Tata Aig Proposal Accident Guard Form

What is the Tata Aig Proposal Accident Guard Form

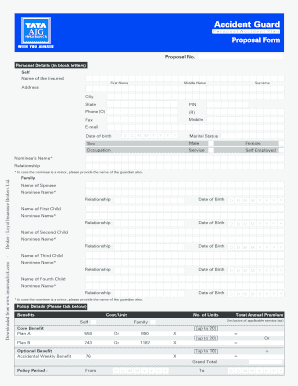

The Tata Aig Proposal Accident Guard Form is a crucial document designed for individuals seeking personal accident insurance coverage. This form collects essential information about the applicant, including personal details, health history, and coverage requirements. By completing this form, applicants can apply for a policy that offers financial protection in the event of an accident, ensuring peace of mind for themselves and their families.

Steps to complete the Tata Aig Proposal Accident Guard Form

Completing the Tata Aig Proposal Accident Guard Form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including identification details and contact information. Next, provide relevant health history, which may include pre-existing conditions and previous accidents. After filling out the required sections, review the form for any errors or omissions. Finally, sign the form electronically or physically, depending on submission preferences.

How to obtain the Tata Aig Proposal Accident Guard Form

The Tata Aig Proposal Accident Guard Form can be obtained through various channels. Applicants can visit the official Tata Aig website to download the form directly in a PDF format. Alternatively, individuals may request a physical copy from local Tata Aig offices or authorized agents. It is advisable to ensure that the most current version of the form is used to avoid any discrepancies during the application process.

Legal use of the Tata Aig Proposal Accident Guard Form

The legal use of the Tata Aig Proposal Accident Guard Form is governed by specific regulations that ensure the document is valid and enforceable. To be legally binding, the form must be completed accurately and signed by the applicant. Additionally, compliance with electronic signature laws, such as the ESIGN Act and UETA, is essential when submitting the form online. These regulations establish the legitimacy of digital signatures, ensuring that the form holds up in legal contexts.

Key elements of the Tata Aig Proposal Accident Guard Form

Several key elements are critical to the Tata Aig Proposal Accident Guard Form. These include personal identification details, such as name, address, and date of birth, as well as health-related questions that assess the applicant's risk profile. The form also outlines the desired coverage amount and any specific riders or additional benefits the applicant wishes to include. Understanding these elements is vital for ensuring that the form is completed accurately and comprehensively.

Form Submission Methods (Online / Mail / In-Person)

The Tata Aig Proposal Accident Guard Form can be submitted through multiple methods, providing flexibility for applicants. Online submission is available through the Tata Aig website, allowing for a quick and efficient process. Alternatively, applicants may choose to mail the completed form to the designated Tata Aig address or deliver it in person to a local branch. Each method has its own advantages, and applicants should select the one that best suits their needs.

Eligibility Criteria

Eligibility for the Tata Aig Proposal Accident Guard Form typically requires applicants to meet certain criteria. Generally, individuals aged between eighteen and sixty-five are eligible to apply for personal accident insurance. Additionally, applicants should not have any significant pre-existing medical conditions that could affect their coverage. Understanding these eligibility requirements is essential for ensuring a successful application process.

Quick guide on how to complete tata aig proposal accident guard form

Complete Tata Aig Proposal Accident Guard Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, alter, and eSign your documents swiftly without any holdups. Manage Tata Aig Proposal Accident Guard Form on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest method to modify and eSign Tata Aig Proposal Accident Guard Form with ease

- Find Tata Aig Proposal Accident Guard Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your desktop.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Tata Aig Proposal Accident Guard Form to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tata aig proposal accident guard form

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is the tata aig form accident guard?

The tata aig form accident guard is an insurance product designed to provide financial protection in case of accidental injuries or death. This form allows policyholders to access comprehensive coverage options tailored to meet their needs, ensuring peace of mind while they navigate everyday risks.

-

How do I fill out the tata aig form accident guard?

Filling out the tata aig form accident guard is straightforward. You will need to provide personal details, coverage preferences, and any specific circumstances that may apply to your situation. Make sure to review all information for accuracy before submitting, to ensure a smooth processing experience.

-

What features are included in the tata aig form accident guard?

The tata aig form accident guard includes several key features such as personal accident coverage, disablement benefits, and accidental death benefits. Additionally, you can opt for add-ons based on your needs, ensuring a tailored insurance experience designed for your protection.

-

What are the benefits of the tata aig form accident guard?

The benefits of the tata aig form accident guard include financial security in the event of an accident, coverage for medical expenses, and support for family members in case of permanent disability or death. With this form, you can ensure that you and your loved ones are safeguarded against unexpected events.

-

How much does the tata aig form accident guard cost?

The cost of the tata aig form accident guard varies depending on factors such as age, coverage amount, and premium options chosen. It’s essential to review the various pricing tiers offered by Tata AIG to select one that fits your budget while providing adequate coverage.

-

Can I integrate the tata aig form accident guard with other insurance policies?

Yes, you can integrate the tata aig form accident guard with other Tata AIG insurance products to enhance your overall coverage. Bundling your policies may also lead to discounts and a more comprehensive insurance strategy, allowing you to benefit from a holistic approach to risk management.

-

How do claims work with the tata aig form accident guard?

Submitting a claim for the tata aig form accident guard involves completing a claims form and providing necessary documentation to support your case. The process is designed to be user-friendly, ensuring you receive your entitled benefits promptly and without undue stress.

Get more for Tata Aig Proposal Accident Guard Form

- County michigan declare this as a codicil to my will dated form

- Minnesota limited liability company minnesota secretary of state form

- Document grep for query ampquotform n 27e 1ampquot and grep phrase ampquotampquot

- Decree of descent form

- With links to web based paternity statutes and resources for minnesota form

- A form

- Chapter 10 real property nebraska department of revenue form

- The clerk of the above named court above named petitioner form

Find out other Tata Aig Proposal Accident Guard Form

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS