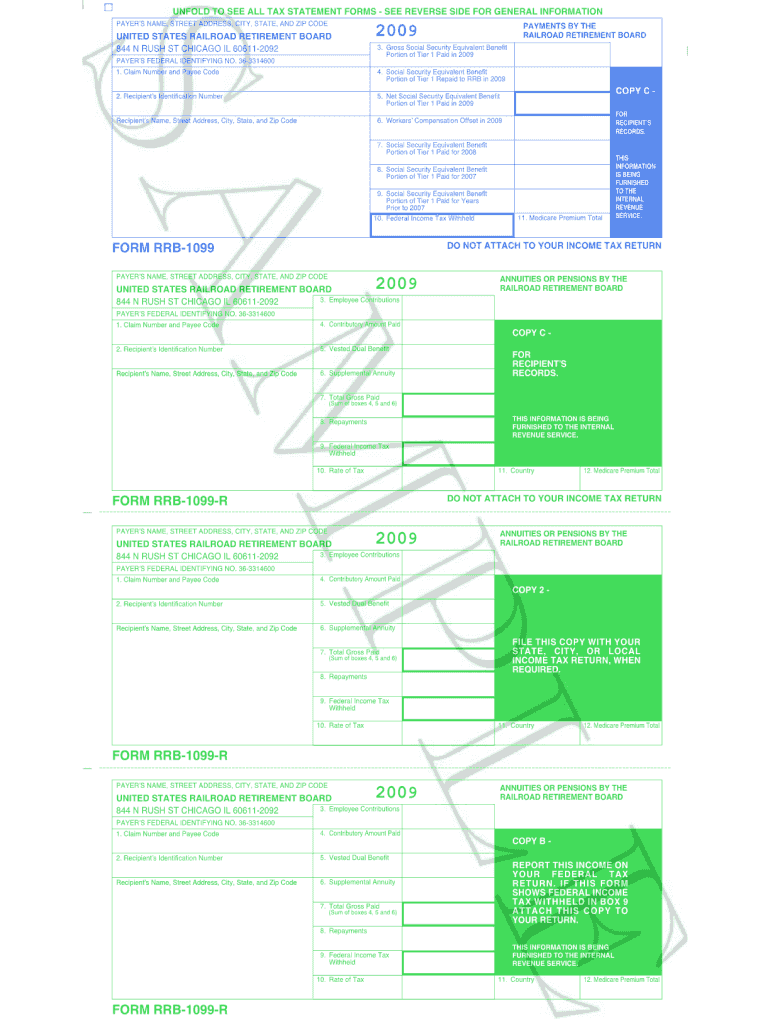

UNFOLD to SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE for GENERAL INFORMATION Rrb

Understanding Form 6271

Form 6271 is a tax-related document used primarily for reporting specific financial information to the IRS. This form is essential for individuals and businesses who need to disclose particular types of income or deductions. Understanding the purpose of Form 6271 is crucial for ensuring compliance with tax regulations and avoiding potential penalties. The form includes sections that require detailed information about income sources, deductions, and other relevant financial data.

Steps to Complete Form 6271

Completing Form 6271 involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements, previous tax returns, and any relevant financial records. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill out the form with accurate information, ensuring all sections are completed.

- Double-check your entries for any errors or omissions.

- Sign and date the form before submission.

By following these steps, you can ensure that your Form 6271 is completed correctly, minimizing the risk of issues with the IRS.

Legal Use of Form 6271

Form 6271 is legally binding and must be filled out accurately to comply with IRS regulations. The information provided on this form can be subject to audits, so it is crucial to maintain thorough records that support the data reported. Failure to complete the form correctly may lead to penalties or additional scrutiny from tax authorities. It is advisable to consult a tax professional if you have questions regarding the legal implications of the information you report on Form 6271.

Filing Deadlines for Form 6271

Timely filing of Form 6271 is essential to avoid penalties. The IRS typically sets specific deadlines for submitting tax forms, including Form 6271. Generally, this form must be filed by the tax return due date, which is usually April 15 for individuals. However, if you are filing for a business entity or have special circumstances, deadlines may vary. Always check the IRS website or consult with a tax advisor for the most accurate and up-to-date information regarding filing deadlines.

Required Documents for Form 6271

To complete Form 6271 accurately, you will need to gather several key documents. These may include:

- Income statements such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation supporting deductions claimed.

- Any notices or correspondence from the IRS related to previous filings.

Having these documents on hand will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

IRS Guidelines for Form 6271

The IRS provides specific guidelines for the completion and submission of Form 6271. These guidelines outline the required information, filing procedures, and compliance standards. It is important to familiarize yourself with these guidelines to ensure that your form meets all necessary criteria. The IRS also updates its guidelines periodically, so staying informed about any changes is essential for accurate reporting.

Quick guide on how to complete unfold to see all tax statement bformsb see reverse side for general information rrb

Complete UNFOLD TO SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE FOR GENERAL INFORMATION Rrb effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly solution to traditional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Handle UNFOLD TO SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE FOR GENERAL INFORMATION Rrb on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign UNFOLD TO SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE FOR GENERAL INFORMATION Rrb with ease

- Find UNFOLD TO SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE FOR GENERAL INFORMATION Rrb and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign UNFOLD TO SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE FOR GENERAL INFORMATION Rrb and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the unfold to see all tax statement bformsb see reverse side for general information rrb

How to generate an electronic signature for the Unfold To See All Tax Statement Bformsb See Reverse Side For General Information Rrb in the online mode

How to make an electronic signature for your Unfold To See All Tax Statement Bformsb See Reverse Side For General Information Rrb in Google Chrome

How to make an electronic signature for putting it on the Unfold To See All Tax Statement Bformsb See Reverse Side For General Information Rrb in Gmail

How to make an electronic signature for the Unfold To See All Tax Statement Bformsb See Reverse Side For General Information Rrb right from your mobile device

How to generate an electronic signature for the Unfold To See All Tax Statement Bformsb See Reverse Side For General Information Rrb on iOS devices

How to create an eSignature for the Unfold To See All Tax Statement Bformsb See Reverse Side For General Information Rrb on Android devices

People also ask

-

What is the form 6271 and why do I need it?

The form 6271 is a crucial document used in specific business processes to ensure compliance and proper documentation. Utilizing the form 6271 can streamline your workflow, especially when paired with eSigning solutions like airSlate SignNow.

-

How does airSlate SignNow support the completion of form 6271?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and electronically sign form 6271. With various templates and features for document management, completing this form becomes seamless and efficient.

-

What are the pricing options for using airSlate SignNow for form 6271?

airSlate SignNow offers several pricing tiers, allowing businesses to choose a package that best fits their needs for managing documents, including the form 6271. Each plan includes different features designed to optimize your document workflow.

-

Can I integrate airSlate SignNow with other software while managing form 6271?

Yes, airSlate SignNow supports numerous integrations with popular software like CRM systems and cloud storage services, which can enhance your experience when working with form 6271. This flexibility allows you to embed the signing process into your existing workflows.

-

What benefits does airSlate SignNow offer for handling form 6271?

Using airSlate SignNow for form 6271 provides benefits such as increased efficiency, reduced turnaround time, and enhanced security for your documents. The platform also ensures compliance with industry standards, making it a reliable choice for businesses.

-

Is it easy to track the progress of form 6271 when using airSlate SignNow?

Absolutely! airSlate SignNow includes features that allow you to track the status of the form 6271 in real-time. Notifications and updates ensure that you are informed of each step in the signing process.

-

Can I customize the form 6271 within airSlate SignNow?

Yes, airSlate SignNow offers customization options for form 6271, allowing you to modify fields, add branding, and tailor the document to meet your specific needs. This customization capability ensures that it aligns with your business requirements.

Get more for UNFOLD TO SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE FOR GENERAL INFORMATION Rrb

- Return of your deposit form

- Your lease will expire on the day of 20 form

- Your options for renewal of the form

- Demand letter to mortgagee mortgage servicer or off record note form

- Tenant do hereby covenant contract and agree as follows form

- For the valuable consideration described below the sufficiency of which is hereby acknowledged landlord and form

- Husbandquot form

- Preliminary assessment of the effects of recent spay form

Find out other UNFOLD TO SEE ALL TAX STATEMENT BFORMSb SEE REVERSE SIDE FOR GENERAL INFORMATION Rrb

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer