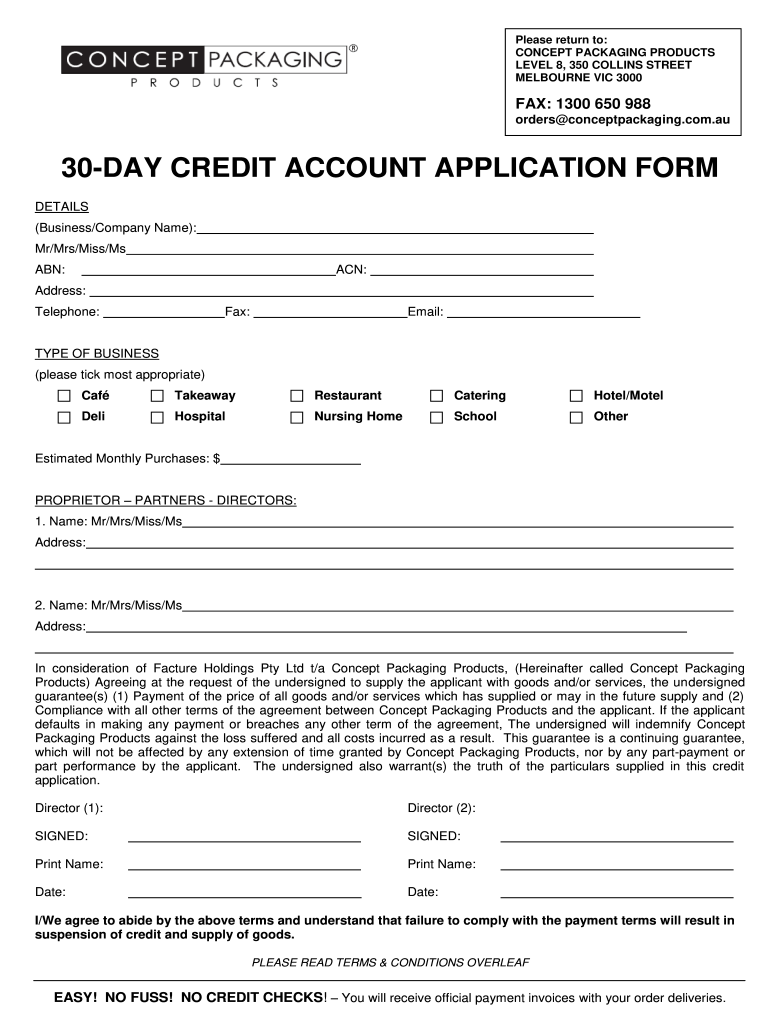

30 DAY CREDIT ACCOUNT APPLICATION FORM Concept

Key elements of the new customer credit application form template

The new customer credit application form template contains several critical components that ensure the application process is thorough and compliant. Key elements include:

- Business Information: This section captures essential details about the business, including the legal name, address, and type of business entity.

- Owner Information: Personal details of the business owner or authorized representative, such as name, social security number, and contact information.

- Financial Information: Applicants must provide financial data, including annual revenue, bank references, and credit history, to assess creditworthiness.

- Trade References: This section allows applicants to list other businesses or suppliers they have credit relationships with, which helps in evaluating their payment history.

- Signature and Date: A legally binding signature is required, along with the date of application, to validate the form.

Steps to complete the new customer credit application form template

Completing the new customer credit application form template involves several straightforward steps:

- Gather Required Information: Collect all necessary details about your business and personal information before starting the form.

- Fill Out the Form: Carefully enter the requested information in each section, ensuring accuracy to avoid delays in processing.

- Review the Application: Double-check all entries for completeness and correctness. This step is crucial to prevent errors that could impact approval.

- Sign the Form: Provide your signature and date the application to confirm that all information is true and accurate.

- Submit the Application: Choose your preferred submission method, whether online or via mail, and ensure it is sent to the appropriate department.

Legal use of the new customer credit application form template

The legal validity of the new customer credit application form template hinges on compliance with relevant laws and regulations. It is essential to ensure that:

- The form is filled out truthfully and accurately to avoid legal repercussions.

- Electronic signatures are used in accordance with the ESIGN Act and UETA, ensuring they are legally binding.

- All personal and financial information is handled in compliance with privacy laws, such as the CCPA and GDPR, to protect applicant data.

Eligibility criteria for the new customer credit application form template

Understanding the eligibility criteria is vital for businesses applying for credit. Generally, the following criteria apply:

- The business must be legally registered in the United States.

- The applicant must be at least eighteen years old and have the authority to apply on behalf of the business.

- Businesses should have a verifiable financial history to demonstrate creditworthiness.

- Applicants must provide accurate and complete information as required by the credit application form.

Application process & approval time for the new customer credit application form template

The application process for the new customer credit application form typically involves several stages:

- Submission: Once the application is completed and submitted, it enters the review phase.

- Review: The credit department evaluates the application, which may include checking credit scores and contacting trade references.

- Approval or Denial: Applicants will receive notification of approval or denial, often within a few business days, depending on the complexity of the application.

- Terms Agreement: If approved, the applicant may need to sign a credit agreement outlining the terms and conditions of the credit offered.

Examples of using the new customer credit application form template

The new customer credit application form template can be utilized in various scenarios, including:

- Retail Businesses: Retailers often use this form to extend credit to customers for purchases, allowing for flexible payment options.

- Service Providers: Companies providing services, such as construction or consulting, may require clients to complete this form before starting work.

- Wholesale Distributors: Distributors frequently use credit applications to assess the financial stability of retailers before establishing credit lines.

Quick guide on how to complete 30 day credit account application form concept

Effortlessly Prepare 30 DAY CREDIT ACCOUNT APPLICATION FORM Concept on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely store it in the cloud. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hiccups. Manage 30 DAY CREDIT ACCOUNT APPLICATION FORM Concept on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and eSign 30 DAY CREDIT ACCOUNT APPLICATION FORM Concept with Ease

- Find 30 DAY CREDIT ACCOUNT APPLICATION FORM Concept and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign 30 DAY CREDIT ACCOUNT APPLICATION FORM Concept and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 30 day credit account application form concept

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is a new customer credit application form template?

A new customer credit application form template is a standardized document that businesses can use to collect essential information from customers applying for credit. This template streamlines the application process and ensures that all necessary data is collected efficiently, making it easier for businesses to assess creditworthiness.

-

How can the new customer credit application form template benefit my business?

Using a new customer credit application form template can signNowly speed up the application process, allowing you to evaluate potential customers quickly. It helps maintain consistency in your data collection and reduces errors, fostering a smoother relationship with your clients.

-

Are there any costs associated with using the new customer credit application form template?

airSlate SignNow offers flexible pricing plans that include access to the new customer credit application form template. Depending on your business needs and the features you choose, you can find an affordable plan that fits your budget while streamlining your document management.

-

Can I customize the new customer credit application form template?

Yes, you can easily customize the new customer credit application form template to align with your business requirements. Whether it's adding specific fields or modifying existing ones, airSlate SignNow provides a user-friendly interface that allows for customization without any hassle.

-

What features are included with the new customer credit application form template?

The new customer credit application form template includes features like eSignature capability, real-time collaboration, and secure document storage. This ensures you can not only collect necessary information but also track the progress of applications seamlessly.

-

Is the new customer credit application form template compliant with legal standards?

Yes, the new customer credit application form template compliant with legal standards, ensuring that your business meets all regulatory requirements for document handling and data protection. This helps protect not only your business but also the sensitive information provided by your customers.

-

Can I integrate the new customer credit application form template with other software?

Absolutely! The new customer credit application form template can be integrated with various third-party applications and tools, enhancing your existing workflows. This flexibility allows you to manage customer information more effectively, streamline processes, and improve overall customer service.

Get more for 30 DAY CREDIT ACCOUNT APPLICATION FORM Concept

Find out other 30 DAY CREDIT ACCOUNT APPLICATION FORM Concept

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online