GUARANTOR'S APPLICATION Property Book UK Form

Understanding the guarantor's application for the property book UK

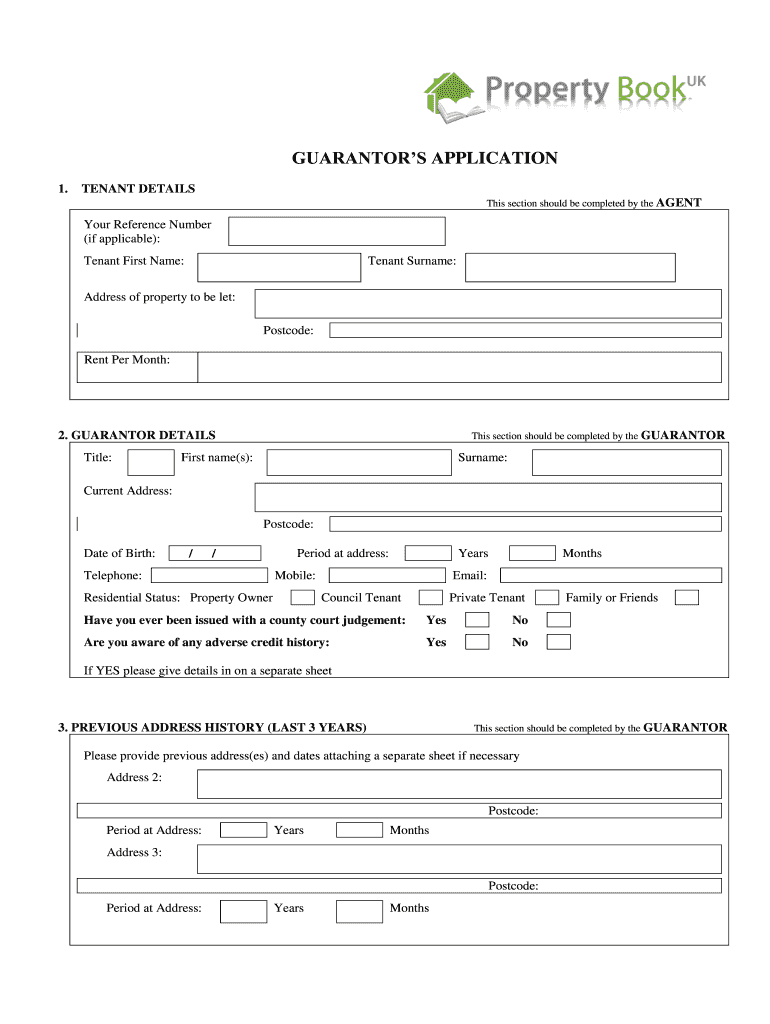

The guarantor's application for the property book UK serves as a crucial document for individuals looking to secure a rental property. This form outlines the responsibilities of the guarantor, who agrees to cover the rent or any damages incurred by the tenant. Understanding its purpose is essential for both tenants and landlords, as it ensures that all parties are aware of their obligations. The application typically requires personal information, financial details, and identification to verify the guarantor's ability to fulfill their commitments.

Steps to complete the guarantor's application for the property book UK

Completing the guarantor's application involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including proof of income, identification, and any relevant financial statements.

- Fill out the application form with accurate personal details, including full name, address, and contact information.

- Provide information about the tenant, including their name and the property address.

- Sign the application, confirming your understanding of the responsibilities as a guarantor.

- Submit the completed application to the landlord or property management company, ensuring all required documents are attached.

Legal use of the guarantor's application for the property book UK

The legal use of the guarantor's application is defined by various laws governing rental agreements and obligations in the UK. This document becomes legally binding once signed by the guarantor and accepted by the landlord. It is essential that the guarantor understands their responsibilities, as failure to comply with the terms can lead to legal action, including claims for unpaid rent or damages. The application must also adhere to privacy laws, ensuring that personal information is handled securely and responsibly.

Key elements of the guarantor's application for the property book UK

Several key elements are integral to the guarantor's application, ensuring clarity and legal compliance:

- Personal Information: Full name, address, and contact details of the guarantor.

- Financial Details: Information about income and employment to demonstrate financial capability.

- Tenant Information: Name of the tenant and the property address being rented.

- Signature: The guarantor's signature, indicating acceptance of the terms and conditions.

- Date: The date when the application is signed, marking the beginning of the legal agreement.

Examples of using the guarantor's application for the property book UK

The guarantor's application can be utilized in various scenarios, such as:

- A parent acting as a guarantor for their child renting their first apartment.

- A friend agreeing to guarantee a lease for another individual with insufficient credit history.

- A relative providing support for a family member who is a first-time renter.

In each case, the guarantor assumes financial responsibility, ensuring that the landlord has recourse in case of default.

Eligibility criteria for the guarantor's application for the property book UK

Eligibility criteria for becoming a guarantor typically include:

- Being at least eighteen years old and legally capable of entering into a contract.

- Having a stable income or sufficient financial resources to cover potential liabilities.

- Possessing a good credit history, which may be verified by the landlord or property management.

These criteria help landlords assess the reliability of the guarantor and ensure that they can fulfill their obligations if necessary.

Quick guide on how to complete guarantoramp39s application property book uk

Effortlessly Prepare GUARANTOR'S APPLICATION Property Book UK on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage GUARANTOR'S APPLICATION Property Book UK on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-driven process today.

How to Modify and Electronically Sign GUARANTOR'S APPLICATION Property Book UK with Ease

- Locate GUARANTOR'S APPLICATION Property Book UK and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing additional copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign GUARANTOR'S APPLICATION Property Book UK and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I get the educational loan for my higher studies?

MS applicants spend considerable time and resources preparing for the GRE, shortlisting and applying to schools, and choosing a final school (when lucky enough to receive multiple admits).The best idea is to gain an understanding of financing options while preparing applications and waiting for University responses. Knowing the options empowers MS aspirants to make the best decisions for the academic and financial futures.Type of Loans-Public sector banks: Collateral loansA number of banks offer education loans with collateral for MS studies abroad. Key features of such loan offers include:Up to 90% CoA cover. In some countries, the remaining 10% must be paid up front into the bank by the borrower; this is sometimes known as margin money.A variable interest rate of ~10.5%. In some cases, a discount may be applied for taking insurance against the loan. For, example, you may receive a 0.5% discount for such insurance although this is still an additional cost which factors into the total cost of a loan.In some countries, public sector banks require both collateral and a co-signer for loans. It’s important to be prepared for extensive paperwork and a long loan approval period.While it’s not a universal norm, the collateral requested in some countries requires a parental property to be put on the line - an option that isn’t available to everyone.Non-Banking Financial Corporation (NBFCs): co-signer loansNBFCs in some countries are enabled to provide financing for international education. Typical features of these loan offers include:An offer of up to 100% CoA cover, though a co-signer is always required, and collateral is often required for high-value loans.A proprietary interest rate which isn’t defined by a governing financial institute. It’s important to understand the full cost of any loan (including factors in hidden fees like loan sanction letter fee and currency conversion charges) to enable loan comparison.Loans might be assessed on the basis of co-signer credit score, as well as their salary and other credentials. This can be a real challenge for MS applicants whose co-signers are retired or have not built their credit histories.International lenders: No co-signer, collateral-free loansSome lenders, such as Prodigy Finance, provide loans to international students, often in the currency of the study destination country. Key features of such loan offers include:Loan cover up to 100% CoA without collateral or co-signers; these are merit-based loans provided on the basis of admission to a top-ranked international school.Customized interest rates that have a fixed component and a variable component – which is often the LIBOR rate of the loan currency.Online application processes that are often quicker than other loan providers - and typically more transparent as well.Prodigy Finance’s future earnings model assess your potential based on your post-masters income and career direction.In addition to no co-signer, collateral-free loans, Prodigy Finance borrowers are also eligible for value-added benefits like scholarships and careers support.Keep in mind that every loan offer has its own merits - and you should consider all of your options carefully. This quick guide is just a jumping off point to get you started. Education is an investment and study loans are a commitment; you’ll want to consider the future as well as the present because that acceptance letter is just the beginning.Want to see the terms Prodigy Finance can offer you?Applying for Prodigy Finance’s no-cosigner, collateral-free loans takes just 30 minutes. And, with no obligation to accept a provisional loan offer, there’s no reason to wait.Check more about Prodigy Finance- Prodigy Finance Answers your Top 10 Education-Loan Questions | YocketYou can decide about which type of Educational Loan you want as per your requirements.Share and upvote if helpful.

-

How would it turn out if the U.S. ceased to be a guarantor of Israeli security?

IS the USA a “guarantor of Israeli security”?Highly questionable. Israel is an important market for American weapons technologies, but they are also a large competitor of similar Israeli products.More importantly, the USA has never “provided” security for Israel. They have never directly responded to threats against Israel, and only rarely supports Israeli security operations. So HOW exactly do they guarantee our security?

