8796 2011-2026

What is the 8796?

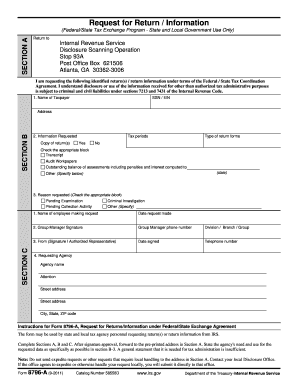

The 8796 form, officially known as the IRS 8796, is a crucial document used primarily for tax purposes in the United States. This form is designed to assist taxpayers in reporting specific financial information to the Internal Revenue Service (IRS). Understanding the purpose and function of the 8796 is essential for compliance with tax regulations and ensuring accurate reporting of income and deductions.

How to use the 8796

Using the 8796 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and deduction records. Next, fill out the form with precise details, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the IRS. It is advisable to keep a copy of the completed form for your records.

Steps to complete the 8796

Completing the 8796 form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Fill in the financial data as required, ensuring that all figures are accurate and correspond to your records.

- Review each section to confirm that no information is missing and that all calculations are correct.

- Sign and date the form to validate your submission.

Legal use of the 8796

The legal use of the 8796 form is governed by IRS regulations. It is essential to ensure that the form is filled out correctly and submitted within the designated timelines to avoid penalties. The information provided on the form must be truthful and accurate, as any discrepancies may lead to audits or legal consequences. Compliance with IRS guidelines is crucial for the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the 8796 form are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, if you are filing for an extension, be aware of the extended deadlines and ensure that the form is submitted accordingly. Keeping track of these important dates can help maintain compliance with IRS regulations.

Required Documents

To complete the 8796 form accurately, several documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of deductions and credits you plan to claim.

- Any previous tax returns that may provide relevant information.

Having these documents on hand will streamline the process of filling out the form and ensure accuracy in your reporting.

Quick guide on how to complete 8796

Complete 8796 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your papers promptly without delays. Manage 8796 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign 8796 with ease

- Locate 8796 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 8796 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8796

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to '8796'?

airSlate SignNow is a powerful electronic signature solution that simplifies document signing processes for businesses of all sizes. With the code '8796', users can experience essential features including document tracking, customizable templates, and secure eSigning, making it easier to manage contracts and agreements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Starting from a free trial, you can explore features with the promotional code '8796', which may unlock special discounts on premium plans, ensuring you get the best possible deal for your signing requirements.

-

What key features does airSlate SignNow provide?

With airSlate SignNow, users can enjoy features such as real-time document collaboration, secure eSignature capabilities, and automated workflows. Utilizing the '8796' key, customers can access exclusive templates tailored to enhance their signing experience, making the entire process seamless and efficient.

-

How can airSlate SignNow benefit my business?

airSlate SignNow streamlines the document signing process, saving your business time and reducing paper usage. By incorporating the code '8796', companies experience improved efficiency and enhanced compliance, which can lead to faster sales cycles and better customer satisfaction.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with popular business tools such as Google Drive, Salesforce, and Zapier. Utilizing the '8796' integration code can unlock customized workflows, allowing your business to connect more effectively with existing platforms for a more cohesive experience.

-

Is airSlate SignNow secure for sensitive documents?

Yes, airSlate SignNow employs advanced security measures including encryption and multi-factor authentication to ensure document safety. By leveraging the special code '8796', users can opt for enhanced security features that cater to industries handling sensitive information, providing peace of mind for all transactions.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to send and sign documents on the go. By accessing features through the '8796' mobile app, users can manage documents anytime, anywhere, ensuring productivity is never compromised.

Get more for 8796

- Not used to make resale purchases form

- Request for waiver from public disclosure of tax preference form

- Request for waiver from public disclosure form

- Cigarette tax washington state department of revenue form

- Form 237 motor vehicle accident release missouri department of dor mo

- Tax application form pdf

- For sales use and withholding tax facts sales tax rates and faqs form

- Po box 9034 olympia wa 98507 9034 360 705 6741 dorwagov form

Find out other 8796

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy