Icc 2 Form

What is the ICC2 Form

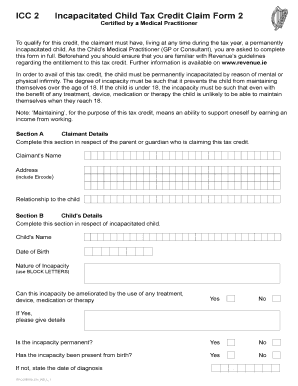

The ICC2 form, also known as the incapacitated child tax credit claim 2, is a critical document used in the United States for claiming tax credits associated with an incapacitated child. This form is specifically designed for taxpayers who are eligible to claim a tax credit for dependents who are unable to care for themselves due to physical or mental conditions. The ICC2 form helps to ensure that families receive the financial support they need while navigating the complexities of tax regulations.

How to Use the ICC2 Form

Using the ICC2 form involves several important steps. First, gather all necessary documentation that supports your claim, such as medical records or proof of the child's incapacitation. Next, fill out the form accurately, ensuring that all required fields are completed. It is essential to provide detailed information about the child’s condition and the nature of your relationship. After completing the form, review it for accuracy before submission to avoid delays or complications with your claim.

Steps to Complete the ICC2 Form

Completing the ICC2 form requires careful attention to detail. Follow these steps for a smooth process:

- Obtain the ICC2 form from the appropriate source, such as the IRS or tax preparation software.

- Fill in your personal information, including your name, Social Security number, and contact information.

- Provide details about the incapacitated child, including their name, age, and the nature of their condition.

- Attach any supporting documents that verify the child’s incapacitation.

- Review the form thoroughly to ensure all information is accurate and complete.

- Submit the form according to the guidelines provided, either electronically or by mail.

Key Elements of the ICC2 Form

The ICC2 form consists of several key elements that are crucial for a successful claim. These include:

- Personal Information: Details about the taxpayer, including name and Social Security number.

- Dependent Information: Information about the incapacitated child, including age and condition.

- Supporting Documentation: Required documents that validate the claim, such as medical records.

- Signature: A declaration that the information provided is accurate, requiring the taxpayer's signature.

Legal Use of the ICC2 Form

The ICC2 form is legally recognized for claiming tax credits under U.S. tax law. To ensure its validity, it must be filled out in compliance with IRS guidelines. This includes providing accurate and truthful information, as any discrepancies may lead to penalties or denial of the claim. Understanding the legal framework surrounding the ICC2 form is essential for taxpayers to protect their rights and ensure they receive the benefits they are entitled to.

Eligibility Criteria

To qualify for the incapacitated child tax credit claim using the ICC2 form, certain eligibility criteria must be met. These criteria typically include:

- The child must be under the age of 17 at the end of the tax year.

- The child must have a qualifying disability that prevents them from self-care.

- The taxpayer must provide more than half of the child's financial support during the tax year.

- The child must be a U.S. citizen, national, or resident alien.

Quick guide on how to complete icc 2 form

Prepare Icc 2 Form effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Icc 2 Form across any platform with airSlate SignNow's Android or iOS applications and enhance your document-driven workflow today.

The easiest way to alter and electronically sign Icc 2 Form without hassle

- Locate Icc 2 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Icc 2 Form to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the icc 2 form

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the ICC2 form and how is it used?

The ICC2 form is a specific document used for regulatory compliance, particularly in business transactions. It plays a crucial role in ensuring that all necessary information is collected and recorded. Using airSlate SignNow, you can easily create, send, and eSign ICC2 forms, streamlining your compliance processes.

-

How does airSlate SignNow support the ICC2 form?

AirSlate SignNow offers a user-friendly platform that simplifies the handling of the ICC2 form. With our solution, you can quickly fill out, send, and sign ICC2 forms securely online. This not only saves time but also enhances accuracy by reducing human errors.

-

Is there a cost associated with using airSlate SignNow for ICC2 forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. All plans include the capability to manage ICC2 forms efficiently. You can choose a plan based on the number of documents and features you require, ensuring cost-effectiveness for your organization.

-

What features does airSlate SignNow offer for managing the ICC2 form?

AirSlate SignNow provides a range of features for managing the ICC2 form, including templates, advanced editing tools, and robust security measures. Users can also track the status of the form in real-time and receive notifications when it has been signed. These features enhance the overall efficiency of document management.

-

Can I integrate airSlate SignNow with other applications while working with the ICC2 form?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, allowing you to manage the ICC2 form alongside your existing workflows. Integrations with CRM systems, cloud storage, and email platforms enhance productivity and improve access to important documents.

-

What are the benefits of using airSlate SignNow for the ICC2 form?

Using airSlate SignNow for the ICC2 form provides numerous benefits, including increased efficiency, enhanced security, and better compliance. Our digital platform reduces the turnaround time for document processing and ensures that your ICC2 forms are always accessible and securely signed.

-

Is it easy to use airSlate SignNow for creating ICC2 forms?

Yes, airSlate SignNow is designed with user-friendliness in mind. Creating ICC2 forms is straightforward, as the platform provides step-by-step guidance and easy-to-use tools. This ensures that even users with minimal technical knowledge can create and manage ICC2 forms effectively.

Get more for Icc 2 Form

- To the clerk of county state of new york form

- Hereinafter referred to as grantor does hereby grant release and form

- And quitclaim unto and form

- Of new york to wit form

- Premises that the premises are free from all encumbrances unless otherwise noted above that grantors form

- Accordance with the applicable laws of the state of new york and form

- Form g 2a petition for appointment of a guardian state

- Demand for terms of contractcorporation form

Find out other Icc 2 Form

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word