-

How do I get out of personal guarantor agreement?

Did you put your legal signature on a legal, binding document, agreeing to pay a certain amount for spevific goods or services? Were said goods or services delivered? If yes, in my opinion, youre stuck.You signed a legal binding agreement. If you were not prepared to hold up your obligation, you should not have signed it!!! No do-overs!

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

Real Estate in New York City: How can a foreigner rent an apartment in NY without a credit score?

You should provide the following, no credit score or tax returns needed:- Employment verification letter- Two recent pay stubs that verify the salary claims in the EV letter- Two most recent bank statements that show a reasonable amount of cash- Photo ID in the form of a passport or visaGenerally, the above should be plenty, but it does depend on the landlord.The landlord will likely have you fill out a W8 form, as well - common with foreign renters.You may also be able to use a corporate guarantor service like Insurent. Not all landlords accept them, due to certain constraints or preferences, but worth checking.Some landlords will accept a full year's payment up-front; however, this can only be done in free market buildings (rent stabilized buildings have some rules against this). Even in free market buildings, it's up to the landlord whether or not to accept full payment, additional security, or some form of back rent up-front.When emailing brokers / leasing offices, make sure to inquire about their international leasing policies, so you don't risk wasting any time on buildings that have strict or unreasonable policies.Good luck and welcome to New York!

Create this form in 5 minutes!

How to create an eSignature for the guarantoramp39s application property book uk

How to create an electronic signature for your Guarantoramp39s Application Property Book Uk in the online mode

How to create an eSignature for your Guarantoramp39s Application Property Book Uk in Google Chrome

How to create an electronic signature for signing the Guarantoramp39s Application Property Book Uk in Gmail

How to generate an electronic signature for the Guarantoramp39s Application Property Book Uk from your mobile device

How to make an electronic signature for the Guarantoramp39s Application Property Book Uk on iOS

How to make an eSignature for the Guarantoramp39s Application Property Book Uk on Android devices

People also ask

-

What is bookuk and how can it benefit my business?

Bookuk is a versatile electronic signature solution offered by airSlate SignNow that streamlines the document signing process. By using bookuk, businesses can save time and enhance efficiency, allowing for quicker transaction completion and improved customer satisfaction.

-

What features does bookuk provide for document signing?

Bookuk offers a range of features including customizable templates, multi-party signing, and real-time tracking of document status. These tools ensure a seamless signing experience and improve overall workflow management for businesses.

-

How does bookuk compare in pricing with other eSignature solutions?

Bookuk from airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With competitive pricing and various plans available, bookuk offers great value without compromising quality, making it an attractive choice in the eSignature market.

-

Can bookuk integrate with other software I’m already using?

Yes, bookuk supports integration with popular tools such as Google Drive, Salesforce, and more. This allows businesses to maintain their existing workflows while enhancing them with the efficient signing capabilities of bookuk.

-

Is bookuk compliant with legal and security standards?

Absolutely, bookuk adheres to stringent legal and security standards, ensuring that all signed documents are legally binding and securely stored. Companies can trust bookuk for compliance with regulations like eIDAS and ESIGN, providing peace of mind.

-

What types of businesses can benefit from using bookuk?

Bookuk is suitable for a variety of businesses, from small startups to large enterprises. Its user-friendly interface and robust features make it ideal for organizations looking to streamline their document signing process across various industries.

-

How easy is it to use bookuk for new users?

Using bookuk is incredibly easy, even for new users. The intuitive interface and helpful tutorials allow anyone to start sending and signing documents in just minutes, making it accessible for all team members regardless of their tech-savviness.

Get more for GUARANTOR'S APPLICATION Property Book UK

Find out other GUARANTOR'S APPLICATION Property Book UK

- Invite Sign PDF Simple

- Invite Sign PDF Easy

- How To Invite Sign PDF

- Invite Sign Document Online

- Complete Sign PDF Now

- Complete Sign PDF Free

- Complete Sign Word Online

- Complete Sign Word Free

- Complete Sign Word Fast

- Complete Sign Document Myself

- Complete Sign Form Now

- Complete Sign Form Free

- Complete Sign Form Secure

- Complete Sign Form Android

- Complete Sign Form iPad

- Complete Sign Presentation Computer

- Request Sign PDF Myself

- Request Sign PDF Free

- Request Sign PDF Android

- How To Request Sign Word