Best Ira 2015-2026

What is the best IRA?

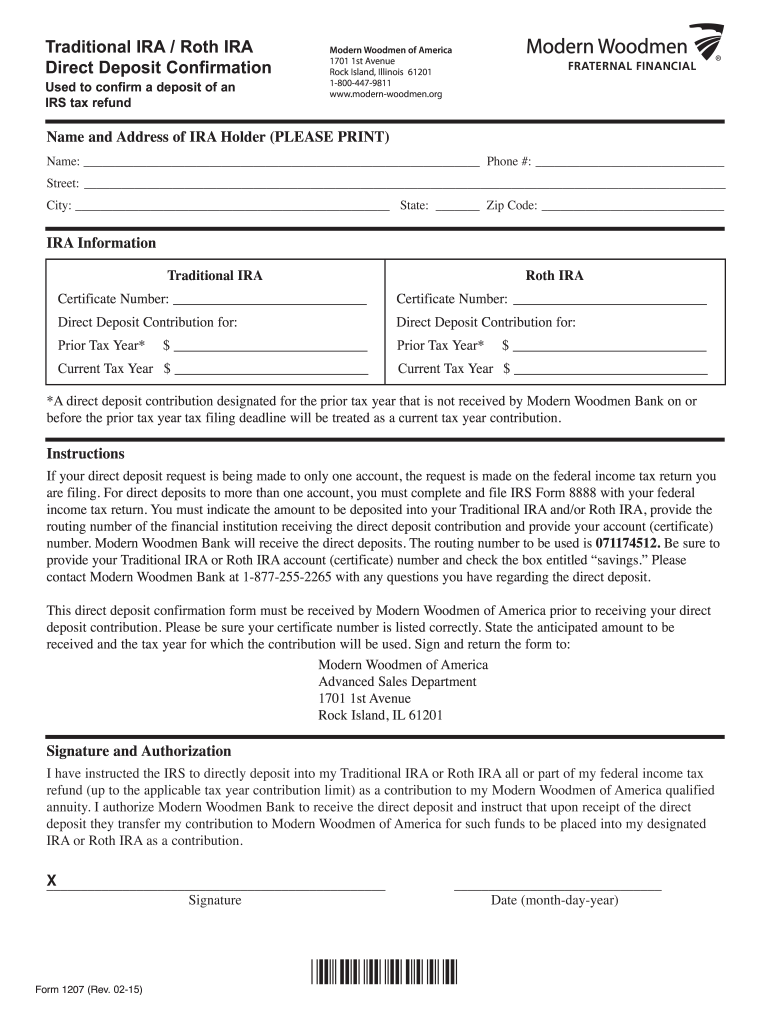

The best IRA (Individual Retirement Account) is designed to help individuals save for retirement while providing tax advantages. There are several types of IRAs, including traditional IRAs and Roth IRAs, each with unique features. A traditional IRA allows individuals to make tax-deductible contributions, with taxes paid upon withdrawal during retirement. In contrast, a Roth IRA offers tax-free withdrawals in retirement, as contributions are made with after-tax dollars. Understanding the differences between these accounts is crucial for selecting the best IRA for your financial goals.

How to obtain the best IRA

Obtaining the best IRA involves several steps. First, assess your retirement goals and financial situation to determine which type of IRA suits you best. Next, research various financial institutions, such as banks, credit unions, and brokerage firms, that offer IRA accounts. Compare fees, investment options, and customer service. Once you have selected a provider, you can open an account online or in-person, providing necessary information such as your Social Security number and employment details. After your account is established, you can begin making contributions.

Steps to complete the best IRA

Completing the paperwork for the best IRA typically involves several steps. Start by gathering required documents, such as identification and proof of income. Next, fill out the IRA application form, which may require personal information, beneficiary designations, and investment preferences. Review the terms and conditions carefully before submitting your application. After submission, monitor your account for confirmation and ensure that your contributions are processed correctly. Regularly review your investment choices to align with your retirement goals.

Key elements of the best IRA

Key elements of the best IRA include contribution limits, tax implications, and withdrawal rules. For the tax year 2023, individuals can contribute up to six thousand dollars to their IRA, with an additional one thousand dollars allowed for those aged fifty and older. Understanding the tax benefits is essential, as traditional IRAs offer tax deductions on contributions, while Roth IRAs provide tax-free withdrawals. Additionally, familiarize yourself with withdrawal rules, as early withdrawals may incur penalties unless specific conditions are met.

IRS guidelines

The IRS provides guidelines that govern IRAs, including contribution limits, eligibility criteria, and tax treatment. It is crucial to stay informed about these guidelines to ensure compliance. For instance, the IRS mandates that contributions must be made by the tax filing deadline, typically April fifteenth, to count for the previous tax year. Additionally, individuals must meet income requirements to contribute to a Roth IRA. Regularly reviewing IRS updates can help you make informed decisions regarding your retirement savings.

Required documents

When opening an IRA, certain documents are typically required. These may include a government-issued identification, such as a driver's license or passport, and your Social Security number. You may also need to provide information about your employment and income. If you are rolling over funds from another retirement account, documentation from the previous account will be necessary. Having these documents ready can streamline the account opening process and ensure compliance with regulatory requirements.

Eligibility criteria

Eligibility criteria for opening an IRA vary depending on the type of account. Generally, anyone with earned income can contribute to a traditional IRA, while Roth IRA contributions are subject to income limits. For 2023, individuals with modified adjusted gross incomes above one hundred thirty-eight thousand dollars for single filers and two hundred seven thousand dollars for married couples filing jointly may not be eligible for Roth IRA contributions. Understanding these criteria is essential for selecting the best IRA for your financial situation.

Quick guide on how to complete best ira

Complete Best Ira effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documentation, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without hindrance. Handle Best Ira on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to adjust and eSign Best Ira effortlessly

- Obtain Best Ira and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Adjust and eSign Best Ira and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the best ira

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the best IRA for my retirement savings?

The best IRA for your retirement savings depends on your individual financial goals and investment preferences. Traditional IRAs and Roth IRAs both offer unique benefits and tax advantages; therefore, it’s important to evaluate which fits your situation best. By considering factors like your current income, expected retirement tax bracket, and investment choices, you can choose the best IRA that aligns with your future plans.

-

How does airSlate SignNow assist with IRA document management?

airSlate SignNow simplifies IRA document management by providing an easy-to-use platform for preparing, signing, and sending important documents securely. Users can quickly create and manage the necessary paperwork associated with the best IRA options on the go. The platform's integrations with financial tools enhance efficiency in handling all IRA-related documentation.

-

What features make airSlate SignNow the best IRA solution?

AirSlate SignNow offers a range of features that position it as one of the best IRA solutions. These include customizable templates for various IRA documents, advanced security protocols for sensitive information, and seamless collaboration tools. With airSlate SignNow, managing your IRA paperwork is straightforward and secure.

-

Is pricing an important factor when choosing the best IRA?

Absolutely! Pricing is a critical factor when determining the best IRA for your needs. It's essential to consider any fees associated with opening and maintaining an IRA, as well as management fees for the investments you select. AirSlate SignNow provides cost-effective solutions for document management, ensuring budget-friendly options complements your IRA planning.

-

What benefits does an IRA offer for long-term savings?

An IRA serves as a powerful tool for long-term savings, helping individuals build wealth for retirement. The best IRA accounts often provide tax advantages, allowing your investments to grow tax-deferred or tax-free. Additionally, they can diversify your investment portfolio, reducing risk while maximizing potential returns for your future.

-

How can airSlate SignNow integrate with my investment platforms for IRAs?

AirSlate SignNow easily integrates with various investment platforms, enhancing your IRA management experiences. These integrations allow you to streamline the document signing process directly from your investment accounts, ensuring your transactions are smooth and efficient. By using airSlate SignNow, you can keep your best IRA organized within your existing investment workflows.

-

What types of assets can I include in the best IRA?

You can include a variety of assets in the best IRA, such as stocks, bonds, mutual funds, and ETFs, among others. Additionally, certain accounts allow for alternative investments like real estate or precious metals. Consulting with a financial advisor is advisable to tailor your IRA investments to match your risk tolerance and retirement objectives.

Get more for Best Ira

- Arkansas ar notarial certificates american association of form

- Untitled wv secretary of state state of west virginia form

- County of state of arkansas and described as form

- Oath that form

- Loan modification in the united states wikipedia form

- Wills clinic arkansas legal services form

- Seal of office form

- Judgment and disposition order form

Find out other Best Ira

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors