Auto Loan Payoff Letter Sample Form

What is the auto loan payoff letter sample

An auto loan payoff letter is a formal document provided by a lender that outlines the total amount needed to pay off a car loan. This letter serves as a crucial tool for borrowers who wish to settle their debts, especially when selling or trading in a vehicle. The payoff letter typically includes important details such as the remaining balance, interest rate, and any applicable fees. Understanding the components of a payoff letter can help borrowers make informed financial decisions when it comes to their auto loans.

How to obtain the auto loan payoff letter sample

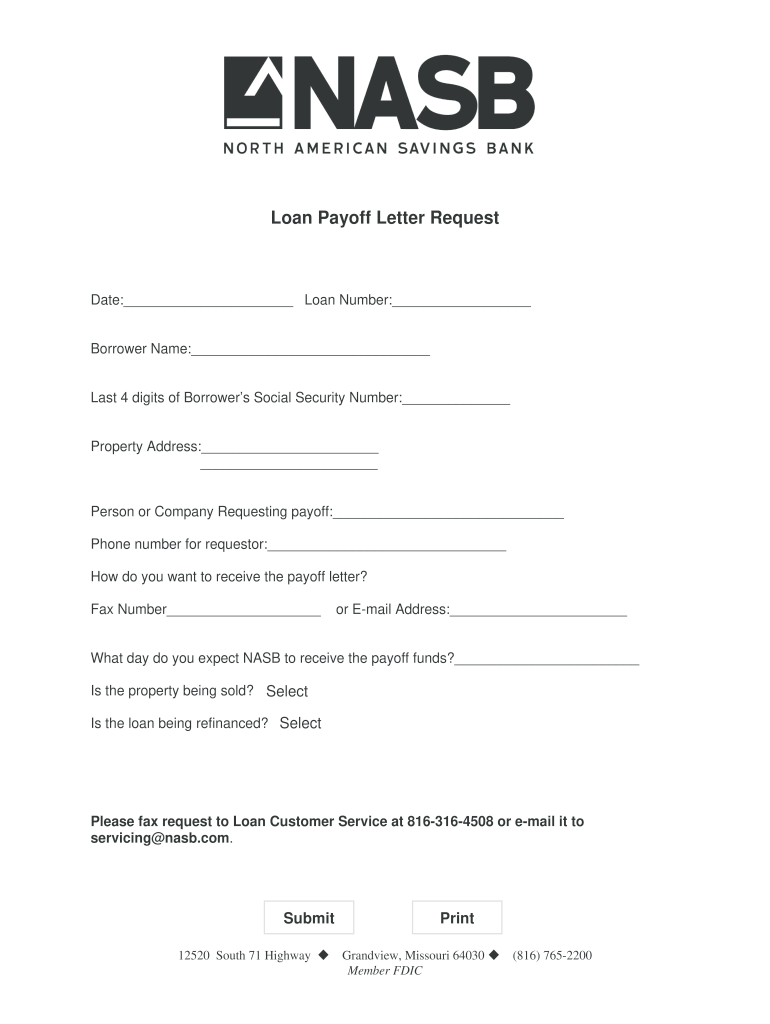

To obtain an auto loan payoff letter, borrowers should contact their lender directly. This can often be done through various channels, including phone calls, online banking portals, or in-person visits to a branch. When requesting the letter, it is helpful to provide identifying information such as the loan account number, the borrower's name, and any other relevant details that can assist the lender in processing the request quickly. Some lenders may also have specific forms or procedures to follow, so checking their website or customer service resources can be beneficial.

Steps to complete the auto loan payoff letter sample

Completing an auto loan payoff letter involves several key steps:

- Gather necessary information, including the loan account number, borrower details, and vehicle information.

- Request the payoff letter from the lender, ensuring all required details are provided.

- Review the letter for accuracy, checking the payoff amount, interest rate, and any fees.

- Prepare the funds needed to pay off the loan, which may include arranging a wire transfer or certified check.

- Submit the payment to the lender as outlined in the payoff letter.

- Request confirmation of the loan payoff from the lender once the payment has been processed.

