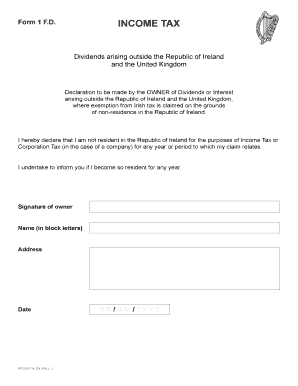

Form 1 F D Dividends Arising Outside the Republic of Ireland and the United Kingdom Revenue

What is the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue

The Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue is a specific tax form used to report dividend income received from foreign sources. This form is essential for individuals and businesses that have received dividends from investments outside of Ireland and the UK, ensuring compliance with tax obligations. It helps taxpayers declare their foreign income accurately, allowing for the appropriate taxation and potential credits for foreign taxes paid.

How to use the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue

Using the Form 1 F D involves several steps to ensure accurate reporting of foreign dividend income. First, gather all necessary documentation regarding the dividends received, including statements from foreign entities. Next, fill out the form with accurate information, including details about the dividend amounts and the countries from which they originated. After completing the form, it must be submitted to the appropriate tax authority, either electronically or via mail, depending on your preference and compliance requirements.

Steps to complete the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue

Completing the Form 1 F D requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents that detail the dividends received.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Report the total amount of dividends received from foreign sources.

- Indicate the countries from which the dividends were sourced.

- Review the form for accuracy before submission.

Legal use of the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue

The legal use of the Form 1 F D is crucial for ensuring compliance with tax laws. This form must be completed accurately to avoid potential penalties or legal issues. It serves as a formal declaration of foreign income, which is necessary for tax assessment purposes. Failure to file this form correctly can lead to audits and fines, making it essential for taxpayers to understand their obligations under U.S. tax law.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1 F D are critical to avoid late penalties. Typically, the form must be filed by the annual tax return deadline, which is usually April fifteenth for individual taxpayers. It is important to check for any updates or changes in deadlines each tax year, as these can vary based on specific circumstances or legislative changes.

Required Documents

To complete the Form 1 F D accurately, certain documents are required. These include:

- Dividend statements from foreign companies.

- Tax documents indicating any foreign taxes paid on the dividends.

- Personal identification information, such as a Social Security number or taxpayer identification number.

Quick guide on how to complete form 1 f d dividends arising outside the republic of ireland and the united kingdom revenue

Complete Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the required form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to edit and electronically sign Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue easily

- Find Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1 f d dividends arising outside the republic of ireland and the united kingdom revenue

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue?

The Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue is a declaration necessary for reporting foreign dividends. It ensures compliance with tax regulations when dividends are received from outside these regions. Understanding this form is crucial for tax reporting and avoidance of penalties.

-

How can airSlate SignNow assist with managing the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue?

airSlate SignNow simplifies the completion and submission of the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue. Our platform allows users to eSign documents securely and efficiently, ensuring your submissions are prompt and compliant. With our user-friendly interface, you'll save time and reduce errors.

-

Is there a cost associated with using airSlate SignNow for Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including handling the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue. Our cost-effective solution ensures that you can manage your document signing and submission without breaking the bank. We also offer a free trial for new users to explore our features.

-

What features does airSlate SignNow offer for managing tax-related forms like the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue?

airSlate SignNow provides features such as customizable templates, secure eSignatures, and document analytics, all of which can enhance your experience with the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue. These tools enable efficient document handling, ensuring that your tax-related submissions are accurate and timely.

-

Can I integrate airSlate SignNow with other software to manage the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue?

Yes, airSlate SignNow offers seamless integrations with various third-party applications that can help you manage your tax documents, including the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue. This capability allows for a more streamlined workflow and better data management across platforms, enhancing your overall efficiency.

-

What benefits can I expect when using airSlate SignNow for the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue?

By using airSlate SignNow for the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue, you can expect increased efficiency, enhanced compliance, and easier document tracking. Our platform ensures that your documents are stored securely and can be accessed anytime, making tax time less stressful and more organized.

-

Is airSlate SignNow user-friendly for someone unfamiliar with the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue?

Absolutely! airSlate SignNow is designed with ease of use in mind. Even if you're unfamiliar with the Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue, our intuitive platform provides guidance and resources to help you navigate the process smoothly and effectively.

Get more for Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue

- Referred to as grantors do hereby convey and warrant unto an individual form

- Free illinois quit claim deed form wordpdfeforms

- Notice of a right to a liencorporation or llc form

- Glossary of probate estates terms alaska court system form

- Boarding contract ipage form

- Full text of ampquotdecimal classification and relativ index for form

- A national protocol for sexual abuse medical forensic form

- Uniform single party or multiple party account form

Find out other Form 1 F D Dividends Arising Outside The Republic Of Ireland And The United Kingdom Revenue

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later