Ucla W9 2010-2026

What is the UCLA W-9?

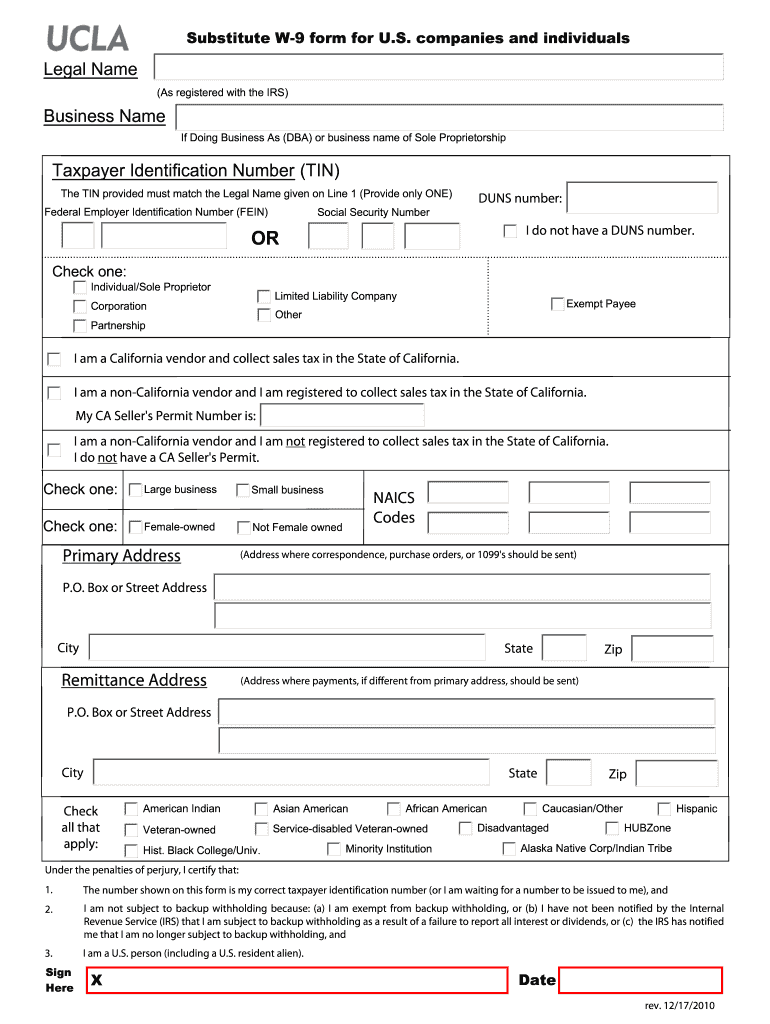

The UCLA W-9 form is a tax document used by the University of California, Los Angeles, to collect information from individuals or entities that will receive payments from the university. This form is essential for tax reporting purposes, as it provides the necessary details for the IRS regarding the payee's taxpayer identification number (TIN) and other relevant information. The UCLA W-9 is particularly important for independent contractors, vendors, and other service providers who work with the university.

How to Use the UCLA W-9

Using the UCLA W-9 form involves a few straightforward steps. First, ensure you have the correct version of the form, which can often be downloaded from the university's official website. Next, fill out the form with accurate information, including your name, business name (if applicable), address, and taxpayer identification number. Once completed, the form should be submitted to the appropriate department at UCLA, typically the accounting or finance office, to ensure that your information is processed for payment.

Steps to Complete the UCLA W-9

Completing the UCLA W-9 form requires attention to detail. Follow these steps:

- Download the UCLA W-9 form from the university's website.

- Provide your full legal name and any business name if applicable.

- Enter your address, including city, state, and ZIP code.

- Input your taxpayer identification number, which can be your Social Security number or Employer Identification Number.

- Sign and date the form to certify the information is accurate.