Legal use of the auto loan payoff letter sample

The auto loan payoff letter is a legally binding document that serves as proof of the borrower's obligation to pay off the loan. It is essential for ensuring that all parties involved understand the terms of the loan settlement. When properly executed, the payoff letter protects both the borrower and the lender by providing clear documentation of the transaction. Additionally, it can be used in legal situations to demonstrate that a loan has been satisfied, which may be necessary for title transfers or disputes.

Key elements of the auto loan payoff letter sample

Several key elements should be included in an auto loan payoff letter to ensure it serves its purpose effectively:

- Borrower Information: Full name and contact details of the borrower.

- Lender Information: Name and contact details of the lending institution.

- Loan Account Number: Unique identifier for the loan.

- Payoff Amount: Total amount required to pay off the loan, including principal, interest, and any fees.

- Expiration Date: Date by which the payoff amount is valid, after which it may change.

- Payment Instructions: Details on how to submit the payment to the lender.

Examples of using the auto loan payoff letter sample

There are various scenarios in which an auto loan payoff letter may be utilized:

- When selling a vehicle, the seller may need to provide the payoff letter to the buyer to clarify the amount owed on the loan.

- In a trade-in situation, dealerships often request a payoff letter to facilitate the transaction and ensure the loan is settled.

- Borrowers may need the payoff letter when refinancing their auto loan with a different lender.

- In legal disputes regarding ownership or debt, the payoff letter can serve as evidence of the loan's status.

Quick guide on how to complete auto loan payoff letter sample

Effortlessly Prepare Auto Loan Payoff Letter Sample on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Auto Loan Payoff Letter Sample on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to edit and eSign Auto Loan Payoff Letter Sample effortlessly

- Obtain Auto Loan Payoff Letter Sample and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select how you'd like to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Auto Loan Payoff Letter Sample to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the auto loan payoff letter sample

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is a 10 day loan payoff?

A 10 day loan payoff refers to the process of paying off your loan balance in full within a 10-day period. This short time frame can help borrowers reduce interest costs and clear their debts quickly. Understanding the terms and conditions of your loan is crucial for an effective 10 day loan payoff.

-

How can airSlate SignNow help with a 10 day loan payoff?

airSlate SignNow simplifies the document signing process, making it easy to complete your 10 day loan payoff paperwork. Our platform allows you to electronically sign and send important documents securely and efficiently. This ensures a swift and hassle-free experience when managing your loan payoff.

-

What are the costs associated with using airSlate SignNow for a 10 day loan payoff?

Using airSlate SignNow for a 10 day loan payoff is cost-effective and offers various pricing plans to suit different business needs. You can choose a subscription that best fits your volume of eSignatures required. With our straightforward pricing, you can ensure a budget-friendly solution for your loan processes.

-

Are there any specific features for a quick 10 day loan payoff?

Yes, airSlate SignNow includes features like document templates, reminders, and real-time tracking that can expedite your 10 day loan payoff process. These tools help you manage your paperwork effectively, ensuring that all necessary documents are completed promptly. This can streamline your loan payoff and ensure compliance.

-

Can I integrate airSlate SignNow with other financial tools for my loan payoff?

Absolutely! airSlate SignNow offers integrations with various financial platforms which streamline the management of your 10 day loan payoff. By connecting our service with your existing tools, you can efficiently handle all your document workflows and ensure a seamless experience.

-

What are the benefits of using airSlate SignNow for loan payoffs?

The benefits of using airSlate SignNow for your loan payoffs include increased efficiency, reduced paperwork, and faster transaction times. With our easy-to-use platform, you can complete your 10 day loan payoff digitally, which saves time and minimizes errors. This helps you focus on important financial decisions rather than on administrative tasks.

-

Is airSlate SignNow secure for handling sensitive loan payoff documents?

Yes, airSlate SignNow implements advanced security measures to ensure your sensitive loan payoff documents are protected. We use encryption and secure data transmission to safeguard your information during the entire process. This helps guarantee that your 10 day loan payoff is conducted securely.

Get more for Auto Loan Payoff Letter Sample

- Services lawchekcom form

- From you i have not received one form

- Forms for non individuals filing for bankruptcy united states

- Computed on full value of property conveyed or computed on full value less value of liens or encumbrances form

- Form of amended and restated executive employment and

- Promissory note for vehicle purchase fill online printable form

- Length ft form

- Contracting with a contractor the homeowners rights to form

Find out other Auto Loan Payoff Letter Sample

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word