What is Printable Claim Format

Understanding the Printable Claim Format

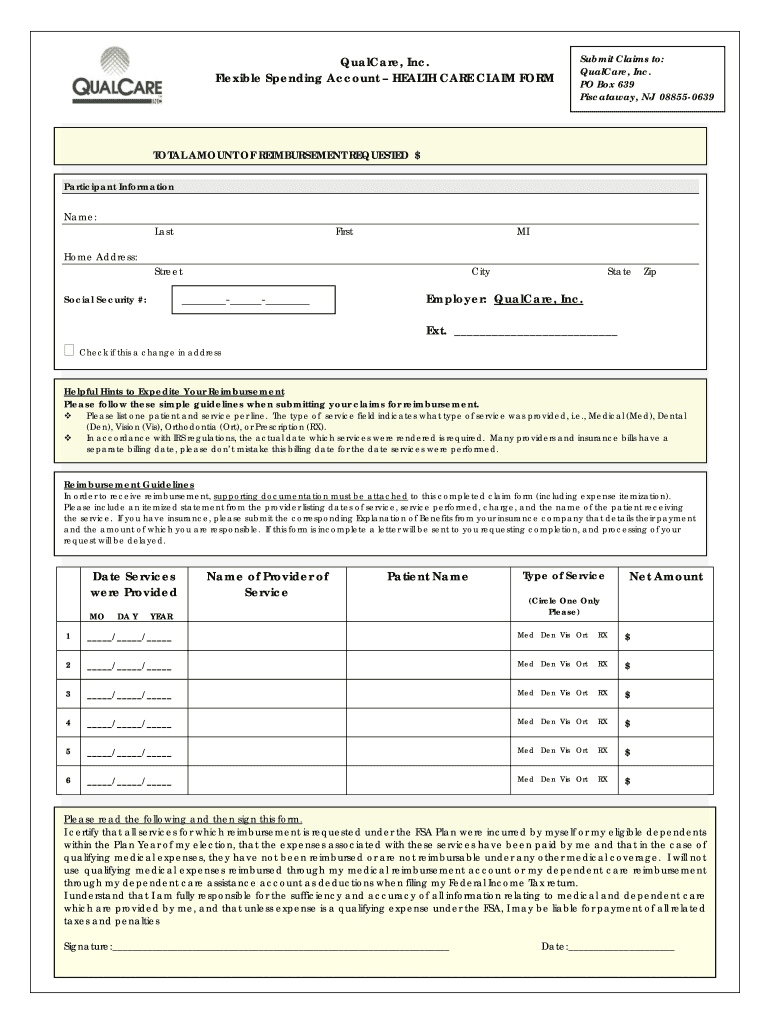

The printable claim format is a standardized document used for submitting claims related to flexible spending accounts (FSAs) or health care expenses. This format ensures that all necessary information is captured in a clear and organized manner, making it easier for both the claimant and the processing entity. The form typically includes sections for personal information, details about the expenses being claimed, and any required supporting documentation.

Steps to Complete the Printable Claim Format

Completing the printable claim format involves several key steps to ensure accuracy and compliance. Start by gathering all relevant receipts and documentation for the expenses you intend to claim. Next, fill in your personal information at the top of the form, including your name, address, and account number. Carefully enter the details of each expense, noting the date, type of service, and amount. Attach any required receipts and double-check all entries for accuracy before submitting the form.

Required Documents for Submission

When submitting the printable claim format, certain documents are typically required to validate your claim. These may include:

- Original receipts for each expense, showing the date and amount.

- A completed claim form with all necessary personal information.

- Any additional documentation requested by your flexible spending account provider.

Ensuring that all required documents are included can help prevent delays in processing your claim.

Form Submission Methods

The printable claim format can usually be submitted through various methods, depending on the policies of your flexible spending account provider. Common submission methods include:

- Online submission through a secure portal.

- Mailing the completed form and documents to the designated address.

- In-person submission at a local office if applicable.

