensitive transactions.

Get more for Irs Form 10492

- Annual budget statement form

- Pdf covid 19 and students communicative construction of form

- Headquarters office sector h 82 form

- Wwwfinancegovpkrebuttalsdetails1ministry of financegovernment of pakistan form

- Name holder of entity participanttre form

- Know your customer application individual form

- Name of entity participant tre place logo certificate form

- Quadrilaterals in the coordinate plane worksheet answer key form

Find out other Irs Form 10492

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT