Demand Letter to Mortgagee, Mortgage Servicer or off Record Note Form

What is the mortgage demand letter?

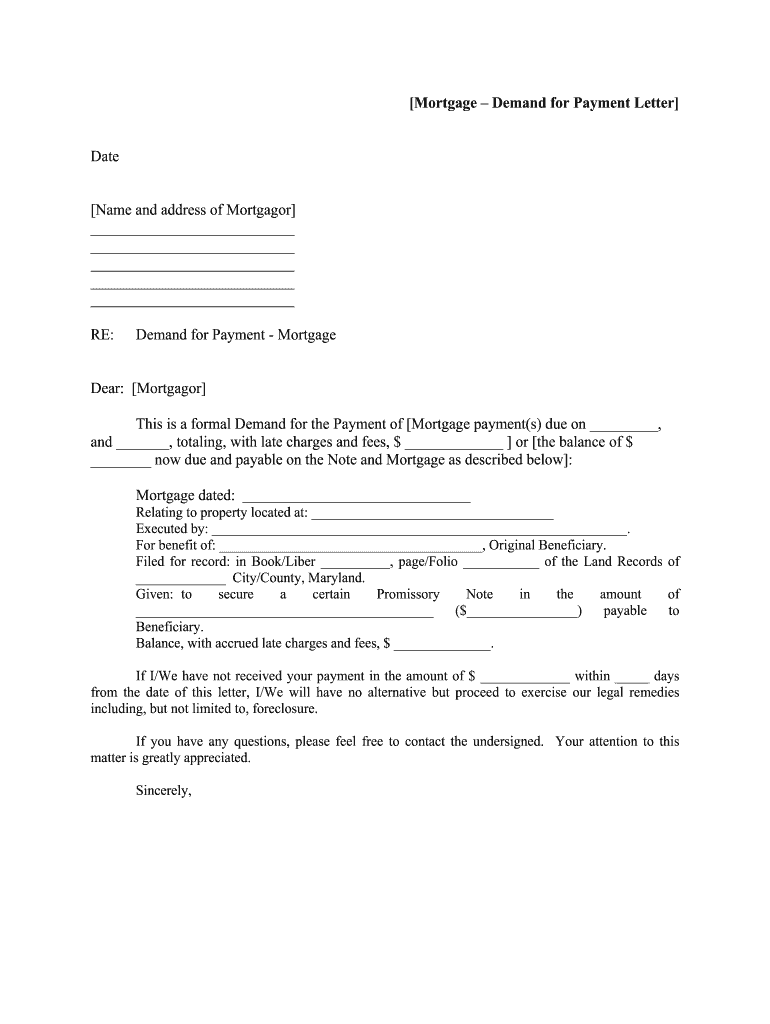

The mortgage demand letter is a formal document used to request payment or action from a mortgagee or mortgage servicer. It typically outlines the specific reasons for the demand, such as missed payments or other breaches of the mortgage agreement. This letter serves as a crucial step in the process of resolving issues related to mortgage defaults or disputes.

It is essential for the letter to clearly state the amount owed, the due date, and any relevant terms of the mortgage agreement. By providing this information, the mortgage demand letter ensures that the recipient understands the nature of the demand and the potential consequences of failing to respond.

Key elements of the mortgage demand letter

Several key elements are vital for a well-structured mortgage demand letter. These include:

- Identification of parties: Clearly state the names and addresses of both the borrower and the lender or servicer.

- Details of the mortgage: Include the mortgage account number and any relevant dates, such as the original loan date.

- Statement of default: Specify the reasons for the demand, such as missed payments or failure to maintain insurance.

- Amount owed: Clearly outline the total amount due, including any late fees or penalties.

- Deadline for response: Provide a specific date by which the recipient must respond to avoid further action.

Incorporating these elements helps ensure that the letter is clear, concise, and legally sound, making it more likely to achieve the desired outcome.

Steps to complete the mortgage demand letter

Completing a mortgage demand letter involves several important steps to ensure clarity and effectiveness:

- Gather necessary information: Collect all relevant details about the mortgage, including account numbers, payment history, and any correspondence with the mortgage servicer.

- Draft the letter: Use a clear and professional tone. Start with the identification of the parties, followed by the details of the mortgage and the reasons for the demand.

- Review for accuracy: Check all information for correctness, ensuring that dates, amounts, and names are accurate.

- Sign and date the letter: Include your signature and the date to validate the document.

- Send the letter: Choose a reliable method of delivery, such as certified mail, to ensure that there is proof of receipt.

Following these steps can help ensure that the mortgage demand letter is effective and legally compliant.

