4579 Pass through Entity Tax Return 2005-2026

What is the 4579 Pass Through Entity Tax Return

The 4579 Pass Through Entity Tax Return is a specific tax form used in the United States for reporting income, deductions, and credits from pass-through entities such as partnerships, S corporations, and limited liability companies (LLCs). This form is essential for ensuring that income generated by these entities is accurately reported to the IRS and that taxes are appropriately calculated. It allows the entity to pass its income directly to its owners or shareholders, who then report it on their personal tax returns.

Steps to Complete the 4579 Pass Through Entity Tax Return

Completing the 4579 Pass Through Entity Tax Return involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Fill out the basic information section, including the entity's name, address, and Employer Identification Number (EIN).

- Report all income received by the entity during the tax year, ensuring to include all sources of revenue.

- Detail any deductions applicable to the entity, such as operating expenses, salaries, and other costs.

- Calculate the total tax liability based on the net income reported.

- Review the completed form for accuracy before submission.

Required Documents

To successfully complete the 4579 Pass Through Entity Tax Return, certain documents are required. These include:

- Financial statements for the tax year, including profit and loss statements.

- Records of all income and expenses related to the entity.

- Previous year’s tax return for reference.

- Any supporting documentation for deductions claimed, such as receipts and invoices.

Filing Deadlines / Important Dates

Filing deadlines for the 4579 Pass Through Entity Tax Return are crucial to avoid penalties. Typically, the form must be submitted by:

- March 15 for S corporations and partnerships.

- Extensions may be available, allowing additional time to file, but any taxes owed must be paid by the original deadline.

Legal Use of the 4579 Pass Through Entity Tax Return

The 4579 Pass Through Entity Tax Return must be used in accordance with IRS regulations to ensure compliance with federal tax laws. This includes accurately reporting all income and expenses, maintaining proper documentation, and filing the form by the required deadlines. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes.

Examples of Using the 4579 Pass Through Entity Tax Return

Examples of scenarios where the 4579 Pass Through Entity Tax Return is applicable include:

- A partnership that generates income from rental properties must report its earnings and expenses using this form.

- An S corporation reporting its business income and distributing profits to its shareholders.

- An LLC electing to be taxed as a partnership, which requires filing the 4579 to report its income and expenses.

Quick guide on how to complete 4579 pass through entity tax return

Complete 4579 Pass Through Entity Tax Return effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 4579 Pass Through Entity Tax Return on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign 4579 Pass Through Entity Tax Return with ease

- Obtain 4579 Pass Through Entity Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign 4579 Pass Through Entity Tax Return and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4579 pass through entity tax return

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

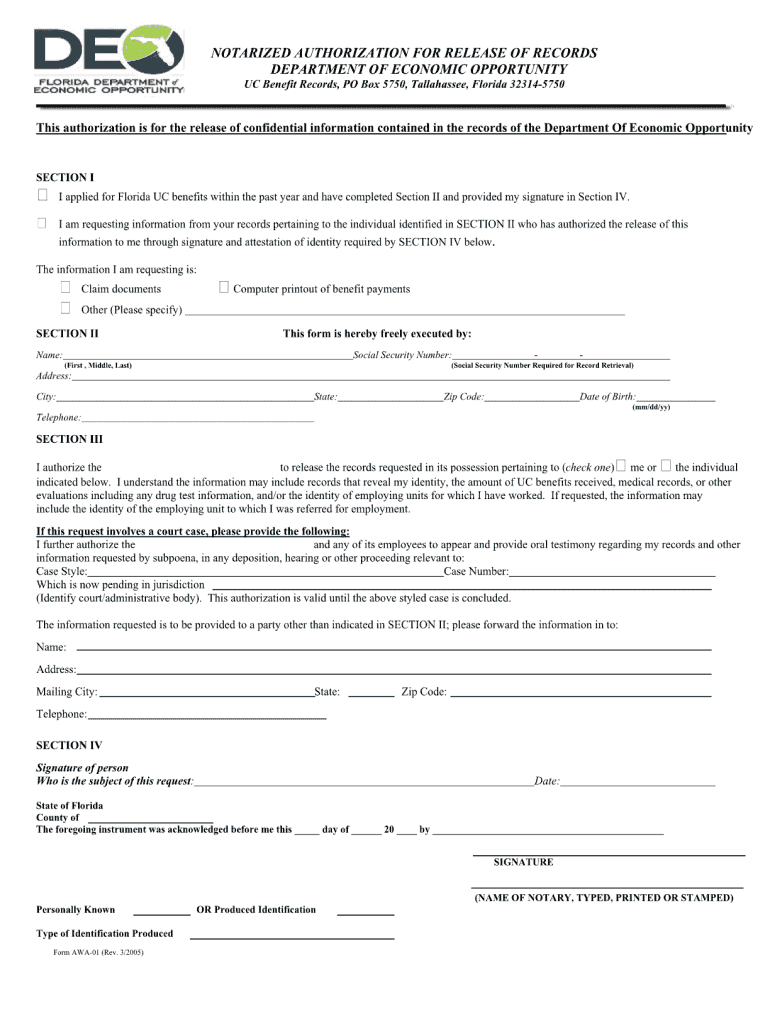

What is the florida opportunity awa01 and how does it relate to airSlate SignNow?

The florida opportunity awa01 is a unique business initiative that allows organizations in Florida to streamline their document signing processes. With airSlate SignNow, you can easily eSign documents and enhance productivity while staying compliant with state regulations.

-

What are the key features of airSlate SignNow for the florida opportunity awa01?

airSlate SignNow offers a range of features tailored to the florida opportunity awa01, including seamless eSigning, document templates, and audit trails. These features ensure that your signing processes are efficient, secure, and well-documented.

-

How does pricing work for airSlate SignNow under the florida opportunity awa01?

The pricing for airSlate SignNow is designed to offer great value under the florida opportunity awa01. We provide flexible plans that cater to businesses of all sizes, ensuring you only pay for the features you need.

-

Can airSlate SignNow help my business benefit from the florida opportunity awa01?

Absolutely! By leveraging airSlate SignNow, your business can take full advantage of the florida opportunity awa01. The platform not only simplifies document management but also accelerates the signing process, leading to enhanced efficiency and reduced turnaround times.

-

What integrations does airSlate SignNow support for businesses under the florida opportunity awa01?

airSlate SignNow supports a variety of integrations that can enhance your experience with the florida opportunity awa01. You can easily connect with popular tools such as Google Drive, Salesforce, and Dropbox to streamline your document workflows.

-

How secure is airSlate SignNow when utilizing the florida opportunity awa01?

Security is a top priority for us at airSlate SignNow, especially when navigating the florida opportunity awa01. Our platform complies with industry-standard security protocols, ensuring that all your documents are protected throughout the signing process.

-

Is there a free trial available for airSlate SignNow related to the florida opportunity awa01?

Yes! airSlate SignNow offers a free trial that allows potential customers to explore the benefits of our service concerning the florida opportunity awa01. This trial enables you to experience firsthand how our eSigning solutions can enhance your document management workflows.

Get more for 4579 Pass Through Entity Tax Return

- God se apteek boek pdf form

- Moni plus loan statement form

- Netcare assessment test questions form

- Klb chemistry book 3 pdf download form

- Resident council tool kit illinois department on aging form

- Security screening statutory declaration form

- Utas course approval form university of tasmania

- Meo transportation form

Find out other 4579 Pass Through Entity Tax Return

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online