Vat 103 Certificate Form

What is the Vat 103 Certificate

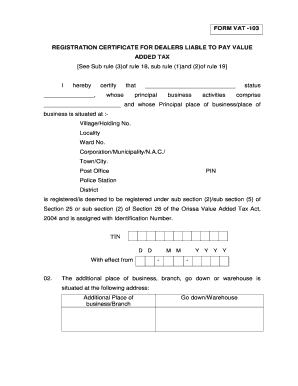

The Vat 103 registration certificate is an essential document for businesses engaged in transactions subject to value-added tax (VAT). This certificate serves as proof of registration with the appropriate tax authority, allowing businesses to collect VAT from customers and claim input tax credits on their purchases. The Vat 103 certificate is particularly relevant for dealers operating within the VAT framework, ensuring compliance with tax regulations and facilitating smooth business operations.

How to obtain the Vat 103 Certificate

To obtain the Vat 103 registration certificate, businesses must complete a specific application process. This process typically involves submitting a registration form to the relevant tax authority, providing necessary documentation such as proof of business identity, financial statements, and any other required information. Once the application is reviewed and approved, the tax authority issues the Vat 103 certificate, enabling the business to operate within the VAT system legally.

Steps to complete the Vat 103 Certificate

Completing the Vat 103 certificate involves several key steps:

- Gather necessary documentation, including business identification and financial records.

- Fill out the Vat 103 registration form accurately, ensuring all information is complete.

- Submit the completed form along with required documents to the appropriate tax authority.

- Await confirmation of registration and receipt of the Vat 103 certificate.

Legal use of the Vat 103 Certificate

The Vat 103 certificate is legally binding and must be used in accordance with relevant tax laws. Businesses are required to display their certificate when conducting transactions subject to VAT. This document not only legitimizes the collection of VAT but also ensures that businesses can reclaim input tax credits, thereby maintaining compliance with tax regulations and avoiding potential penalties.

Key elements of the Vat 103 Certificate

The Vat 103 registration certificate contains several key elements that are crucial for its validity. These include:

- The business name and registration number.

- The effective date of registration.

- The tax authority's official seal or signature.

- Any specific terms or conditions related to the VAT registration.

Required Documents

When applying for the Vat 103 certificate, businesses must provide various documents to support their application. Commonly required documents include:

- Proof of business identity, such as a business license or incorporation documents.

- Financial statements or tax returns from previous years.

- Identification for the business owner or authorized representative.

- Any additional documentation requested by the tax authority.

Penalties for Non-Compliance

Failure to comply with VAT registration requirements can result in significant penalties for businesses. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to ensure they have a valid Vat 103 certificate and adhere to all related regulations to avoid these consequences.

Quick guide on how to complete vat 103 certificate

Effortlessly Prepare Vat 103 Certificate on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without any holdups. Manage Vat 103 Certificate seamlessly on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Vat 103 Certificate with Ease

- Locate Vat 103 Certificate and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form retrieval, and errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Vat 103 Certificate and ensure outstanding communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 103 certificate

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is a VAT103 registration certificate?

A VAT103 registration certificate is an official document issued by the tax authority, confirming that a business is registered for Value Added Tax (VAT). This certificate is essential for businesses that operate in the VAT system, enabling them to charge VAT on their sales and claim back tax on qualifying purchases.

-

How can airSlate SignNow help with VAT103 registration certificate processing?

airSlate SignNow streamlines the process of obtaining and managing your VAT103 registration certificate by providing an easy-to-use eSigning solution. You can electronically sign and send necessary documents, ensuring quick and secure approval from the appropriate authorities.

-

What are the costs associated with acquiring a VAT103 registration certificate?

Acquiring a VAT103 registration certificate typically involves administrative fees charged by tax authorities, which may vary by country. Using airSlate SignNow can help minimize additional costs by reducing the time and resources spent on document management and signature collection.

-

What features does airSlate SignNow offer for managing VAT103 registration certificates?

airSlate SignNow offers features like document templates, real-time tracking, and automated reminders to manage your VAT103 registration certificate efficiently. These tools simplify the documentation process, ensuring you never miss a deadline related to your VAT registration.

-

Is airSlate SignNow compliant with VAT registration requirements?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and documentation, making it suitable for managing your VAT103 registration certificate. Our solution ensures that your signed documents are secure, legally binding, and compliant with tax authority regulations.

-

Can I integrate airSlate SignNow with my accounting software for VAT processes?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, allowing you to manage your VAT103 registration certificate and related documents efficiently. This integration provides a holistic approach to your VAT management, improving workflow and accuracy.

-

What benefits does airSlate SignNow offer for businesses handling VAT103 certificates?

Using airSlate SignNow to manage your VAT103 registration certificate provides numerous benefits, including enhanced efficiency, reduced paperwork, and faster transactions. Our platform helps businesses stay organized and ensures that all documentation is secure and easily accessible.

Get more for Vat 103 Certificate

- Domestic professional corporation form

- 08 438 articles of incorporation formdoc

- Sample llc operating agreement free template downloads form

- Domestic limited liability company statement of change pdf form

- For state licensed professionals form

- Court system information alaska court system state of

- Above this line reserved for official use only form

- Community property without rights of survivorship hereinafter grantees form

Find out other Vat 103 Certificate

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later