How to use the mortgage demand letter

The mortgage demand letter can be used in various situations, primarily when a borrower has fallen behind on payments or violated other terms of the mortgage agreement. It serves as a formal notice to the borrower, prompting them to take corrective action.

Once the letter is sent, the borrower should be given a reasonable timeframe to respond or rectify the situation. If the borrower fails to address the issues outlined in the letter, the lender may proceed with further actions, such as foreclosure or legal proceedings.

Legal use of the mortgage demand letter

The mortgage demand letter is not just a formal request; it also serves as a legal document that can be used in court if necessary. For the letter to be legally binding, it must adhere to specific requirements, such as proper identification of parties, clear communication of the issues, and compliance with state laws.

It is advisable to keep a copy of the letter and any related correspondence, as these documents may be needed for legal proceedings or negotiations in the future. Understanding the legal implications of the mortgage demand letter can help both borrowers and lenders navigate potential disputes effectively.

State-specific rules for the mortgage demand letter

Each state in the United States may have different regulations and requirements regarding mortgage demand letters. It is important to be aware of these rules to ensure compliance and effectiveness.

For instance, some states may require specific language to be included in the letter or mandate that it be sent via certified mail. Additionally, the timeframe for the borrower to respond may vary by state. Researching local laws or consulting with a legal professional can provide clarity and help ensure that the mortgage demand letter meets all necessary legal standards.

Quick guide on how to complete demand letter to mortgagee mortgage servicer or off record note

Easily Prepare Demand Letter To Mortgagee, Mortgage Servicer Or Off Record Note on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to quickly create, amend, and eSign your documents without delays. Manage Demand Letter To Mortgagee, Mortgage Servicer Or Off Record Note on any device with airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

How to Modify and eSign Demand Letter To Mortgagee, Mortgage Servicer Or Off Record Note Effortlessly

- Obtain Demand Letter To Mortgagee, Mortgage Servicer Or Off Record Note and then click Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred delivery method for your form: by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Adjust and eSign Demand Letter To Mortgagee, Mortgage Servicer Or Off Record Note to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the demand letter to mortgagee mortgage servicer or off record note

How to generate an electronic signature for your Demand Letter To Mortgagee Mortgage Servicer Or Off Record Note online

How to make an eSignature for the Demand Letter To Mortgagee Mortgage Servicer Or Off Record Note in Google Chrome

How to create an electronic signature for signing the Demand Letter To Mortgagee Mortgage Servicer Or Off Record Note in Gmail

How to make an electronic signature for the Demand Letter To Mortgagee Mortgage Servicer Or Off Record Note straight from your smartphone

How to generate an electronic signature for the Demand Letter To Mortgagee Mortgage Servicer Or Off Record Note on iOS devices

How to make an eSignature for the Demand Letter To Mortgagee Mortgage Servicer Or Off Record Note on Android devices

People also ask

-

What are demands letters and how are they used?

Demands letters are official documents used to request payment or action from another party. They serve as a formal communication to outline obligations, deadlines, and consequences of non-compliance. Using airSlate SignNow, you can easily create, send, and eSign demands letters while maintaining a professional appearance.

-

How can airSlate SignNow help me create demands letters?

airSlate SignNow provides customizable templates for demands letters, making it easy to draft and tailor your documents. Our intuitive platform allows you to add necessary details and send them for eSignature in just a few clicks. This streamlines the process, saving you time and ensuring your letters are legally binding.

-

What is the pricing structure for using airSlate SignNow for demands letters?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're a solo entrepreneur or part of a larger organization, you can choose a plan that fits your requirements for sending and signing demands letters. Check our website for detailed pricing information and features included in each plan.

-

Are there any integrations available for demands letters with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with a variety of business applications such as CRM systems, project management tools, and cloud storage services. This means you can easily incorporate demands letters into your existing workflows and streamline your operations. Explore our integration options to maximize your productivity.

-

What benefits does airSlate SignNow provide for demands letters?

Using airSlate SignNow for demands letters offers numerous benefits, including enhanced security, legal compliance, and faster turnaround times. Our platform ensures your documents are securely stored and transmitted, giving you peace of mind. Additionally, the eSigning feature allows for quicker responses, helping you resolve issues promptly.

-

Is airSlate SignNow user-friendly for creating demands letters?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to create demands letters without extensive training. Our step-by-step guide and intuitive interface enable users to navigate the platform effortlessly and complete their document tasks efficiently.

-

Can I track the status of my demands letters with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your demands letters. You can monitor when your letter is sent, viewed, and signed, allowing you to stay updated throughout the process. This feature ensures transparency and helps you follow up with recipients as needed.

Get more for Demand Letter To Mortgagee, Mortgage Servicer Or Off Record Note

Find out other Demand Letter To Mortgagee, Mortgage Servicer Or Off Record Note

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will