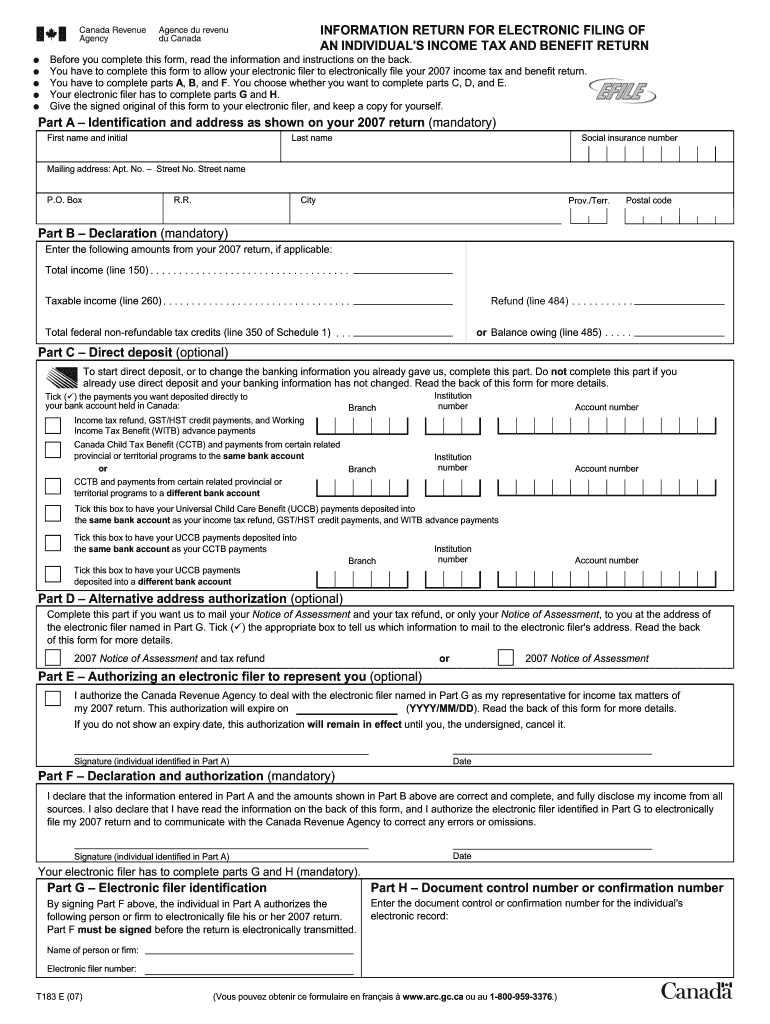

Cra T183 Fillable Form 2007

What is the Cra T183 Fillable Form

The CRA T183 fillable form, also known as the "Information Return for Electing Under Section 183," is a tax document used by individuals and businesses in the United States to report specific financial information. This form is particularly relevant for taxpayers who have opted to make an election under Section 183 of the Internal Revenue Code. It helps ensure compliance with tax regulations by providing the necessary details about income and expenses related to the election. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Cra T183 Fillable Form

Using the CRA T183 fillable form involves several key steps. First, download the form from a reliable source. Once you have the form, carefully read the instructions provided to understand the information required. Fill out the form electronically, ensuring that all fields are completed accurately. It is essential to provide truthful and complete information to avoid issues with the IRS. After completing the form, review it for any errors before submission. Finally, save a copy for your records and submit it according to the guidelines specified for your situation.

Steps to complete the Cra T183 Fillable Form

Completing the CRA T183 fillable form can be streamlined by following these steps:

- Download the form from a trusted source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about your income and expenses as required by the form.

- Review all entries for accuracy and completeness.

- Save the completed form in a secure location.

- Submit the form as directed, whether online, by mail, or in person.

Legal use of the Cra T183 Fillable Form

The CRA T183 fillable form is legally binding when filled out correctly and submitted according to IRS regulations. For the form to be considered valid, it must be signed by the taxpayer, affirming that the information provided is accurate to the best of their knowledge. Compliance with the guidelines set forth by the IRS is crucial to avoid potential penalties or legal issues. Utilizing a secure platform for electronic signatures can enhance the legal standing of the submitted document, ensuring that it meets all necessary requirements.

Required Documents

When preparing to complete the CRA T183 fillable form, certain documents may be necessary to ensure accurate reporting. These may include:

- Previous tax returns for reference.

- Records of income received during the tax year.

- Documentation of any expenses related to the election under Section 183.

- Identification documents, such as a Social Security number or taxpayer identification number.

Gathering these documents beforehand can facilitate a smoother completion process and help ensure compliance with tax regulations.

Form Submission Methods

The CRA T183 fillable form can be submitted through various methods, depending on the preferences of the taxpayer and the guidelines provided by the IRS. Common submission methods include:

- Online submission through the IRS e-filing system, if applicable.

- Mailing a printed copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if required.

Each submission method has its own set of guidelines and deadlines, so it is important to choose the one that best fits your situation.

Quick guide on how to complete cra t183 fillable form

Effortlessly Prepare Cra T183 Fillable Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Handle Cra T183 Fillable Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign Cra T183 Fillable Form with Ease

- Obtain Cra T183 Fillable Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Cra T183 Fillable Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cra t183 fillable form

Create this form in 5 minutes!

How to create an eSignature for the cra t183 fillable form

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Cra T183 Fillable Form?

The Cra T183 Fillable Form is a specific document used in Canada that allows individuals to authorize electronic filing of their tax returns. This form is crucial for those who wish to ensure their tax submissions are handled efficiently. Using a fillable version simplifies the process, making it easy to complete and submit online.

-

How can I access the Cra T183 Fillable Form?

You can easily access the Cra T183 Fillable Form through various online platforms, including tax software and government websites. Additionally, airSlate SignNow provides a seamless experience for filling out and signing this form electronically. You can just upload the document and start filling it out right away.

-

Is the Cra T183 Fillable Form easy to fill out?

Yes, the Cra T183 Fillable Form is designed to be user-friendly, especially when using digital solutions like airSlate SignNow. The fillable format ensures that all fields are easy to navigate and complete. Moreover, our platform simplifies the process with straightforward instructions and smooth functionality.

-

Can I eSign the Cra T183 Fillable Form?

Absolutely! airSlate SignNow allows you to electronically sign the Cra T183 Fillable Form with ease. With our secure eSignature feature, you can complete your tax documents without the need for printing, saving time and resources.

-

What are the benefits of using the Cra T183 Fillable Form?

Using the Cra T183 Fillable Form has several benefits, including time efficiency and accuracy in tax submissions. When filled out digitally, there's less room for errors, and you can ensure that all required fields are completed. Leveraging tools like airSlate SignNow enhances this process, providing ease of access and electronic signing.

-

Does airSlate SignNow support the integration of the Cra T183 Fillable Form?

Yes, airSlate SignNow supports seamless integration with the Cra T183 Fillable Form. You can easily integrate this form with your existing software and workflows, ensuring a smooth and efficient document workflow. This integration allows businesses to improve their tax filing processes signNowly.

-

What is the pricing for using the Cra T183 Fillable Form with airSlate SignNow?

Pricing for using the Cra T183 Fillable Form with airSlate SignNow varies depending on the plan you choose. We offer flexible subscription models to accommodate businesses of all sizes. You can start with a free trial to explore features that assist in filling and signing the Cra T183 Fillable Form.

Get more for Cra T183 Fillable Form

- To city officer constable county sheriff process server form

- Montana judges deskbook municipal justice and city courts form

- The state of montana to the above named defendants greetings form

- 162 pretrial procedure in civil cases a matters to be form

- Justice of the peace 2 1 writ of reentry dallas county form

- Before justice of the peacecity judge form

- Montana justice and city court rules of civil procedure form

- Or attorney for petitioner form

Find out other Cra T183 Fillable Form

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF