Advance Lease Addendum 2003-2026

Understanding the Renters Insurance Addendum

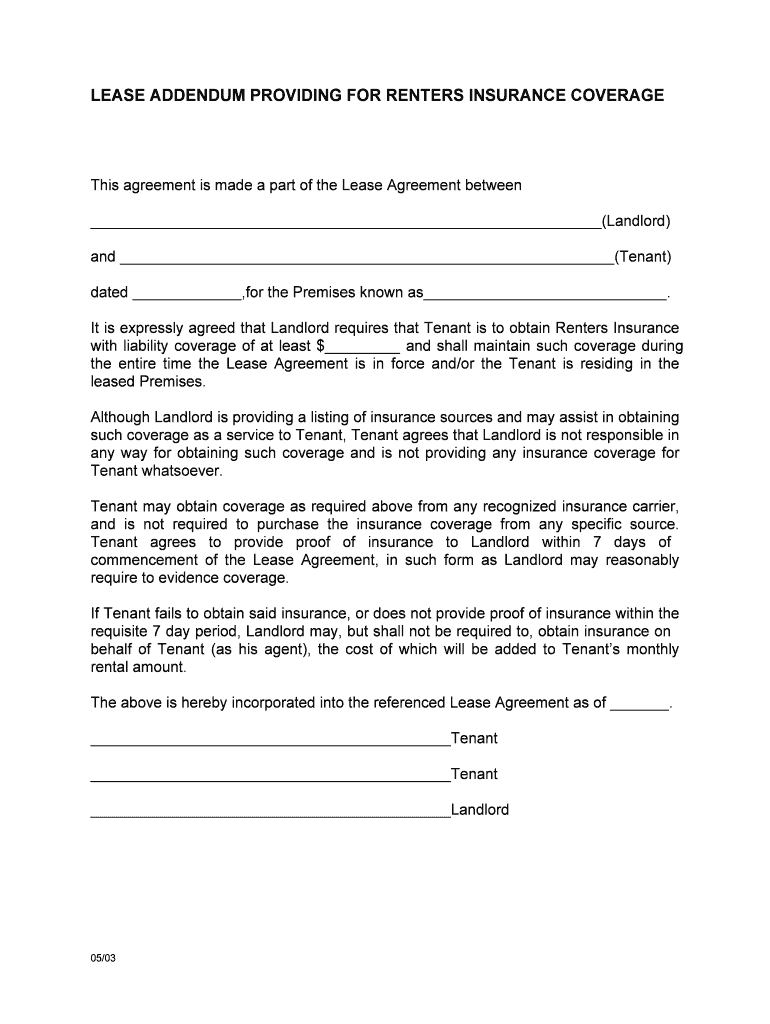

The renters insurance addendum is a crucial document that outlines the specific insurance requirements for tenants within a lease agreement. This addendum serves to clarify the obligations of both landlords and tenants regarding insurance coverage, ensuring that renters maintain a certain level of protection for their personal property. It typically specifies the minimum coverage amounts and types of policies acceptable to the landlord, fostering a secure living environment for all parties involved.

Steps to Complete the Renters Insurance Addendum

Completing the renters insurance addendum involves several key steps to ensure clarity and compliance. Begin by reviewing the lease agreement to understand the insurance requirements set forth by the landlord. Next, gather necessary documentation, such as proof of insurance from your provider. Fill out the addendum form accurately, ensuring that all required fields are completed. Finally, both the tenant and landlord should sign the document to validate the agreement. Using an electronic signature platform can simplify this process and ensure that the addendum is legally binding.

Legal Use of the Renters Insurance Addendum

The renters insurance addendum is legally binding when executed properly. For it to hold up in court, it must meet specific legal standards, including clear language and mutual consent from both parties. Electronic signatures are recognized under U.S. law, provided they comply with regulations such as ESIGN and UETA. This means that using a reliable e-signature solution can enhance the legal validity of the addendum while streamlining the signing process.

Key Elements of the Renters Insurance Addendum

Several key elements should be included in a renters insurance addendum to ensure it is comprehensive and effective. These elements typically include:

- Coverage Requirements: The minimum amount of personal property coverage required.

- Liability Coverage: Specifications regarding liability insurance to protect against damages or injuries.

- Proof of Insurance: Requirements for tenants to provide documentation of their insurance policy.

- Duration of Coverage: The period during which the insurance must be maintained.

- Consequences of Non-Compliance: Potential penalties for failing to maintain the required insurance.

Obtaining the Renters Insurance Addendum

Obtaining a renters insurance addendum is straightforward. Typically, landlords will provide a template or specific form that outlines the insurance requirements. Tenants can also find standard addendum templates online or through legal resources. It is essential to ensure that any template used is compliant with state laws and tailored to the specific lease agreement. Once obtained, both parties should review the document to ensure it meets their needs before signing.

Examples of Using the Renters Insurance Addendum

Examples of using the renters insurance addendum can help clarify its practical applications. For instance, a landlord may require tenants to maintain renters insurance to protect against potential damages caused by fire or theft. Another example is when a landlord specifies that tenants must have liability coverage in case of accidents occurring within the rental property. These examples illustrate the importance of the addendum in safeguarding both the landlord's property and the tenant's interests.

Quick guide on how to complete advance lease addendum

Complete Advance Lease Addendum effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without any holdups. Manage Advance Lease Addendum on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Advance Lease Addendum with ease

- Locate Advance Lease Addendum and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, exhausting document searches, or errors that require reprinting new copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign Advance Lease Addendum and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the advance lease addendum

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is addendum renters insurance?

Addendum renters insurance is a supplemental policy that adjusts your standard renters insurance to include specific coverage needs or conditions. It typically addresses additional risks and responsibilities that may not be covered in a basic policy. Understanding and incorporating an addendum can help tenants maximize their insurance protection.

-

How does addendum renters insurance benefit me?

The primary benefit of addendum renters insurance is that it tailors your coverage to your unique living situation. This includes protection for specific high-value items or additional liability coverage that standard policies may not encompass. By utilizing an addendum, you ensure comprehensive protection against unforeseen events.

-

What types of events does addendum renters insurance cover?

Addendum renters insurance generally covers various events such as theft, fire, water damage, and personal liability claims specific to your living arrangement. Additionally, it can expand coverage for unique scenarios, such as including roommates' belongings or specific natural disaster protections. This flexibility allows you to adapt your policy as your situation changes.

-

How does pricing work for addendum renters insurance?

Pricing for addendum renters insurance can vary based on factors like the scope of coverage, the value of items insured, and your location. It often comes at a relatively low additional cost, offering signNow value by enhancing your overall protection. Obtaining quotes from different insurers can help you find the best deal for the coverage you need.

-

Can I integrate addendum renters insurance with other policies?

Yes, many insurance providers allow you to integrate addendum renters insurance with other policies, such as auto or life insurance. This bundling can not only simplify your insurance management but also lead to potential discounts. It's advisable to discuss integration options with your insurance agent to customize your coverage effectively.

-

What should I include in my addendum renters insurance?

When creating an addendum renters insurance policy, it's essential to specify high-value items, unique risks, or any additional coverage necessities you may have. This might include items such as electronics, jewelry, or art. Working closely with your insurance provider can help identify the specific details that should be included for optimal coverage.

-

How do I file a claim with addendum renters insurance?

Filing a claim with addendum renters insurance typically begins with contacting your insurance provider directly. You'll need to provide documentation of the loss, such as photos and receipts, and detail how the event has affected you. Following the provider's claims process closely will ensure a more efficient resolution.

Get more for Advance Lease Addendum

- The information provided in this publication is generic

- How to complete the request for a writ of execution nj courts form

- Media request to photograph record or broadcast california courts form

- Warrant to satisfy judgment child support nj courts form

- Las vegas small claims forms civil law self help center

- Box 972 form

- Complaintslampampml attorneys lesnevich marzano lesnevich form

- In order to proceed in the small claims division the property at issue must be a class 2 property 1 4 family residence or a form

Find out other Advance Lease Addendum

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document