Shellpoint Third Party Authorization Form

Understanding Shellpoint Third Party Authorization

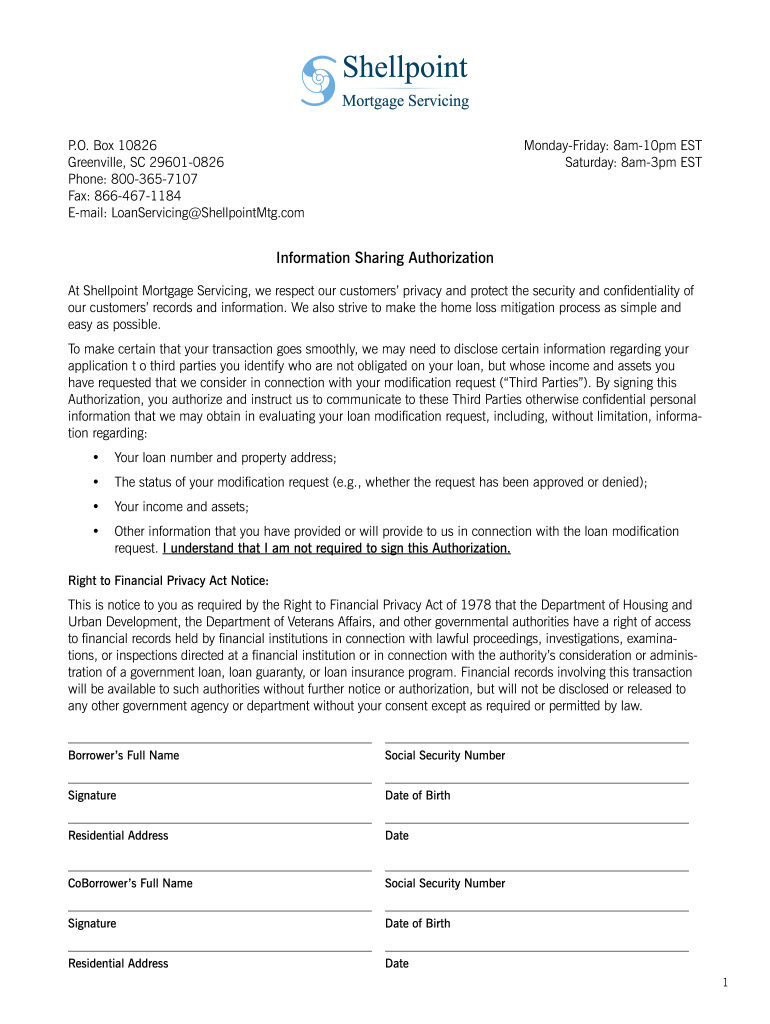

The Shellpoint Third Party Authorization is a formal document that allows a designated individual or organization to act on behalf of the mortgage holder in dealings with Shellpoint Mortgage Servicing. This authorization is crucial for facilitating communication and transactions, such as obtaining payoff information or discussing account details. By granting this authority, the mortgage holder ensures that their representative can receive sensitive information and make inquiries without compromising privacy or security.

Steps to Complete the Shellpoint Third Party Authorization

Completing the Shellpoint Third Party Authorization involves several straightforward steps:

- Obtain the Shellpoint Third Party Authorization form, which can typically be downloaded from the Shellpoint website.

- Fill out the form with accurate information, including the mortgage holder's details and the representative's information.

- Sign and date the form to validate the authorization.

- Submit the completed form to Shellpoint through the designated method, which may include online submission, mail, or fax.

Legal Use of the Shellpoint Third Party Authorization

The Shellpoint Third Party Authorization is legally binding, provided it meets specific criteria. It must be signed by the mortgage holder and clearly state the scope of authority granted to the third party. Compliance with relevant laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensures that the authorization is recognized in legal contexts. This legal standing safeguards both the mortgage holder's interests and the integrity of the information shared.

Key Elements of the Shellpoint Third Party Authorization

When preparing the Shellpoint Third Party Authorization, it is essential to include several key elements:

- Mortgage Holder Information: Full name, address, and account number.