Legal Use of the UCLA W-9

The UCLA W-9 form is legally binding once signed and submitted. It serves as a declaration of your taxpayer identification number and is critical for tax reporting. The information provided on the form must be accurate, as discrepancies can lead to penalties or issues with the IRS. It is important to keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Examples of Using the UCLA W-9

There are various scenarios where the UCLA W-9 form is utilized. For instance, a freelance graphic designer hired by UCLA would need to complete a W-9 to receive payment for their services. Similarly, a vendor supplying materials to the university must submit a W-9 to ensure proper tax reporting. These examples illustrate the form's importance in maintaining compliance with tax regulations while facilitating smooth transactions between the university and its service providers.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form, including who should complete it and when. According to IRS regulations, individuals or entities receiving payments that require tax reporting must submit a W-9. This includes freelancers, independent contractors, and vendors. The IRS also mandates that the information on the W-9 must be accurate to avoid backup withholding on payments. Familiarizing yourself with these guidelines can help ensure compliance and prevent any potential issues with the IRS.

Quick guide on how to complete ucla w9

Complete Ucla W9 effortlessly on any device

Online document management has surged in popularity among organizations and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Ucla W9 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Ucla W9 without hassle

- Obtain Ucla W9 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Ucla W9 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ucla w9

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the UCLA W 9 form and why do I need it?

The UCLA W 9 form is a tax form utilized by individuals and businesses to provide their taxpayer identification information to UCLA. This form is essential for UCLA to process payments and ensure compliance with IRS regulations. By completing the UCLA W 9 form, you can facilitate timely financial transactions with UCLA, making it a crucial document for efficient collaboration.

-

How do I access the UCLA W 9 form through airSlate SignNow?

You can easily access the UCLA W 9 form via airSlate SignNow by searching for it in our document template library. Once you locate the form, you can customize it as needed and send it for electronic signatures. Our platform streamlines the process, ensuring that you can quickly obtain the necessary signatures on your UCLA W 9 form.

-

Are there any costs associated with using the UCLA W 9 form on airSlate SignNow?

Using the UCLA W 9 form on airSlate SignNow is part of our subscription plans, which are designed to be affordable for individuals and businesses. We offer different pricing tiers to accommodate various needs, ensuring you can utilize the UCLA W 9 form along with other functionalities at a competitive rate. Explore our pricing page for more details.

-

What features does airSlate SignNow offer for the UCLA W 9 form?

airSlate SignNow provides several features for the UCLA W 9 form, including templates, customizable fields, and secure electronic signatures. You can track the progress of your document in real-time, enabling you to know when it has been viewed or signed. These features enhance efficiency and make managing the UCLA W 9 form easier than ever.

-

Can I integrate airSlate SignNow with other applications for managing the UCLA W 9 form?

Yes, airSlate SignNow offers seamless integrations with a variety of applications such as Google Drive, Dropbox, and Salesforce. This allows you to manage the UCLA W 9 form alongside other important documents in your workflow. By integrating our platform, you can ensure all your paperwork is organized and accessible in one place.

-

What are the benefits of using airSlate SignNow for the UCLA W 9 form?

Using airSlate SignNow for the UCLA W 9 form offers numerous benefits, including faster processing times and improved accuracy. The electronic signing feature eliminates the need for paper-based forms, which can be cumbersome and time-consuming. Additionally, our platform’s security measures ensure that your information remains confidential and protected.

-

How secure is the UCLA W 9 form processing on airSlate SignNow?

AirSlate SignNow prioritizes security in processing the UCLA W 9 form. We use advanced encryption methods to protect your data during transmission and storage. Our platform complies with industry standards to maintain the confidentiality and integrity of your tax information.

Get more for Ucla W9

- Waiver and release from liability for lacrosse form

- Participation agreement roberts wesleyan college form

- Waiver and release from liability for owner of bed and breakfast form

- Or in any way related to childs participation in any of the events or activities conducted by on the form

- Contractual agreement please read carefully this form

- Forever discharge from any and all claims demands debts contracts form

- For burning form

- Waiver and release from liability for fairgrounds owner form

Find out other Ucla W9

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free