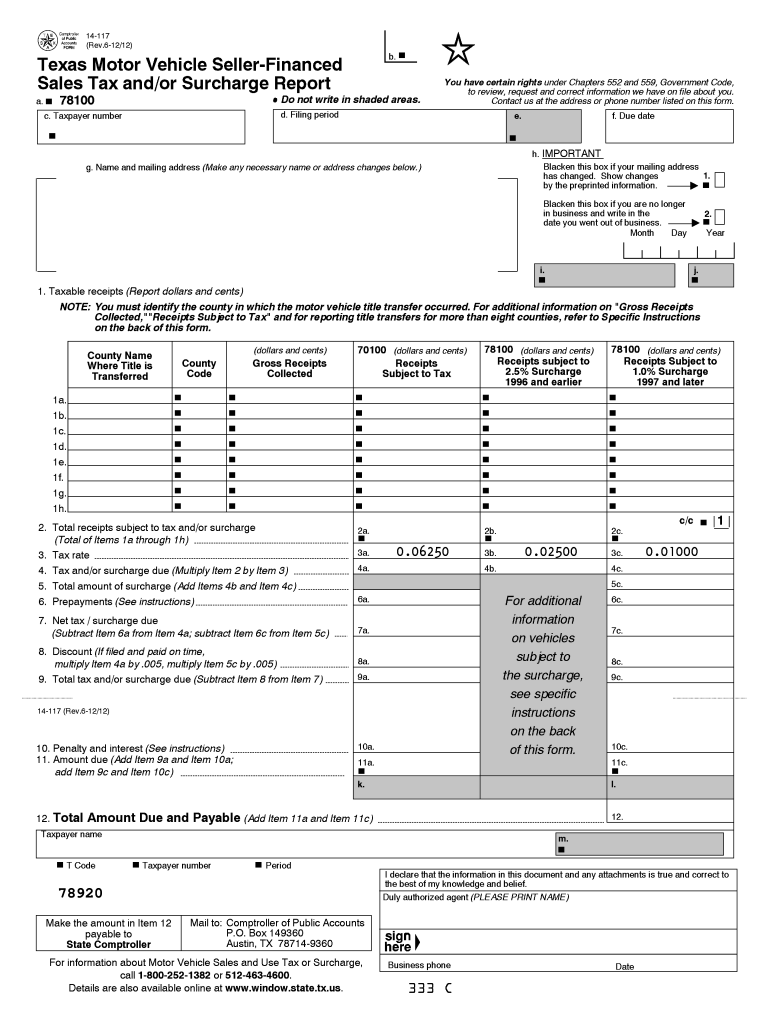

Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form

What is the Texas Motor Vehicle Seller Financed Sales Tax Report?

The Texas Motor Vehicle Seller Financed Sales Tax Report is a specific form used by sellers who finance the sale of motor vehicles in Texas. This report is essential for documenting the sales tax obligations associated with seller-financed transactions. It ensures compliance with state tax regulations and helps sellers accurately report the sales tax collected on these transactions. The form captures critical information such as the sale price, financing details, and the amount of sales tax due. Understanding this form is crucial for sellers to avoid penalties and maintain compliance with Texas tax laws.

Steps to Complete the Texas Motor Vehicle Seller Financed Sales Tax Report

Completing the Texas Motor Vehicle Seller Financed Sales Tax Report involves several key steps:

- Gather necessary information, including the buyer's details, vehicle identification number (VIN), and sale price.

- Calculate the total sales tax based on the sale price of the vehicle and applicable tax rates.

- Fill out the report form accurately, ensuring all required fields are completed.

- Review the report for any errors or omissions before submission.

- Submit the completed report to the appropriate state tax authority, either online or via mail.

Following these steps helps ensure that the report is completed correctly and submitted on time.

Key Elements of the Texas Motor Vehicle Seller Financed Sales Tax Report

The Texas Motor Vehicle Seller Financed Sales Tax Report includes several key elements that must be accurately filled out:

- Seller Information: Name, address, and contact details of the seller.

- Buyer Information: Name and address of the buyer.

- Vehicle Information: VIN, make, model, and year of the vehicle.

- Sale Price: Total amount for which the vehicle is sold.

- Sales Tax Calculation: Total sales tax amount due based on the sale price.

- Signature: Required signature of the seller to validate the report.

Ensuring that all these elements are accurately reported is crucial for compliance with Texas tax regulations.

Legal Use of the Texas Motor Vehicle Seller Financed Sales Tax Report

The Texas Motor Vehicle Seller Financed Sales Tax Report serves a legal purpose by documenting the sales tax obligations for seller-financed vehicle transactions. This report is essential for maintaining compliance with state tax laws and can be used as evidence in case of audits or disputes. Properly completing and submitting this report helps protect the seller from potential legal issues related to tax compliance. It is vital for sellers to understand the legal implications of this report and to ensure it is filled out correctly to avoid penalties.

Form Submission Methods

There are various methods for submitting the Texas Motor Vehicle Seller Financed Sales Tax Report:

- Online Submission: Many sellers prefer to submit the report electronically through the Texas state tax website.

- Mail Submission: The completed form can also be printed and mailed to the appropriate tax authority.

- In-Person Submission: Sellers may choose to deliver the report in person at designated tax offices.

Each submission method has its advantages, and sellers should choose the one that best suits their needs and compliance requirements.

Filing Deadlines and Important Dates

Timely filing of the Texas Motor Vehicle Seller Financed Sales Tax Report is crucial to avoid penalties. Sellers should be aware of the following important dates:

- Filing Deadline: The report is typically due on the last day of the month following the sale.

- Payment Due Date: Sales tax payment is also due by the same filing deadline.

Keeping track of these deadlines helps ensure compliance and prevents unnecessary fines.

Quick guide on how to complete texas motor vehicle seller financed sales tax andor surcharge report form

Effortlessly Prepare Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any holdups. Manage Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and electronically sign Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form effortlessly

- Obtain Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas motor vehicle seller financed sales tax andor surcharge report form

How to generate an electronic signature for the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form online

How to generate an eSignature for the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form in Chrome

How to make an electronic signature for signing the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form in Gmail

How to make an eSignature for the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form right from your smartphone

How to generate an electronic signature for the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form on iOS devices

How to create an electronic signature for the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form on Android OS

People also ask

-

What is the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form?

The Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form is a document required by the state of Texas for sellers who finance motor vehicle sales. This form helps ensure that the appropriate sales tax and surcharges are collected and reported correctly. Using airSlate SignNow, you can easily complete and eSign this form, streamlining your compliance process.

-

How can airSlate SignNow help with the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form?

airSlate SignNow simplifies the process of managing the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form. Our platform allows you to fill out, eSign, and share this form seamlessly, helping you stay organized and compliant with Texas regulations. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those requiring the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form. Our plans are designed to be cost-effective, allowing you to choose the features that best fit your requirements while ensuring compliance at a reasonable cost.

-

What features does airSlate SignNow offer for completing the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form?

airSlate SignNow provides a range of features to assist with the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form, including customizable templates, eSignature capabilities, and secure document storage. These features enhance your workflow, making it easier to manage your documentation efficiently and securely.

-

Can I integrate airSlate SignNow with other software for managing the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form?

Absolutely! airSlate SignNow offers integrations with a variety of popular software solutions, allowing you to manage the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form within your existing workflows. This seamless integration helps you streamline processes and enhance productivity across your operations.

-

What are the benefits of using airSlate SignNow for motor vehicle financing documentation?

Using airSlate SignNow for your motor vehicle financing documentation, including the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form, provides numerous benefits. You'll enjoy faster processing times, enhanced accuracy, and improved compliance with state regulations. This ultimately leads to a better customer experience and increased efficiency for your business.

-

Is airSlate SignNow secure for handling sensitive documents like the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form?

Yes, airSlate SignNow prioritizes the security of your documents, including the Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form. Our platform uses advanced encryption and secure cloud storage to protect your sensitive information, ensuring that your data remains confidential and secure throughout the signing process.

Get more for Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form

- Form of employee non disclosure agreement secgov

- Signature affidavitfree legal forms

- Sample corporate resolution to purchase real estate mycorporation form

- Affidavit for lost stolen or destroyed stock certificate form

- Release of claims against estate by creditor form

- The following is a sample codicil only not an entire will form

- Comments on form n 565 application for replacement reginfogov

- Agreement for sale of business by sole proprietorship with leased premises form

Find out other Texas Motor Vehicle Seller Financed Sales Tax Andor Surcharge Report Form

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later