Dave Ramsey Pay off Debt Worksheet Form

What is the Dave Ramsey Pay Off Debt Worksheet

The Dave Ramsey Pay Off Debt Worksheet is a structured tool designed to assist individuals in managing and eliminating their debt. This worksheet helps users list their debts, including credit cards, loans, and other financial obligations, while providing a clear overview of their total debt situation. By organizing debts in a systematic manner, users can identify which debts to prioritize, especially when utilizing the Dave Ramsey snowball method, which advocates for paying off smaller debts first to build momentum.

How to use the Dave Ramsey Pay Off Debt Worksheet

To effectively use the Dave Ramsey Pay Off Debt Worksheet, follow these steps:

- List all debts: Begin by writing down each debt, including the creditor's name, total amount owed, minimum monthly payment, and interest rate.

- Prioritize debts: Use the snowball method by focusing on the smallest debt first while making minimum payments on larger debts.

- Set a payment plan: Determine how much extra money can be allocated toward the smallest debt each month until it is paid off.

- Track progress: Regularly update the worksheet as debts are paid off and adjust the payment plan for remaining debts.

Steps to complete the Dave Ramsey Pay Off Debt Worksheet

Completing the Dave Ramsey Pay Off Debt Worksheet involves several key steps:

- Gather financial information: Collect all statements related to your debts to ensure accuracy.

- Fill in the worksheet: Input the details of each debt into the appropriate sections of the worksheet.

- Calculate totals: Sum up the total debt and minimum payments to understand your overall financial picture.

- Review and adjust: Regularly review your progress and make adjustments to your payment plan as necessary.

Legal use of the Dave Ramsey Pay Off Debt Worksheet

The Dave Ramsey Pay Off Debt Worksheet is a personal financial tool and does not require formal legal validation. However, when using it to negotiate with creditors or for other financial planning purposes, it is important to ensure that the information is accurate and up to date. This can help in discussions with financial advisors or during debt counseling sessions.

Key elements of the Dave Ramsey Pay Off Debt Worksheet

Key elements of the worksheet include:

- Debt details: Sections for listing each debt, including creditor information and payment terms.

- Payment strategy: A framework for determining how to allocate payments, particularly for those following the snowball method.

- Progress tracking: Areas to mark off debts as they are paid, providing motivation and a sense of accomplishment.

Examples of using the Dave Ramsey Pay Off Debt Worksheet

Examples of using the worksheet can illustrate its effectiveness. For instance, a user with three debts totaling $10,000 might list them as follows:

- Credit Card A: $3,000 at 18% interest

- Medical Bill: $2,000 with no interest

- Personal Loan: $5,000 at 10% interest

By focusing on paying off Credit Card A first, the user can apply any extra funds toward this debt while making minimum payments on the others. Once Credit Card A is paid off, the user can redirect those funds to the next smallest debt, creating a snowball effect.

Quick guide on how to complete dave ramsey pay off debt worksheet

Complete Dave Ramsey Pay Off Debt Worksheet seamlessly on any device

Online document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Dave Ramsey Pay Off Debt Worksheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Dave Ramsey Pay Off Debt Worksheet effortlessly

- Locate Dave Ramsey Pay Off Debt Worksheet and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred distribution method for your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Dave Ramsey Pay Off Debt Worksheet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dave ramsey pay off debt worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

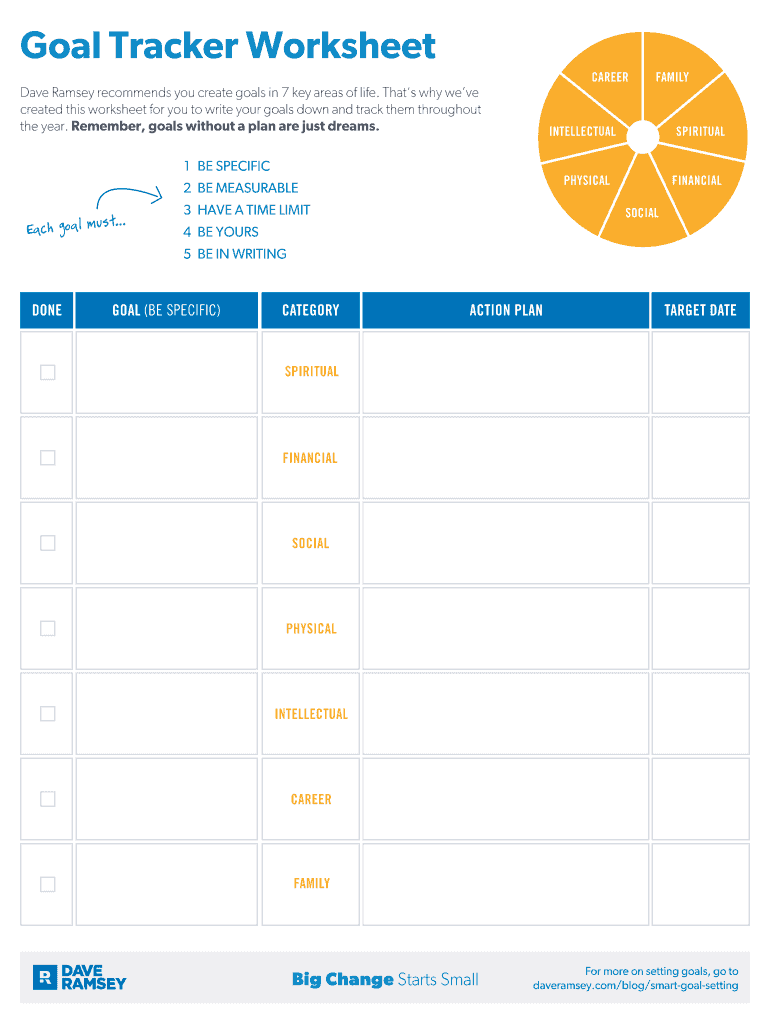

What is the Ramsey goal tracker and how does it work?

The Ramsey goal tracker is a digital tool designed to help individuals and businesses set, track, and achieve their financial goals. By utilizing its intuitive interface, users can monitor their progress and adjust their strategies as needed, ensuring they stay on track to meet their objectives.

-

What features does the Ramsey goal tracker offer?

The Ramsey goal tracker includes features such as customizable goal settings, progress tracking, detailed reporting, and reminders. These functionalities empower users to stay focused and organized while working toward their financial aspirations.

-

How much does the Ramsey goal tracker cost?

Pricing for the Ramsey goal tracker is competitive and varies based on subscription plans. Users can choose a plan that suits their needs and budget, ensuring they get the best value for their goal tracking experience.

-

Can I integrate the Ramsey goal tracker with other financial apps?

Yes, the Ramsey goal tracker can seamlessly integrate with various financial applications, allowing users to align their budgeting and saving efforts with their financial goals. This integration makes it easier to gain a comprehensive view of one's financial health.

-

What are the advantages of using the Ramsey goal tracker?

Using the Ramsey goal tracker offers numerous advantages, including enhanced goal visibility, organized financial planning, and motivation through progress feedback. Users often find that this tool signNowly simplifies their journey toward achieving financial success.

-

Is the Ramsey goal tracker suitable for businesses?

Absolutely! The Ramsey goal tracker is not only beneficial for individuals but also for businesses looking to set financial benchmarks and track performance. Its features cater to both personal and organizational goal tracking needs.

-

Is there a free trial available for the Ramsey goal tracker?

Yes, the Ramsey goal tracker typically offers a free trial period, allowing prospective users to test its features before committing to a paid plan. This trial can help users determine if the tool meets their financial tracking needs.

Get more for Dave Ramsey Pay Off Debt Worksheet

Find out other Dave Ramsey Pay Off Debt Worksheet

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form