- Authorized Representative Information: Name, relationship to the mortgage holder, and contact details.

- Scope of Authority: A clear description of what the authorized party can do, such as requesting payoff information or discussing account status.

- Signatures: Both the mortgage holder's signature and date are required to validate the authorization.

How to Obtain the Shellpoint Third Party Authorization

The Shellpoint Third Party Authorization form can typically be obtained directly from the Shellpoint Mortgage Servicing website. It may also be available through customer service representatives. Ensure that you are using the most current version of the form to avoid any issues during submission. If assistance is needed, contacting Shellpoint’s customer service can provide guidance on how to access and complete the form properly.

Form Submission Methods

Once the Shellpoint Third Party Authorization is completed, it can be submitted through various methods:

- Online Submission: Many users prefer to submit the form electronically through the Shellpoint portal.

- Mail: The completed form can be sent to the designated address provided by Shellpoint.

- Fax: Some users may choose to fax the authorization form directly to Shellpoint for quicker processing.

Quick guide on how to complete shellpoint third party authorization

Complete Shellpoint Third Party Authorization effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Shellpoint Third Party Authorization on any device using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest method to edit and eSign Shellpoint Third Party Authorization with ease

- Obtain Shellpoint Third Party Authorization and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you prefer. Modify and eSign Shellpoint Third Party Authorization and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the shellpoint third party authorization

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is a Shellpoint mortgage payoff request for third parties?

A Shellpoint mortgage payoff request for third parties is a formal process that allows external entities, such as title companies or real estate agents, to request the payoff amount for a mortgage directly from Shellpoint. This streamlines the closing process and ensures that all parties have the accurate payoff amount needed to complete the transaction quickly.

-

How can airSlate SignNow help with Shellpoint mortgage payoff requests?

airSlate SignNow offers a seamless solution for managing Shellpoint mortgage payoff requests for third parties by enabling users to eSign documents quickly and securely. This ensures that all necessary documents are correctly signed and submitted, reducing delays in the mortgage payoff process.

-

What are the costs associated with making a Shellpoint mortgage payoff request for third parties?

The costs associated with a Shellpoint mortgage payoff request can vary depending on the service provider and any related fees. With airSlate SignNow, you can signNowly reduce costs due to its affordable pricing plans, making it an economical choice for handling such requests efficiently.

-

Are there any specific features for processing Shellpoint mortgage payoff requests?

Yes, airSlate SignNow provides specific features tailored for processing Shellpoint mortgage payoff requests. These include custom templates, document tracking, and secure storage, which all contribute to a more efficient handling of documents required for third-party requests.

-

How does airSlate SignNow ensure security for Shellpoint mortgage payoff requests?

Security is a top priority for airSlate SignNow. We implement advanced encryption and secure sharing features to protect all documents, including those involved in Shellpoint mortgage payoff requests for third parties, ensuring that sensitive information remains confidential and secure.

-

Can airSlate SignNow integrate with other platforms to assist with Shellpoint mortgage requests?

Absolutely, airSlate SignNow offers integrations with various platforms that can help streamline Shellpoint mortgage payoff requests. Whether you're using CRM systems, cloud storage solutions, or real estate management tools, our integrations facilitate smooth document handling and communication between parties.

-

What benefits does using airSlate SignNow provide for handling Shellpoint mortgage payoff requests?

Using airSlate SignNow for handling Shellpoint mortgage payoff requests for third parties provides several benefits, including faster turnaround times, improved accuracy, and reduced paperwork. This results in a more efficient process that not only saves time but also enhances collaboration among all parties involved.

Get more for Shellpoint Third Party Authorization

- Master forms list nebraska judicial branch

- South carolina child support order state guidepdf form

- New 0918 form

- Master forms list page 4 nebraska judicial branch nebraskagov

- Cc 47 rev 0215 form

- Emancipation forms ampamp instructionsnebraska judicial branch

- Instructions for completing certificate of mailing form

- Learn what to expect during a hearing test healthy hearing form

Find out other Shellpoint Third Party Authorization

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy