Form 712 2006

What is the Form 712

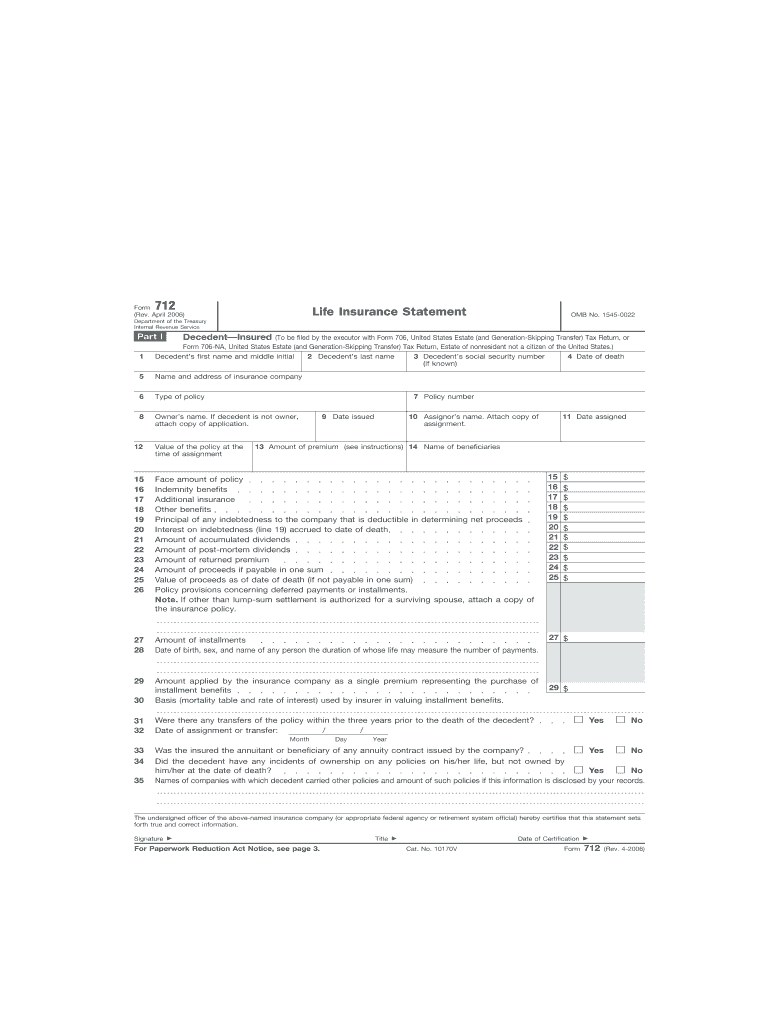

The life insurance form 712, also known as IRS Form 712, serves as a statement of the value of a life insurance policy. This form is essential for tax purposes, particularly when a policyholder passes away, as it helps determine the value of the insurance proceeds that may be subject to estate taxes. The form provides crucial information about the insured individual, the policy itself, and the beneficiary. Understanding the purpose of Form 712 is vital for anyone dealing with life insurance claims or estate planning.

How to use the Form 712

Using the life insurance form 712 involves several steps. First, gather the necessary information about the life insurance policy, including the policy number, the insured's details, and the beneficiary's information. Next, complete the form accurately, ensuring that all fields are filled out correctly. Once the form is completed, it should be submitted to the appropriate parties, such as the insurance company or the IRS, depending on the context in which it is being used. Proper usage of this form helps facilitate the smooth processing of claims and estate matters.

Steps to complete the Form 712

Completing the life insurance form 712 requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain a copy of Form 712 from the IRS website or through your insurance provider.

- Fill in the insured's name, address, and Social Security number.

- Provide the policy number and the name of the insurance company.

- Indicate the date of death of the insured, if applicable.

- List the beneficiaries and their respective shares of the policy proceeds.

- Review the completed form for any errors or omissions.

