APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION 2019-2026

Understanding the appraisal gap pilot program participant application

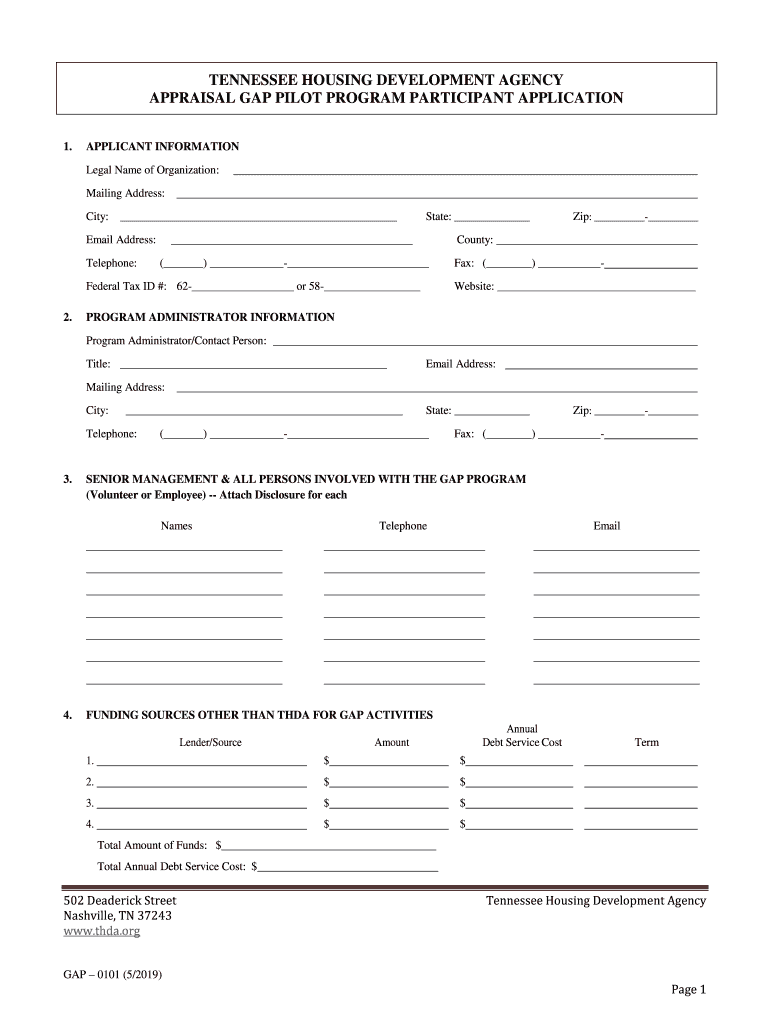

The appraisal gap pilot program participant application is designed to help homebuyers navigate the complexities of appraisal gaps in real estate transactions. An appraisal gap occurs when the appraised value of a property is lower than the purchase price. This application allows participants to request assistance in bridging this gap, ensuring that buyers can proceed with their home purchases despite potential valuation discrepancies. It is essential for applicants to understand the implications of the appraisal gap and how this program can support them in securing their desired property.

Steps to complete the appraisal gap pilot program participant application

Completing the appraisal gap pilot program participant application involves several straightforward steps:

- Gather necessary documentation, including proof of income, credit history, and details about the property in question.

- Access the application form through the designated online platform or obtain a physical copy if needed.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for completeness and accuracy before submission.

- Submit the application electronically or via mail, depending on the guidelines provided.

Legal use of the appraisal gap pilot program participant application

The appraisal gap pilot program participant application is legally recognized when completed according to specific regulations. It is crucial that applicants adhere to the legal requirements set forth by relevant authorities. This includes providing accurate information and obtaining the necessary signatures. The application must also comply with electronic signature laws, ensuring that all digital submissions are valid and enforceable. Utilizing a reliable eSignature platform can help maintain compliance with these legal standards.

Eligibility criteria for the appraisal gap pilot program participant application

To qualify for the appraisal gap pilot program, applicants must meet certain eligibility criteria. Typically, these criteria include:

- Being a first-time homebuyer or a buyer facing financial challenges related to appraisal gaps.

- Demonstrating a valid purchase agreement for a property that has been appraised.

- Providing proof of income and financial stability to support the application.

Meeting these criteria is essential for applicants to receive assistance through the program, allowing them to navigate the challenges of appraisal gaps effectively.

Required documents for the appraisal gap pilot program participant application

Applicants must submit specific documents to support their appraisal gap pilot program participant application. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Credit reports to assess financial standing.

- Details of the property being purchased, including the purchase agreement and appraisal report.

Having these documents ready will streamline the application process and help ensure a smoother review by the program administrators.

Form submission methods for the appraisal gap pilot program participant application

Applicants can submit the appraisal gap pilot program participant application through various methods, depending on the guidelines provided. Common submission methods include:

- Online submission via a secure portal, which allows for immediate processing.

- Mailing a physical copy of the application to the designated address.

- In-person submission at specified locations, if available.

Choosing the appropriate submission method can impact the speed and efficiency of the application review process.

Quick guide on how to complete appraisal gap pilot program participant application

Effortlessly Prepare APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION on Any Device

The management of documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without unnecessary delays. Handle APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION with ease

- Find APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION and click Obtain Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Finish button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION to ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the appraisal gap pilot program participant application

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is an appraisal gap?

An appraisal gap occurs when a property's appraised value is lower than the agreed-upon sale price. Understanding the concept of an appraisal gap is crucial for buyers and sellers as it can impact financing and negotiations during a real estate transaction.

-

How can airSlate SignNow help with appraisal gap agreements?

AirSlate SignNow provides a streamlined platform for eSigning documents related to appraisal gap agreements. With our user-friendly interface, you can easily manage and sign the necessary paperwork to address any appraisal gap concerns efficiently and securely.

-

What features does airSlate SignNow offer for handling appraisal gaps?

AirSlate SignNow offers features like custom templates and document tracking that are beneficial when addressing appraisal gaps. These features allow users to ensure all parties acknowledge the appraisal gap and its implications immediately, facilitating smoother transactions.

-

Is airSlate SignNow cost-effective for managing appraisal gap documentation?

Yes, airSlate SignNow is a cost-effective solution for managing appraisal gap documentation. Our pricing plans offer great value, especially for real estate professionals who need to handle such situations regularly while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other tools to manage appraisal gaps?

Absolutely, airSlate SignNow easily integrates with various CRM and real estate platforms to help manage appraisal gaps. This integration allows seamless workflow and document sharing between systems, ensuring that all relevant parties remain informed and aligned.

-

What benefits does eSigning offer for appraisal gap contracts?

eSigning appraisal gap contracts with airSlate SignNow provides numerous benefits, including faster processing times and enhanced security. By eliminating the hassle of physical signatures, parties can quickly cope with decisions regarding appraisal gaps without delay.

-

How can airSlate SignNow secure transactions involving appraisal gaps?

AirSlate SignNow employs robust encryption and compliance measures to secure transactions involving appraisal gaps. This ensures that all documents, including those discussing appraisal gaps, are protected against unauthorized access, giving users peace of mind.

Get more for APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION

- Looking good feeling great ampliving life to the fullest form

- Venture forthe application form

- 101 rv rentals form

- State form 37964

- Roofers questionnaire gls 8 12 07 form

- Participant waiver ampampamp release form

- Is it realhttpswwwcarpenterssworg form

- State and federal systems school technology leadership form

Find out other APPRAISAL GAP PILOT PROGRAM PARTICIPANT APPLICATION

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile