Auto Insurance Comparison Spreadsheet Template Form

Understanding the Homeowners Insurance Comparison Worksheet

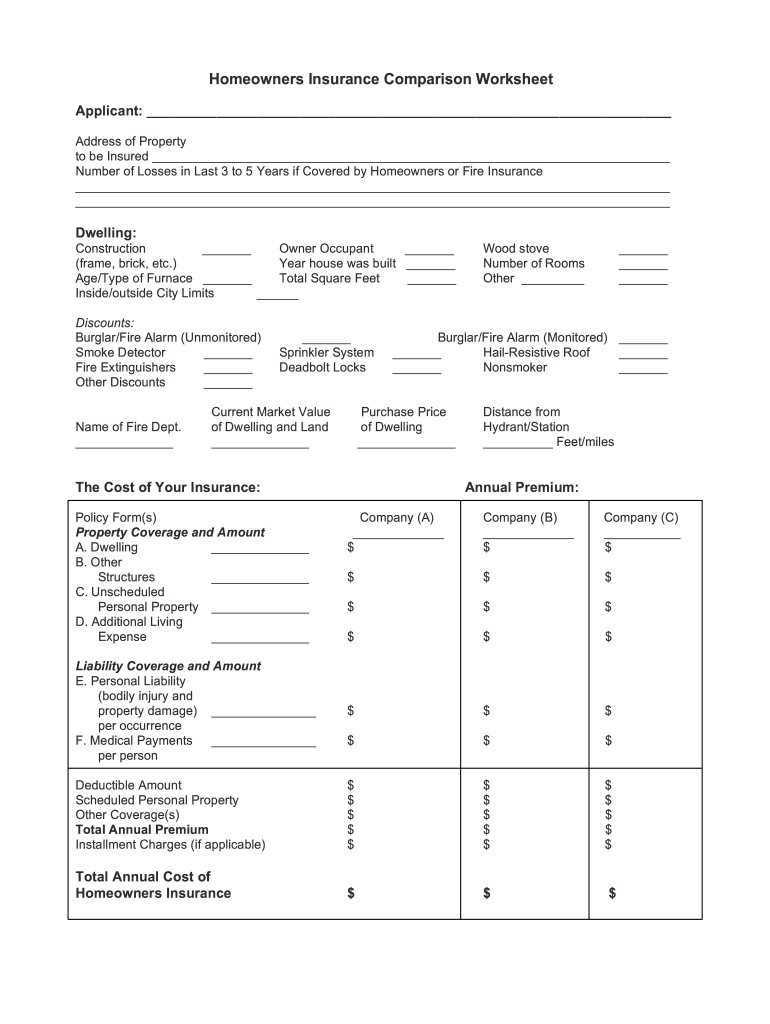

The homeowners insurance comparison worksheet is a valuable tool designed to help individuals assess and compare various homeowners insurance policies. This worksheet allows homeowners to document key information, such as coverage limits, deductibles, premiums, and additional features offered by different insurers. By organizing this data, users can make informed decisions about which policy best meets their needs and budget.

How to Use the Homeowners Insurance Comparison Worksheet

To effectively use the homeowners insurance comparison worksheet, start by gathering quotes from multiple insurance providers. Input relevant details into the worksheet, including the name of the insurer, policy type, and specific coverage options. Compare the premiums, deductibles, and any additional costs associated with each policy. This structured approach enables users to visualize differences and similarities, making it easier to identify the most suitable coverage.

Key Elements of the Homeowners Insurance Comparison Worksheet

Essential components of the homeowners insurance comparison worksheet include:

- Insurer Information: Name and contact details of the insurance company.

- Coverage Types: Details on dwelling coverage, personal property coverage, liability protection, and additional living expenses.

- Premiums: Monthly or annual costs associated with each policy.

- Deductibles: The amount the homeowner must pay out of pocket before the insurance coverage kicks in.

- Policy Features: Additional benefits such as replacement cost coverage, endorsements, and discounts.

Steps to Complete the Homeowners Insurance Comparison Worksheet

Completing the homeowners insurance comparison worksheet involves several straightforward steps:

- Gather quotes from at least three different insurance providers.

