Borrower Information Form

What is the Borrower Information Form

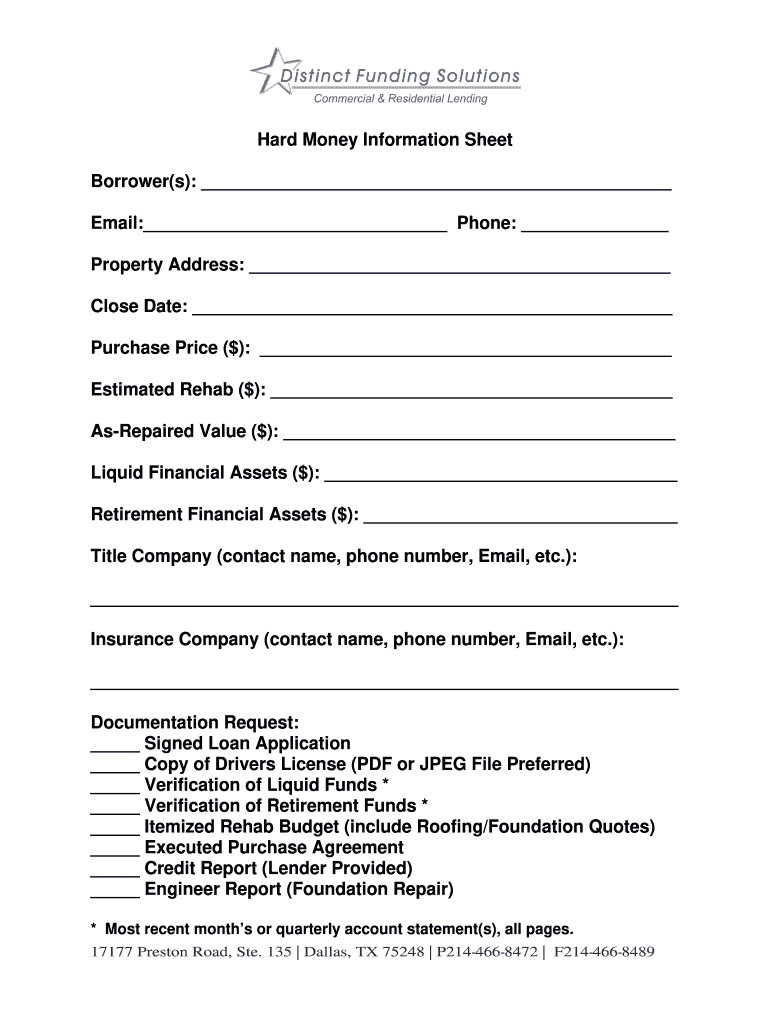

The borrower information form is a crucial document used primarily in the lending process. It collects essential details about the borrower, including personal identification, financial history, and employment information. This form helps lenders assess the creditworthiness of individuals or entities seeking loans. By providing accurate and complete information, borrowers can facilitate a smoother application process and improve their chances of loan approval.

How to use the Borrower Information Form

Using the borrower information form involves several straightforward steps. First, ensure you have all necessary personal and financial details on hand. This includes your Social Security number, income information, and employment history. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, review the form for any errors or omissions before submitting it to the lender. Utilizing electronic signature solutions can streamline this process, allowing for quick and secure submission.

Steps to complete the Borrower Information Form

Completing the borrower information form requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, such as proof of income and identification.

- Fill in your personal information, including name, address, and contact details.

- Provide financial information, including assets, debts, and employment details.

- Review the form for accuracy and completeness.

- Sign the form electronically or manually, depending on submission requirements.

- Submit the form to your lender through the preferred method, whether online or in person.

Legal use of the Borrower Information Form

The legal use of the borrower information form is governed by various regulations that ensure the protection of both the borrower and the lender. When completed and signed, the form serves as a legally binding document, provided it meets specific requirements. It is essential to comply with federal and state laws regarding privacy and data security. Additionally, lenders must follow the guidelines set forth by the Equal Credit Opportunity Act (ECOA) to ensure fair treatment of all borrowers.

Key elements of the Borrower Information Form

Several key elements are essential for the borrower information form to be effective and compliant. These include:

- Personal Information: Name, address, and contact details.

- Financial Data: Income, assets, debts, and employment history.

- Loan Details: Purpose of the loan and desired amount.

- Signature: Acknowledgment of the information provided and consent to verify details.

Form Submission Methods

The borrower information form can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online: Many lenders offer secure portals for electronic submission.

- Mail: Physical copies can be sent directly to the lender's address.

- In-Person: Some borrowers may prefer to deliver the form in person at a local branch.

Quick guide on how to complete borrower information form

Complete Borrower Information Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your files promptly without interruptions. Manage Borrower Information Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and electronically sign Borrower Information Form with ease

- Locate Borrower Information Form and click on Get Form to begin.

- Use the features we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, text message (SMS), or invite link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes requiring new copies to be printed. airSlate SignNow takes care of your document management needs in just a few clicks from the device of your choice. Edit and electronically sign Borrower Information Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrower information form

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a borrower's form and how does it work?

A borrower's form is a document used by lenders to collect personal and financial information from individuals applying for a loan. With airSlate SignNow, you can easily fill out, sign, and send the borrower's form securely online, streamlining the loan application process for both borrowers and lenders.

-

How much does it cost to use airSlate SignNow for a borrower's form?

airSlate SignNow offers a variety of pricing plans, starting from a free trial to premium options that cater to businesses of all sizes. These plans include features for sending and eSigning borrower's forms, ensuring you get the most cost-effective solution for all your document signing needs.

-

Can I integrate airSlate SignNow with my CRM for managing borrower's forms?

Yes, airSlate SignNow seamlessly integrates with a wide range of CRM systems, allowing you to manage your borrower's forms directly within your existing tools. This integration enhances workflow efficiency and ensures that all necessary borrower information is captured promptly.

-

What are the key features of airSlate SignNow for handling borrower's forms?

AirSlate SignNow provides several key features for handling borrower's forms, including customizable templates, automatic reminders, and the ability to track document status in real-time. These features make it easier for businesses to manage loan applications efficiently.

-

Is airSlate SignNow secure for sharing borrower's forms?

Absolutely! airSlate SignNow prioritizes security and compliance, employing advanced encryption technologies to protect your borrower's forms and sensitive data. You can confidently send and receive documents knowing that your information is safe.

-

How does airSlate SignNow enhance the borrower experience with forms?

With airSlate SignNow, borrowers benefit from a user-friendly experience that allows them to complete and sign forms quickly from any device. This convenience helps reduce frustrations and speeds up the loan approval process, enhancing overall satisfaction.

-

Can I track the status of my borrower's forms with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that let you monitor the status of your borrower's forms in real-time. This visibility ensures that you can follow up appropriately with borrowers and streamline the application process.

Get more for Borrower Information Form

- Swarovski reparation form

- This application is for acceptance into the kelberman overnight camp form

- Yukon housing corporation developer build loan form

- Small claims court of yukon notice of trial form

- Business corporations act subsection 21310 form 22

- Auabout uspublicationsip legislation and is protected by the privacy act 1988 www form

- Financial aid office 2017 2018 statement of non filing form

- Attachment es authorization form for release of health information created

Find out other Borrower Information Form

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed