the Information on This Form Relates to the Tax Year Shown in the Top Right Corner 2020-2026

What is the Form T183?

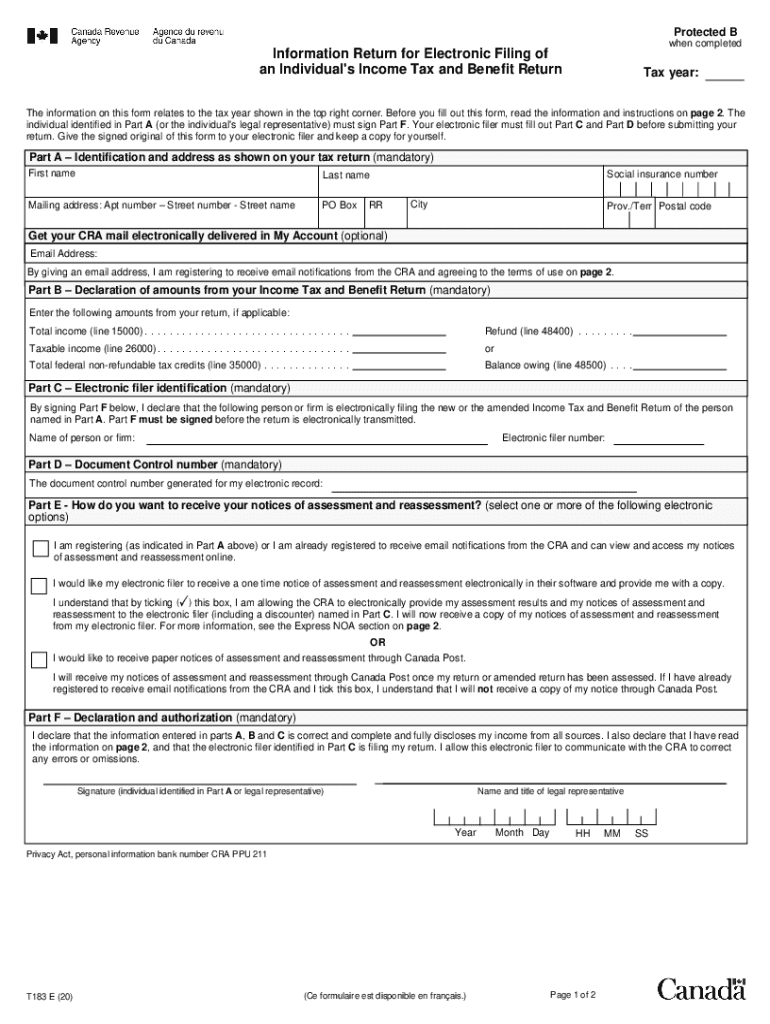

The Form T183 is a tax document used in Canada, specifically for individuals who are filing their income tax returns. This form is essential for taxpayers who wish to authorize a representative, such as a tax professional, to file their returns on their behalf. The information on this form relates to the tax year specified in the top right corner, ensuring that the details are relevant for the appropriate tax period. It is crucial for taxpayers to understand the implications of this form, as it grants permission for third parties to access sensitive tax information.

Steps to Complete the Form T183

Completing the Form T183 involves several steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Insurance Number (SIN) and details about your representative. Next, fill out the form with the required information, ensuring that all sections are completed accurately. After filling out the form, both you and your representative must sign it. Finally, submit the completed form to the Canada Revenue Agency (CRA) along with your tax return. It is advisable to keep a copy for your records.

Legal Use of the Form T183

The Form T183 holds legal significance as it serves as a formal authorization for a representative to act on your behalf regarding tax matters. This authorization is recognized by the CRA, allowing your representative to access your tax information and file your return. It is essential to understand that granting this authorization does not relieve you of your responsibilities as a taxpayer. You remain liable for any tax obligations, and it is crucial to choose a trustworthy representative to handle your tax affairs.

Filing Deadlines / Important Dates

Filing deadlines for the Form T183 align with the general tax filing deadlines set by the CRA. Typically, individual taxpayers must file their income tax returns by April 30 of the year following the tax year. However, if you are self-employed, the deadline extends to June 15. It is important to submit the Form T183 along with your tax return by these deadlines to ensure that your representative can file on your behalf without any delays.

