Rental Property Statement Form

What is the rental property statement?

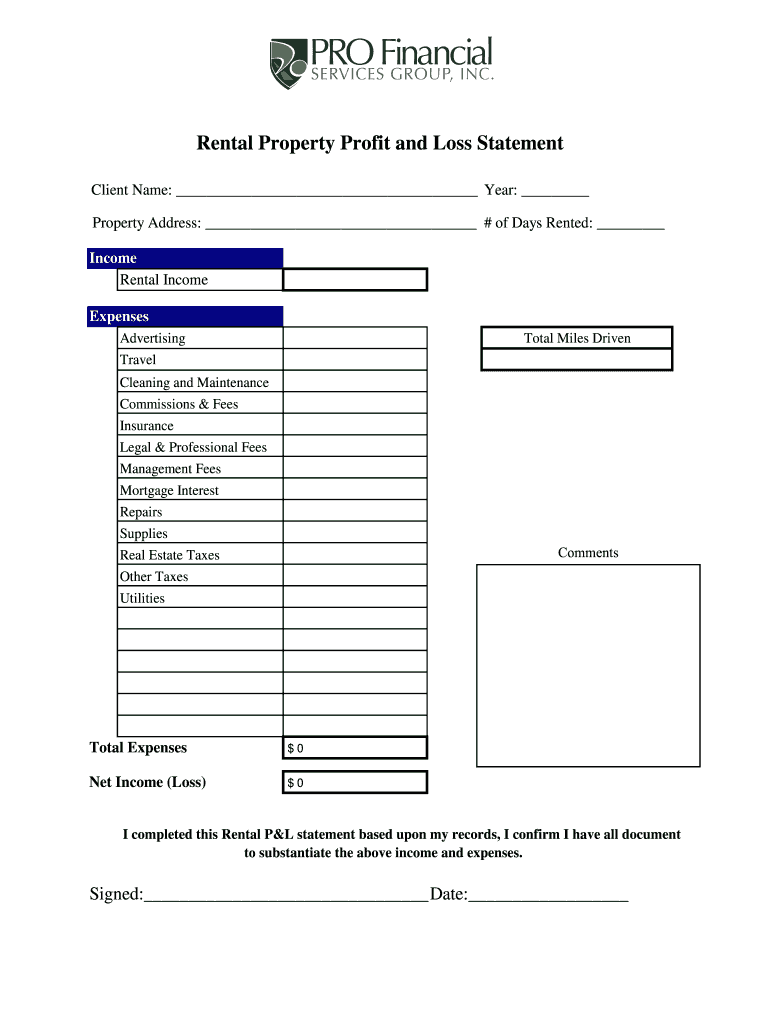

The rental property profit and loss statement is a financial document that summarizes the income and expenses associated with a rental property over a specific period. This statement is crucial for landlords and property managers as it provides a clear overview of the property's financial performance. It typically includes details such as rental income, operating expenses, maintenance costs, and any other relevant financial information. By analyzing this statement, property owners can make informed decisions regarding their investment and identify areas for improvement.

Key elements of the rental property statement

A comprehensive rental property profit and loss statement includes several key components that help in evaluating the property's financial health. These elements typically consist of:

- Rental Income: Total income generated from rent payments.

- Operating Expenses: Costs related to managing the property, such as utilities, property management fees, and repairs.

- Net Operating Income (NOI): The difference between total rental income and operating expenses, which indicates profitability.

- Depreciation: A non-cash expense that accounts for the decrease in property value over time.

- Net Income: The final profit or loss after all expenses, including mortgage payments and taxes, are deducted.

Steps to complete the rental property statement

Completing a rental property profit and loss statement involves several straightforward steps. These steps ensure that all necessary information is accurately recorded:

- Gather Financial Records: Collect all relevant documents, including rent receipts, invoices for expenses, and bank statements.

- List Income Sources: Document all sources of income related to the property, including rent and any additional fees.

- Itemize Expenses: Break down all expenses into categories, such as maintenance, utilities, and management fees.

- Calculate Net Operating Income: Subtract total expenses from total income to determine the net operating income.

- Review and Finalize: Ensure all information is accurate and complete before finalizing the statement.

Legal use of the rental property statement

The rental property profit and loss statement serves as a crucial document for legal and financial purposes. It can be used to demonstrate the financial status of the property for various reasons, such as:

- Tax Reporting: This statement is essential for reporting rental income and expenses on tax returns.

- Loan Applications: Lenders may require this statement to assess the property's profitability when applying for financing.

- Legal Disputes: In case of disputes with tenants or other parties, this document can provide evidence of financial transactions.

How to obtain the rental property statement

Obtaining a rental property profit and loss statement can be done through various methods. Property owners can create their own statements using templates or software designed for financial management. Alternatively, they can consult with a property management company or an accountant who can prepare the statement based on the provided financial records. Many online resources also offer customizable templates that can be easily filled out to meet specific needs.

Examples of using the rental property statement

Understanding practical applications of the rental property profit and loss statement can enhance its utility. Here are a few examples:

- Tax Preparation: Landlords can use the statement to accurately report income and expenses during tax season, ensuring compliance with IRS regulations.

- Investment Analysis: By reviewing the statement, property owners can assess the performance of their investment and make necessary adjustments to improve profitability.

- Budgeting: The statement can help in forecasting future income and expenses, aiding in effective budgeting for property maintenance and improvements.

Quick guide on how to complete rental property statement

Effortlessly Prepare Rental Property Statement on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Rental Property Statement on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and Electronically Sign Rental Property Statement with Ease

- Find Rental Property Statement and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your adjustments.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Rental Property Statement to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rental property statement

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a rental property profit and loss statement PDF?

A rental property profit and loss statement PDF is a financial document that summarizes the income and expenses associated with a rental property over a specific period. It includes details such as rental income, maintenance costs, and other expenditures. This statement is essential for landlords to assess the profitability of their rental investments.

-

How can I create a rental property profit and loss statement PDF using airSlate SignNow?

You can easily create a rental property profit and loss statement PDF with airSlate SignNow by utilizing our template system. Simply fill in the required fields regarding income and expenses, then save and export your document as a PDF. Our user-friendly interface makes this process quick and efficient.

-

Is there a cost associated with generating a rental property profit and loss statement PDF?

While airSlate SignNow offers a free trial, generating a rental property profit and loss statement PDF may incurr costs associated with premium features. We provide transparent pricing plans that cater to different business needs, allowing you to choose a plan that suits your budget and requirements.

-

What benefits does using a rental property profit and loss statement PDF offer?

Using a rental property profit and loss statement PDF provides a clear overview of your financial situation related to rental properties. It helps landlords make informed decisions, track financial performance, and simplifies tax preparation. Additionally, it promotes better cash flow management.

-

Can I integrate airSlate SignNow with other accounting software for my rental property profit and loss statement PDF?

Yes, airSlate SignNow can integrate seamlessly with various accounting and financial software. This integration allows for easy import and export of your rental property profit and loss statement PDF, enhancing your overall workflow and ensuring accurate financial tracking.

-

Are there templates available for the rental property profit and loss statement PDF?

Yes, airSlate SignNow offers a variety of templates specifically designed for creating rental property profit and loss statement PDFs. These templates are customizable and help streamline the process of documenting your rental income and expenses efficiently.

-

How does airSlate SignNow ensure the security of my rental property profit and loss statement PDF?

airSlate SignNow prioritizes your document security by employing advanced encryption methods and secure cloud storage. Your rental property profit and loss statement PDF is protected from unauthorized access, ensuring that your sensitive financial information remains confidential.

Get more for Rental Property Statement

- A member of my family or household is a victim of domestic violence committed by the form

- Court of washington no temporary order for protection and form

- Petitioner first middle last name form

- Petitioner protected persondob doc templatepdffiller form

- Order modifyingterminating order form

- Court of washington for no petitioner protected person form

- Respondents motion to modify form

- 10 vs domestic violence no contact order courtswagov form

Find out other Rental Property Statement

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form