- Submit the form as required, either electronically or via mail.

Legal use of the Form 712

The life insurance form 712 is legally binding when completed and submitted correctly. It is crucial to adhere to IRS guidelines and ensure that the information provided is accurate and truthful. Misrepresentation or errors can lead to complications, including potential penalties or delays in processing claims. Understanding the legal implications of this form is essential for ensuring compliance and protecting the interests of all parties involved.

IRS Guidelines

The IRS has specific guidelines regarding the use and submission of form 712. It is important to follow these guidelines to ensure compliance. The form must be filed in accordance with the IRS deadlines, and it should be submitted alongside any required documentation, such as death certificates or other relevant paperwork. Familiarizing oneself with IRS requirements helps in avoiding issues related to tax liabilities or estate settlements.

Required Documents

When completing the life insurance form 712, certain documents are typically required to support the information provided. These may include:

- A copy of the life insurance policy

- The death certificate of the insured

- Identification documents for the beneficiaries

- Any prior correspondence with the insurance company

Having these documents ready can streamline the process and ensure that the form is submitted correctly.

Quick guide on how to complete form 712

Prepare Form 712 effortlessly on any gadget

Digital document management has become increasingly favored among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Handle Form 712 on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The simplest way to modify and electronically sign Form 712 with ease

- Locate Form 712 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious searches for forms, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 712 while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 712

Create this form in 5 minutes!

How to create an eSignature for the form 712

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is IRS Form 712 and how is it used?

IRS Form 712 is used to report the value of a life insurance policy for federal estate tax purposes. It is essential for beneficiaries to complete this form accurately to ensure tax compliance. Understanding how to fill out IRS Form 712 can simplify the estate settlement process and ensure that all taxes are paid appropriately.

-

Can airSlate SignNow help me eSign IRS Form 712?

Yes, airSlate SignNow allows you to easily eSign IRS Form 712 and other important documents. Our platform provides a secure and efficient way to handle eSignatures, ensuring that your forms are legally binding. This feature enhances the speed and accuracy of your documentation process related to IRS Form 712.

-

What features does airSlate SignNow offer for managing IRS Form 712?

airSlate SignNow offers a comprehensive set of features for managing IRS Form 712, including templates, cloud storage, and automated reminders. These tools streamline the completion and submission of IRS Form 712, making it easier to keep track of important deadlines. With our user-friendly interface, handling IRS Form 712 is more efficient than ever.

-

Is airSlate SignNow secure for eSigning IRS Form 712?

Absolutely! airSlate SignNow implements top-tier security measures to protect your documents, including IRS Form 712. Our platform adheres to rigorous security standards, ensuring that your sensitive information is safe during the eSigning process. You can confidently use airSlate SignNow for all your document signing needs.

-

How does airSlate SignNow integrate with other applications for managing IRS Form 712?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM software to facilitate the management of IRS Form 712. These integrations allow you to access your documents from multiple platforms, making it easier to prepare and send IRS Form 712 efficiently. Utilizing these integrations enhances workflow and productivity.

-

What is the pricing model for using airSlate SignNow with IRS Form 712?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses needing to manage documents like IRS Form 712. You can choose from monthly or annual subscriptions based on your usage requirements. Each plan includes features that facilitate the fast and secure signing of IRS Form 712.

-

Can I track the status of my IRS Form 712 using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your IRS Form 712 throughout the signature process. You’ll receive notifications as your document is viewed and signed, keeping you informed every step of the way. This feature ensures you are always aware of the progress of your important forms.

Get more for Form 712

- Trade kyc form

- Sb 7 back form

- Hr0081 form

- Hr0081 100919545 form

- Wwwdfasmilportals98how to read an active duty army leave and earning statement form

- Wwwcdcpakistancomwp contentuploadscdc investor account services ias form

- Banner3 zahran operation amp maintenance form

- Annexure 28 report of deputy chairman of the commission form

Find out other Form 712

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template