Required Documents for the Form T183

When completing the Form T183, you will need several key documents to ensure accurate information. These include your Social Insurance Number (SIN), previous tax returns, and any relevant tax slips, such as T4s or T5s. Additionally, if you are designating a representative, their information, including their name and contact details, must be included. Having these documents on hand will streamline the process and help avoid errors.

Form Submission Methods

The Form T183 can be submitted to the CRA through various methods. Taxpayers can choose to file it online using the CRA's secure portal, which is a convenient option for many. Alternatively, the form can be mailed to the CRA along with your tax return. For those who prefer in-person interactions, visiting a local CRA office is also an option. It is important to ensure that the form is submitted securely to protect your personal information.

Who Issues the Form T183?

The Form T183 is issued by the Canada Revenue Agency (CRA), which is the federal agency responsible for administering tax laws in Canada. The CRA provides the necessary forms and guidelines to assist taxpayers in fulfilling their tax obligations. It is advisable to obtain the most current version of the form directly from the CRA to ensure compliance with any updates or changes in tax regulations.

Quick guide on how to complete the information on this form relates to the tax year shown in the top right corner

Effortlessly Prepare The Information On This Form Relates To The Tax Year Shown In The Top Right Corner on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files swiftly without any holdups. Manage The Information On This Form Relates To The Tax Year Shown In The Top Right Corner on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign The Information On This Form Relates To The Tax Year Shown In The Top Right Corner with Ease

- Find The Information On This Form Relates To The Tax Year Shown In The Top Right Corner and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this reason.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunts, or errors requiring new copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Amend and electronically sign The Information On This Form Relates To The Tax Year Shown In The Top Right Corner to ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the information on this form relates to the tax year shown in the top right corner

Create this form in 5 minutes!

How to create an eSignature for the the information on this form relates to the tax year shown in the top right corner

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is a T183 fillable form and how can airSlate SignNow help?

A T183 fillable form is a type of document used in tax processing that allows users to enter information directly into pre-defined fields. airSlate SignNow simplifies the process by enabling you to create, send, and eSign T183 fillable forms easily and securely, ensuring compliance and reducing paperwork.

-

Can I create a T183 fillable form using airSlate SignNow?

Yes, airSlate SignNow offers robust features that allow you to create customizable T183 fillable forms. With our intuitive drag-and-drop interface, you can design forms tailored to your specific needs, making document management seamless and efficient.

-

Is airSlate SignNow cost-effective for managing T183 fillable forms?

Absolutely! airSlate SignNow provides a cost-effective solution for managing T183 fillable forms without compromising on quality. With various pricing plans available, you can choose an option that fits your business size and document needs.

-

What are the key features of airSlate SignNow for T183 fillable forms?

airSlate SignNow includes features such as electronic signatures, customizable templates, and real-time tracking for T183 fillable forms. These functionalities help streamline your document workflow and enhance efficiency in signing and organizing forms.

-

How does airSlate SignNow ensure the security of T183 fillable forms?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and multi-factor authentication to safeguard your T183 fillable forms, ensuring that your sensitive information remains protected throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for T183 fillable forms?

Yes, airSlate SignNow offers numerous integrations with popular applications such as Google Drive, Dropbox, and CRM systems. These integrations make it easier for you to manage T183 fillable forms directly from your preferred tools, enhancing productivity.

-

What benefits does airSlate SignNow provide for businesses using T183 fillable forms?

Using airSlate SignNow for T183 fillable forms provides numerous benefits, including time savings, improved accuracy, and streamlined workflows. Our platform helps businesses reduce the hassle of traditional paperwork and allows for quick and efficient document management.

Get more for The Information On This Form Relates To The Tax Year Shown In The Top Right Corner

- Arizona state board of pharmacy protects the health form

- Alabama birth certificate application pdf form

- How do i file a medical malpractice claimalllaw form

- Wholesale distributor instructions form

- Idaho state board of medicine complaint form

- Welcome to state board of pharmacy idahogov form

- Idaho division of vocational rehabilitation intake form

- Certificate of dissolution of invalidity or legal form

Find out other The Information On This Form Relates To The Tax Year Shown In The Top Right Corner

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document