Be sure to check the specific submission guidelines provided by your FSA administrator to ensure compliance.

Legal Use of the Printable Claim Format

The printable claim format is legally recognized as a valid method for submitting claims for reimbursement from flexible spending accounts. To ensure that your claim is processed without issues, it is important to adhere to all applicable laws and regulations governing health care reimbursements. This includes maintaining accurate records and providing truthful information on your claim form.

Eligibility Criteria for Claims

To successfully submit a claim using the printable claim format, you must meet certain eligibility criteria. Typically, these criteria include:

- Being enrolled in a flexible spending account or health plan that allows for reimbursement of qualified expenses.

- Submitting claims for expenses that fall within the guidelines set by your plan.

- Meeting any deadlines for claim submission as specified by your FSA administrator.

Understanding these criteria can help ensure that your claims are accepted and processed efficiently.

Quick guide on how to complete what is printable claim format

Effortlessly prepare What Is Printable Claim Format on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle What Is Printable Claim Format on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign What Is Printable Claim Format with ease

- Find What Is Printable Claim Format and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you’d like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign What Is Printable Claim Format and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is printable claim format

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is qualcare health flexible spending fill?

Qualcare health flexible spending fill refers to an option that allows individuals to manage their healthcare expenses through a flexible spending account. This feature enables users to allocate pre-tax dollars for medical costs, thereby maximizing their savings. It's a beneficial tool for those looking to control healthcare expenses while enjoying tax advantages.

-

How does qualcare health flexible spending fill benefit users?

The main benefits of qualcare health flexible spending fill include tax savings, increased budgeting capabilities, and the ability to cover a wide range of medical expenses. Users can effectively manage their healthcare costs while using funds that are exempt from federal tax. Additionally, this feature promotes proactive health management by encouraging users to plan and spend wisely on eligible healthcare services.

-

What are the pricing options for using qualcare health flexible spending fill?

Pricing for qualcare health flexible spending fill may vary depending on the specific plan chosen by the employer or individual. Typically, there may be setup fees or monthly maintenance charges associated with managing a flexible spending account. It’s essential to review the options available through your employer or visit the airSlate SignNow website for detailed pricing information.

-

Can qualcare health flexible spending fill integrate with other tools?

Yes, qualcare health flexible spending fill can integrate with various tools and software platforms, making it easier to manage your healthcare expenses. Integration with accounting software and payroll systems enables seamless tracking of your spending accounts. By leveraging such integrations, users can streamline their financial processes related to healthcare management.

-

What types of expenses can I cover with qualcare health flexible spending fill?

Qualcare health flexible spending fill can be used for a wide variety of eligible medical expenses, including doctor's visits, prescription medications, dental and vision care, and certain over-the-counter products. It's crucial to familiarize yourself with IRS guidelines to ensure the expenses you plan to cover are permitted. Proper utilization of this feature helps optimize your savings for necessary health services.

-

How do I enroll in qualcare health flexible spending fill?

Enrolling in qualcare health flexible spending fill typically requires you to sign up during your employer's open enrollment period. You can express your interest in this flexible spending option to your HR department, or explore options directly through the airSlate SignNow platform. Ensure all steps are completed timely to take full advantage of the flexible spending account benefits.

-

Is qualcare health flexible spending fill available for independent contractors?

Qualcare health flexible spending fill options may differ for independent contractors compared to traditional employees, as it largely depends on employer policies or individual plans. Independent contractors may not have access to employer-sponsored flexible spending accounts, but can explore different options to manage healthcare costs. Consulting a tax professional may provide clarity on available benefits.

Get more for What Is Printable Claim Format

- Arizona affidavit evidence termination of joint tenancy form

- Information to heirs

- Representative for approval of form

- Representative andor form

- The following inventory of property contains a true statement of all the property owned by decedent as form

- Formal informal supervised

- How to form a nonprofit in arizona startup savant

- How to answer the specific purpose question when forming a

Find out other What Is Printable Claim Format

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe