Irs 6042 Form 2010-2026

What is the IRS 6042 Form

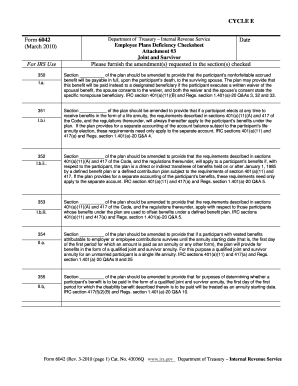

The IRS 6042 Form, commonly referred to as the 6042c letter, is a document used by the Internal Revenue Service to communicate specific tax-related information to taxpayers. This form is often associated with issues regarding tax compliance and may require action from the recipient. Understanding the purpose of the 6042c letter is essential for ensuring proper response and compliance with IRS requirements.

How to Use the IRS 6042 Form

Using the IRS 6042 Form involves carefully reviewing the information provided in the letter. Taxpayers should identify the action required, which may include providing additional documentation or correcting previously submitted information. It is crucial to follow the instructions outlined in the letter to ensure compliance and avoid potential penalties.

Steps to Complete the IRS 6042 Form

Completing the IRS 6042 Form requires several key steps:

- Read the letter thoroughly to understand the IRS's request.

- Gather any necessary documents or information that the IRS may require.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors before submission.

- Submit the form through the specified method, whether online or by mail.

Legal Use of the IRS 6042 Form

The IRS 6042 Form is legally binding when completed and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to legal issues or penalties. Compliance with the instructions and deadlines set forth by the IRS is crucial for maintaining good standing with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 6042 Form can vary based on the specific circumstances outlined in the letter. Taxpayers should pay close attention to any dates mentioned in the correspondence to avoid late submissions. Missing a deadline can result in penalties or further action from the IRS, making it important to prioritize timely responses.

Examples of Using the IRS 6042 Form

Examples of situations requiring the IRS 6042 Form include responding to discrepancies in reported income, addressing issues with tax credits, or clarifying information related to tax deductions. Each case may have unique requirements, so it is important to refer to the specific instructions provided in the 6042c letter.

Quick guide on how to complete irs 6042 form

Complete Irs 6042 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Irs 6042 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Irs 6042 Form with ease

- Find Irs 6042 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you would prefer to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you choose. Edit and electronically sign Irs 6042 Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs 6042 form

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is a 6042c letter and how does it work?

A 6042c letter is an essential document used for tax purposes, mainly involving the IRS. With airSlate SignNow, you can easily eSign and send your 6042c letter securely and efficiently. This streamlines the process, ensuring compliance and timely submissions.

-

How does airSlate SignNow ensure the security of my 6042c letter?

Security is a top priority for airSlate SignNow. We use advanced encryption and secure storage to protect your 6042c letter and any other documents you send. Additionally, our platform is compliant with regulations such as GDPR and HIPAA, providing you with peace of mind.

-

What pricing plans are available for sending a 6042c letter?

airSlate SignNow offers flexible pricing plans that cater to various business needs, starting with a free trial. To send a 6042c letter, you can choose from our affordable plans which include features like unlimited document signing and templates. This helps businesses save costs while ensuring efficiency.

-

Can I integrate airSlate SignNow with other platforms for managing my 6042c letter?

Yes, airSlate SignNow integrates seamlessly with numerous platforms such as Google Drive, Dropbox, and Salesforce. This allows you to manage your 6042c letter alongside other critical documents. Integration enhances workflow efficiency and keeps all your important files in one easily accessible location.

-

What features does airSlate SignNow offer for eSigning a 6042c letter?

airSlate SignNow provides a variety of features for eSigning a 6042c letter, including customizable templates and an easy user interface. You can add multiple signers, track the document status in real-time, and automate reminders. These features simplify the signing process and enhance productivity.

-

How long does it take to finalize and send a 6042c letter using airSlate SignNow?

Finalizing and sending a 6042c letter with airSlate SignNow can take just minutes. The intuitive platform allows you to prepare documents quickly, enabling rapid eSigning and dispatch. This time-saving capability is perfect for businesses needing prompt document processing.

-

What are the benefits of using airSlate SignNow for a 6042c letter?

Using airSlate SignNow for your 6042c letter streamlines the eSigning process, enhances document security, and improves efficiency. The platform's user-friendly features signNowly reduce the time and effort needed for document management, allowing you to focus on core business activities. It’s an investment that provides immediate value.

Get more for Irs 6042 Form

- Nbp registration form

- Annexure 18 guidelines for the appointment of an form

- Get the free httpsapi36ilovepdfcomv1download form

- Payment guideline changes form

- Anti money laundering regulations form

- Pakistan driving form

- Englishmanual06092019pdf ministry of parliamentary form

- Mcps hpe health professions education qarz e hasna form

Find out other Irs 6042 Form

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form