Restoring Urban Neighborhoods Llc New York Ny Form

What is the Restoring Urban Neighborhoods LLC New York Form?

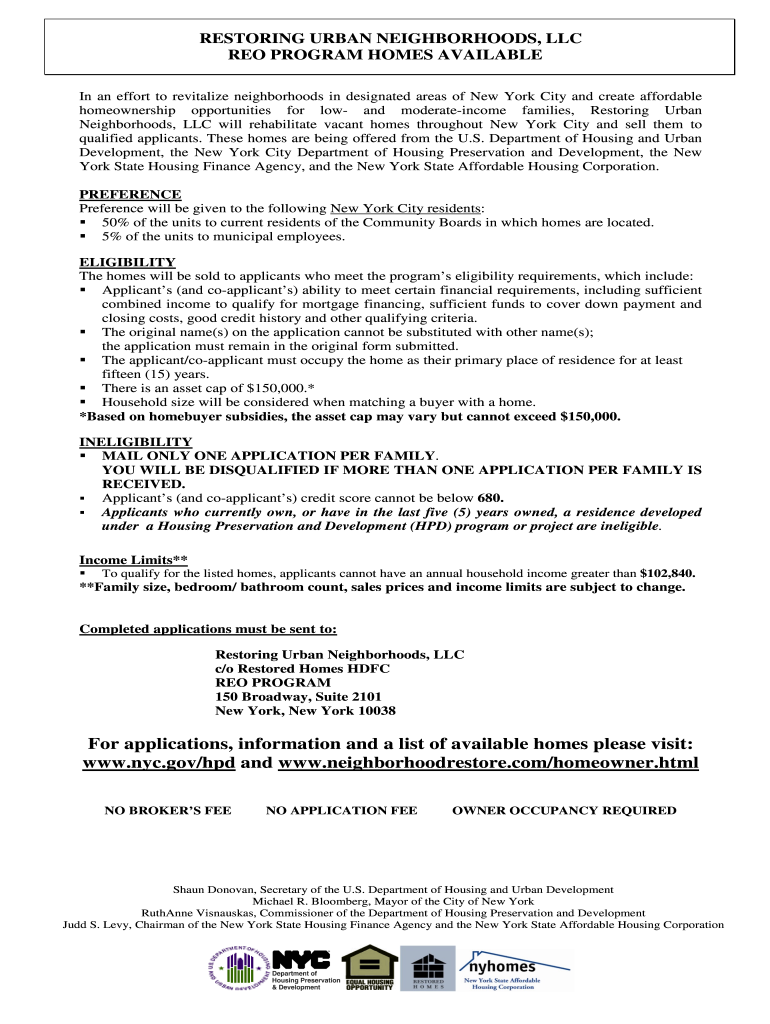

The Restoring Urban Neighborhoods LLC New York Form, commonly referred to as Form 6241, is a legal document required for businesses that aim to participate in the Restoring Urban Neighborhoods (RUN) program in New York. This program is designed to promote economic development in urban areas by providing financial incentives to eligible businesses. The form collects essential information about the business entity, including its structure, purpose, and the specific urban neighborhood it aims to benefit. Proper completion of Form 6241 is crucial for businesses seeking to take advantage of the incentives offered under this program.

Steps to Complete the Restoring Urban Neighborhoods LLC New York Form

Completing Form 6241 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary information about your business, including its legal name, address, and the nature of its operations. Next, provide details about the urban neighborhood you intend to impact, including demographic and economic data that support your application. After filling out the form, review it thoroughly to ensure all sections are completed correctly. Finally, submit the form as instructed, either online or by mail, ensuring you keep a copy for your records.

Legal Use of the Restoring Urban Neighborhoods LLC New York Form

Form 6241 must be used in accordance with New York state laws and regulations governing the RUN program. This form is legally binding and should only be submitted by businesses that meet the eligibility criteria outlined by the state. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or disqualification from the program. Legal use of this form not only facilitates compliance but also enhances the credibility of the business in the eyes of potential investors and partners.

Eligibility Criteria for the Restoring Urban Neighborhoods LLC New York Form

To be eligible to submit Form 6241, businesses must meet specific criteria set forth by the RUN program. This typically includes being a registered LLC in New York, operating within designated urban neighborhoods, and demonstrating a commitment to economic development in those areas. Additionally, applicants may need to provide evidence of their business activities and how they align with the goals of the RUN program. Understanding these eligibility requirements is essential for businesses to successfully navigate the application process.