- Fill in the worksheet with the insurer's name and the corresponding policy details.

- Compare coverage options and note any unique features or exclusions.

- Evaluate the premiums and deductibles to understand the financial implications.

- Make a decision based on the comprehensive comparison of all collected data.

Legal Use of the Homeowners Insurance Comparison Worksheet

Using the homeowners insurance comparison worksheet is legally sound as it helps ensure that consumers make informed choices regarding their insurance coverage. While the worksheet itself does not constitute a legal document, the information gathered can be critical in understanding policy terms and conditions. It is advisable to keep the completed worksheet for personal records and reference when discussing options with insurance agents.

Obtaining the Homeowners Insurance Comparison Worksheet

The homeowners insurance comparison worksheet can be easily obtained online. Many insurance websites and consumer advocacy groups provide free templates that users can download and customize. Additionally, creating a personalized version using spreadsheet software allows for greater flexibility and ease of use, enabling homeowners to tailor the worksheet to their specific needs.

Quick guide on how to complete auto insurance comparison spreadsheet template

Complete Auto Insurance Comparison Spreadsheet Template seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly replacement for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Auto Insurance Comparison Spreadsheet Template on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Auto Insurance Comparison Spreadsheet Template with ease

- Find Auto Insurance Comparison Spreadsheet Template and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device of your choice. Alter and eSign Auto Insurance Comparison Spreadsheet Template and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the auto insurance comparison spreadsheet template

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is a homeowners insurance comparison worksheet?

A homeowners insurance comparison worksheet is a tool designed to help you evaluate different insurance policies. By using this worksheet, you can easily compare coverage options, premiums, and deductibles from various providers, ensuring you find the best homeowners insurance for your needs.

-

How can I use the homeowners insurance comparison worksheet effectively?

To use the homeowners insurance comparison worksheet effectively, gather quotes from multiple insurance companies and input key details. Assess coverages, policy limits, and prices in the worksheet. This organized approach allows you to make a more informed choice about which homeowners insurance policy suits you best.

-

What features should I look for in a homeowners insurance comparison worksheet?

When selecting a homeowners insurance comparison worksheet, look for features like customizable fields for personal details, coverage categories, and comparison metrics. Additionally, a user-friendly design will enable you to easily navigate and make adjustments to your data, enhancing your overall experience.

-

Is there a cost associated with obtaining a homeowners insurance comparison worksheet?

Many homeowners insurance comparison worksheets are available online for free, providing a cost-effective way to compare policies. However, some premium tools may offer additional features or data analysis for a fee. Always review what is included to ensure you get the best value for your needs.

-

How does a homeowners insurance comparison worksheet benefit me?

Using a homeowners insurance comparison worksheet helps simplify the process of understanding different policies. By clearly laying out your options, this tool allows you to identify the best coverage for your budget while ensuring that you meet your personal protection needs.

-

Can I integrate a homeowners insurance comparison worksheet into my business processes?

Yes, many homeowners insurance comparison worksheets can be integrated with digital document signing and management tools like airSlate SignNow. This integration allows you to streamline the process of reviewing and signing insurance documents, making your workflow more efficient.

-

What types of information should I include in my homeowners insurance comparison worksheet?

Your homeowners insurance comparison worksheet should include information such as premiums, deductibles, coverage limits, exclusions, and any discounts offered. This will ensure you have a comprehensive overview of each policy, helping you make the best choices tailored to your specific needs.

Get more for Auto Insurance Comparison Spreadsheet Template

- Divizyon dwa a form

- Pozwany do odpowiedzi na pozew form

- Revised form promulgated by 07012019 notice to the bar cn 10517ps korean

- County of venue form

- That is the plaintiff must file it with the form

- How to complete the civil case information statement cis spanish

- Sa vle di moun ki pote plent la dwe prezante li avk plent la epi akize a dwe form

- W przypadku niezaczenia tego formularza dokumenty zostan

Find out other Auto Insurance Comparison Spreadsheet Template

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms