Fidelity 401k Direct Rollover Form

What is the Fidelity 401k Direct Rollover Form

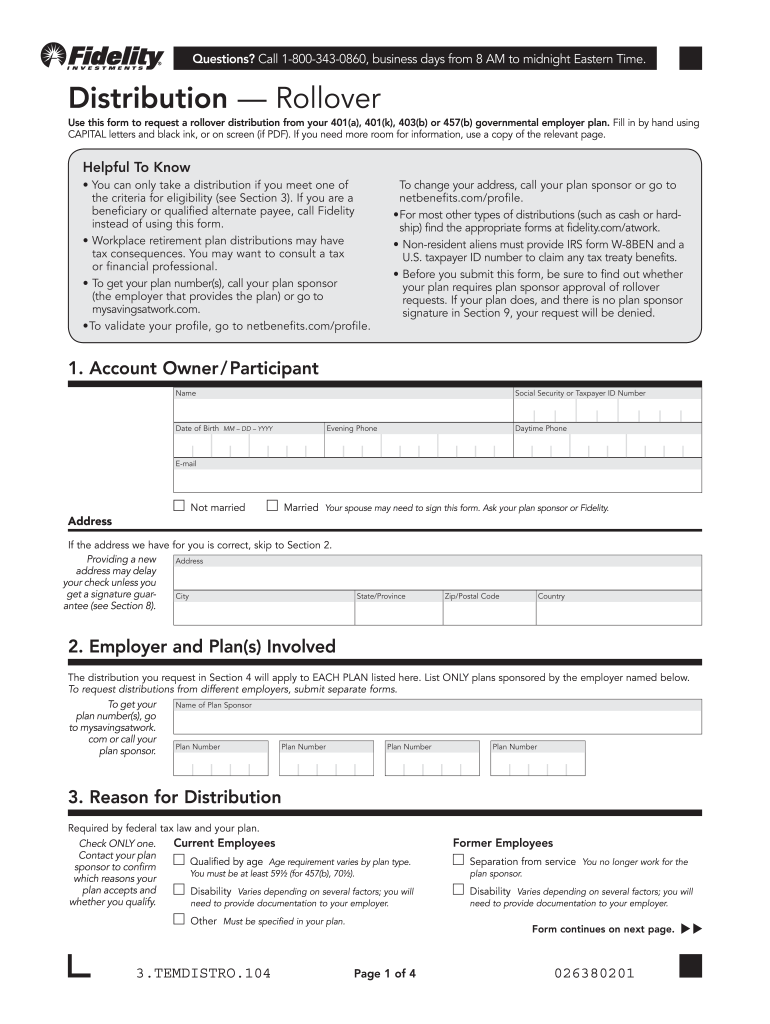

The Fidelity 401k Direct Rollover Form is a crucial document that allows individuals to transfer their retirement savings from one qualified retirement plan to another without incurring tax penalties. This form is specifically designed for those looking to move their funds directly from a Fidelity 401k plan to another eligible retirement account, such as an IRA or another employer's 401k plan. By using this form, individuals can maintain the tax-deferred status of their retirement savings while ensuring a seamless transition between accounts.

How to use the Fidelity 401k Direct Rollover Form

Using the Fidelity 401k Direct Rollover Form involves a straightforward process. First, gather necessary information about both the current and receiving retirement accounts. Next, fill out the form with accurate details, including personal information, account numbers, and the amount to be rolled over. It is essential to ensure that the receiving account is eligible to accept the rollover. Once completed, submit the form according to the instructions provided, either online or via mail, to initiate the transfer of funds.

Steps to complete the Fidelity 401k Direct Rollover Form

Completing the Fidelity 401k Direct Rollover Form requires attention to detail. Follow these steps for a successful submission:

- Obtain the form from Fidelity’s website or your account portal.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details of your current Fidelity 401k account, including the account number.

- Indicate the type of receiving account and its details.

- Specify the amount you wish to roll over.

- Review the form for accuracy and completeness.

- Submit the form as directed, either electronically or by mailing it to the appropriate address.

Legal use of the Fidelity 401k Direct Rollover Form

The legal use of the Fidelity 401k Direct Rollover Form is governed by federal regulations that allow for tax-free transfers between retirement accounts. To ensure compliance, it is vital to complete the form accurately and submit it within the required timeframes. The rollover must be executed directly between institutions to avoid tax implications. Understanding these legal requirements helps protect your retirement savings and ensures a smooth transaction.

Required Documents

When completing the Fidelity 401k Direct Rollover Form, certain documents may be required to facilitate the process. These typically include:

- A copy of your current Fidelity 401k statement.

- Details of the receiving retirement account, such as account statements or documents from the new institution.

- Identification documents, if requested by Fidelity or the receiving institution.

Having these documents ready can expedite the rollover process and help prevent delays.

Form Submission Methods

The Fidelity 401k Direct Rollover Form can be submitted through various methods, providing flexibility for users. Options typically include:

- Online submission through Fidelity’s secure portal.

- Mailing the completed form to Fidelity’s designated address.

- In-person submission at a Fidelity branch, if available.

Choosing the appropriate submission method can depend on personal preference and the urgency of the rollover.

Quick guide on how to complete fidelity 401k direct rollover form

Prepare Fidelity 401k Direct Rollover Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage Fidelity 401k Direct Rollover Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Fidelity 401k Direct Rollover Form with ease

- Find Fidelity 401k Direct Rollover Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Fidelity 401k Direct Rollover Form while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity 401k direct rollover form

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a rollover form in airSlate SignNow?

A rollover form in airSlate SignNow is a digital document that allows businesses to collect necessary information from clients during the signing process. This feature simplifies data gathering while streamlining the eSigning experience, making it more efficient for both parties.

-

How can I create a rollover form using airSlate SignNow?

Creating a rollover form in airSlate SignNow is straightforward. You can easily design your form using our drag-and-drop builder, adding fields for signatures, checkboxes, and text inputs, ensuring you capture all necessary information from your clients.

-

Is there a cost associated with using the rollover form feature?

The rollover form feature is included in airSlate SignNow's competitive pricing plans. Depending on the plan you choose, you can access a variety of features including unlimited rollover forms to meet your business needs effectively.

-

What are the benefits of using a rollover form in my business?

Using a rollover form allows your business to enhance efficiency and accuracy in collecting information. It reduces the need for paper forms, minimizes errors, and improves the overall customer experience when signing documents digitally.

-

Can I integrate the rollover form with other tools?

Yes, airSlate SignNow offers seamless integration with various applications and tools, making it easy to incorporate your rollover form into existing workflows. This integration helps you automate processes and ensures all your data flows smoothly across different platforms.

-

Are rollover forms secure for my clients' information?

Absolutely! Rollover forms created with airSlate SignNow are designed with security in mind. They feature encryption and secure data handling practices to protect your clients' sensitive information throughout the signing process.

-

Can I customize my rollover form to match my branding?

Yes, airSlate SignNow allows you to customize your rollover form fully. You can add your company logo, choose colors, and modify the layout to align with your branding, ensuring a consistent experience for your clients.

Get more for Fidelity 401k Direct Rollover Form

- Brood mare lease agreement form

- Paternity laws and procedures form

- Print the name of the county where this statement is being notarized form

- Petition for dissolution of marriage with dependant or minor children form

- Texas probate code attorneys electronic edition michael a koenecke form

- 1 case no dept noin the seventh judicial district form

- Domestic violence special commissioner third judicial district court form

- Respondents original answer set a no children texaslawhelporg form

Find out other Fidelity 401k Direct Rollover Form

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form