Form Submission Methods for the Restoring Urban Neighborhoods LLC New York Form

Form 6241 can be submitted through various methods, depending on the preferences of the applicant and the requirements of the RUN program. Businesses may have the option to submit the form online through a designated portal, which often allows for quicker processing and confirmation. Alternatively, the form can be mailed to the appropriate state agency or submitted in person at designated offices. It is advisable to check the latest submission guidelines to ensure compliance with any changes in procedures.

Key Elements of the Restoring Urban Neighborhoods LLC New York Form

Form 6241 includes several key elements that must be accurately completed to ensure a successful application. These elements typically consist of the business name, address, and contact information, as well as details about the urban neighborhood being targeted. Additionally, the form may require information regarding the business's financial projections, intended use of funds, and any partnerships or collaborations that will support the project. Providing comprehensive and precise information in these sections is vital for the approval process.

Quick guide on how to complete restoring urban neighborhoods llc new york ny form

Ensure Precision on Restoring Urban Neighborhoods Llc New York Ny Document

Handling contracts, managing listings, coordinating calls, and arranging viewings—realtors and property professionals balance a wide range of tasks daily. Numerous responsibilities entail substantial documentation, such Restoring Urban Neighborhoods Llc New York Ny Form, which must be completed promptly and with utmost accuracy.

airSlate SignNow is a comprehensive solution that enables real estate experts to reduce the documentation workload, allowing them to concentrate more on their clients' goals throughout the entire negotiation journey and secure optimal terms for the agreement.

Steps to finalize Restoring Urban Neighborhoods Llc New York Ny Form with airSlate SignNow:

- Access the Restoring Urban Neighborhoods Llc New York Ny Form page or utilize our library's search features to locate the form you require.

- Select Get form—you'll be instantly directed to the editor.

- Begin completing the document by choosing fillable fields and entering your information into them.

- Insert additional text and modify its settings if necessary.

- Select the Sign button in the top toolbar to create your signature.

- Explore other features to annotate and simplify your document, such as drawing, highlighting, adding shapes, and more.

- Choose the notes tab and include remarks regarding your document.

- Conclude the process by downloading, sharing, or sending your document to your intended users or organizations.

Bid farewell to paper permanently and enhance the home buying experience with our user-friendly and efficient solution. Experience greater convenience when completing Restoring Urban Neighborhoods Llc New York Ny Form and other real estate documents online. Try our tool today!

Create this form in 5 minutes or less

FAQs

-

Is it possible to run a NY LLC out of the New York State and even out of the US?

Sure, it is possible.Registering Business in New YorkIf you decided to open a new business that will be based in New York you can choose from several options:Sole OwnersSole Proprietorship: Sole owners of New York-based businesses could opt for sole proprietorship as the easiest form of business organization. Not the most recommended, given the liability a sole proprietor assumes as a result of owning a business. No registration with New York State Department of State is necessary, but it is recommended to obtain a Business Certificate (DBA), and if you plan to hire employees then also obtain an EIN.Single Member LLC: Limited liability company, as the name suggests, is an entity that allows its owners to limit the liability of the business to the entity itself, shielding the owners' personal assets. This type of entity is recommended for most small businesses. By default your LLC will be taxed as "disregarded entity", meaning you will file your LLC tax return as part of your personal tax return. Keep in mind though - LLC is a flexible entity, which means you have the option of electing it to be taxed as S-Corp (assuming you are a U.S. person) or C-Corp. Learn more about LLC here, and about the details of forming LLC in New York here.Corporation: You can also form a corporation and be a sole shareholder with 100% of all shares. Corporations have more formalities than LLCs (for example in New York you are required to have bylaws and maintain minutes of meetings in corporate records), but provide similar limited liability protection. That's one of the reasons this entity type is often more suitable for bigger companies, or those who seek major investment. Corporations can be taxed as S-Corp or C-Corp, with each form of taxation having its pros and cons. Keep in mind, you can elect your corporation to be S-Corp only if you, as the sole shareholder, are a U.S. person. Learn more about corporations here, and about the details of incorporating in New York here.PartnersGeneral Partnership: Like sole proprietorship, this entity type does not require registration with the New York State Department of State, but it also does not protect the owners from business liability, and therefore is usually not recommended. A General Partnership needs to obtain a Business Certificate (DBA), and obtain an EIN.Multiple Member LLC: like Single Member LLC for sole owner, Multiple Member LLC is often the entity of choice for small and new businesses with more than one partner.Corporation: Since corporation can have many shareholders, and transfering ownership is relatively easy (though share transfer) corporation might be a good choice of entity for business with partners. Keep in mind though - S Corporations are limited to 100 shareholders who must be physical U.S. persons. That means corporations owned (partially or fully) by non-U.S. persons or legal entities, cannot be elected as S-Corp, and therefore subject to double taxation of an C-Corp. In cases like that it would be recommended to consider choosing LLC instead.Limited Partnerships: Limited partnerships come in different forms, depending on the state (LP, LLP, LLLP). Though Limited Partnerships have their own purpose and place, for most cases we believe an LLC would serve its owners well enough, therefore at this point we do not cover Limited Partnerships.Existing Out-of-State CompaniesAn existing company registered in another state or country (called "foreign corporation", "foreign LLC", etc) looking to conduct business in New York might be required to foreign qualify in New York. This rule typically applies to companies looking to open a physical branch in New York, lease an office or warehouse, hire employees, etc."Foreign" businesses that do not create "strong nexus" by moving physically to New York might still be required to obtain Certificate of Authority to Collect Sales Tax from New York Department of Taxation and Finance if selling taxable products or services using local dropshippers.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the restoring urban neighborhoods llc new york ny form

How to make an electronic signature for your Restoring Urban Neighborhoods Llc New York Ny Form in the online mode

How to generate an eSignature for the Restoring Urban Neighborhoods Llc New York Ny Form in Chrome

How to make an electronic signature for signing the Restoring Urban Neighborhoods Llc New York Ny Form in Gmail

How to generate an electronic signature for the Restoring Urban Neighborhoods Llc New York Ny Form straight from your mobile device

How to create an electronic signature for the Restoring Urban Neighborhoods Llc New York Ny Form on iOS devices

How to create an electronic signature for the Restoring Urban Neighborhoods Llc New York Ny Form on Android

People also ask

-

What is the Restoring Urban Neighborhoods LLC New York NY Form?

The Restoring Urban Neighborhoods LLC New York NY Form is an essential document for businesses and organizations involved in urban development in New York. This form helps streamline the process of applying for urban restoration grants and programs. Using airSlate SignNow, you can easily eSign and send this form, ensuring compliance and efficiency.

-

How can I access the Restoring Urban Neighborhoods LLC New York NY Form?

You can access the Restoring Urban Neighborhoods LLC New York NY Form directly through the airSlate SignNow platform. Our user-friendly interface allows you to find and fill out the form quickly. After completing the form, you can eSign it and send it securely to the relevant authorities.

-

What are the benefits of using airSlate SignNow for the Restoring Urban Neighborhoods LLC New York NY Form?

Using airSlate SignNow for the Restoring Urban Neighborhoods LLC New York NY Form offers numerous benefits, including enhanced security, easy eSigning, and fast document processing. This platform ensures that your forms are completed and submitted without delays, helping you focus on your urban restoration projects.

-

Is there a cost associated with using the Restoring Urban Neighborhoods LLC New York NY Form on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those looking to manage the Restoring Urban Neighborhoods LLC New York NY Form. You can choose a plan that suits your budget, ensuring cost-effective options for all your document signing needs.

-

Can I integrate airSlate SignNow with other tools to manage the Restoring Urban Neighborhoods LLC New York NY Form?

Yes, airSlate SignNow offers seamless integrations with various tools and software, allowing you to manage the Restoring Urban Neighborhoods LLC New York NY Form more effectively. Whether you use CRM systems or project management tools, integration ensures a smooth workflow and enhanced productivity.

-

What features does airSlate SignNow provide for the Restoring Urban Neighborhoods LLC New York NY Form?

airSlate SignNow provides features like template creation, real-time tracking, and automated reminders to help you manage the Restoring Urban Neighborhoods LLC New York NY Form efficiently. These features simplify the eSigning process and ensure that you never miss a deadline.

-

How secure is the Restoring Urban Neighborhoods LLC New York NY Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The Restoring Urban Neighborhoods LLC New York NY Form is protected with advanced encryption and authentication measures, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for Restoring Urban Neighborhoods Llc New York Ny Form

- Control number mo s123 z form

- Fields for completion that are gray shaded areas form

- Georgia quitclaim deed legal form nolo

- Id 00llc 1 form

- Individual to trust form

- The grantor an individual form

- Unmarried of the of county of state of form

- Exploration agreement with option for joint venture secgov form

Find out other Restoring Urban Neighborhoods Llc New York Ny Form

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form